June 1, 2024 | Trading Desk Notes For June 1, 2024

Let the cuts begin

The Bank of Canada may announce a 25bps cut (from 5.25%) on Wednesday (markets are pricing a 75% chance), and the ECB is expected to announce a 25bps cut (from 4.50%) on Thursday. The Fed is not likely to cut rates at its June 12 meeting.

The net speculative short positioning in Canadian dollar futures is near a 7-year high (a position that rapidly ramped up from neutral at the beginning of March), and open interest hit an all-time high this week (X delivery spikes).

Short sellers likely expect the premium of American rates over Canadian rates (the 2-year spread is now ~70 bps) to widen if the BoC cuts rates faster than the Fed in the coming months. I recommend readers listen to my friend and excellent analyst Kevin Muir (the Macrotourist) on the June 1 Mike Campbell’s Moneytalks show for a comprehensive explanation of the CAD bearish view. Kevin’s discussion begins around the six-minute mark.

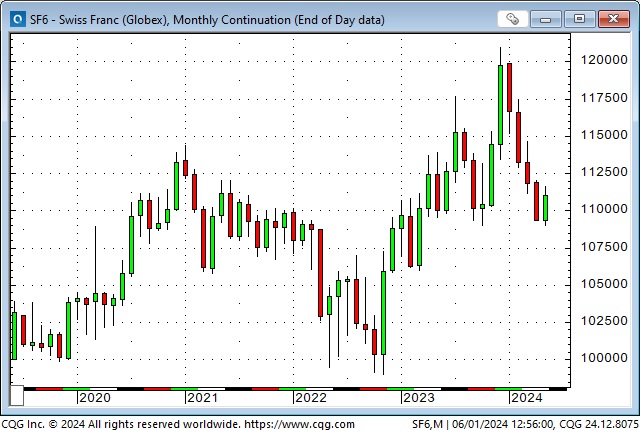

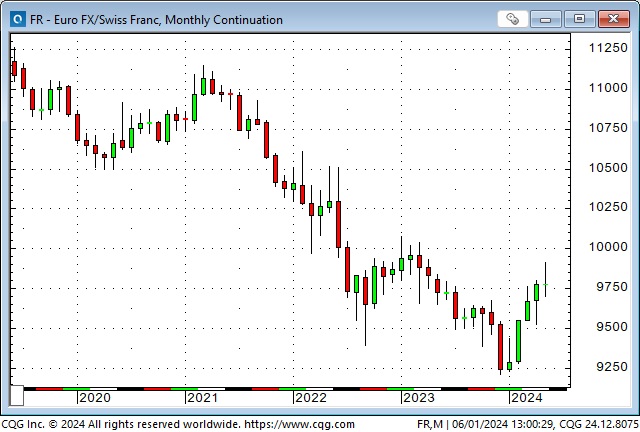

The Swiss Franc had its largest daily rally YTD on Thursday after the head of the Swiss National Bank hinted at intervention if the CHF continued falling. His rationale was that a weaker Franc led to domestic inflation. His warning comes about two months after the SNB surprised the market with a 25 bps interest rate cut (to 1.50%.)

The Swisse rallied to (essentially) all-time highs against the USD and the Euro (and many other currencies) last December. The SNB tolerated the rise in the CHF from late 2022 to December 2023 because it kept a lid on domestic inflation but signalled in December that it had gone too far and was hurting the economy, especially exports.

I suspect that the SNB was more concerned with the weakness of the Euro relative to the Franc (the EURCHF fell ~17% from 2021 to Dec 2023) than the weakness of the USDCHF (which fell ~5% during that period), especially considering export markets.

Since the CHF peaked in December, futures market speculators built a net short position to a 5-year high, with open interest doubling to an all-time high (X delivery spikes.) The premium of US rates over Swiss rates (~380 bps at the 2-year tenor) favours the short sellers, but the size of the net short futures position is about 1.5X the average daily volume, which may become an issue if there is a rush to cover shorts.

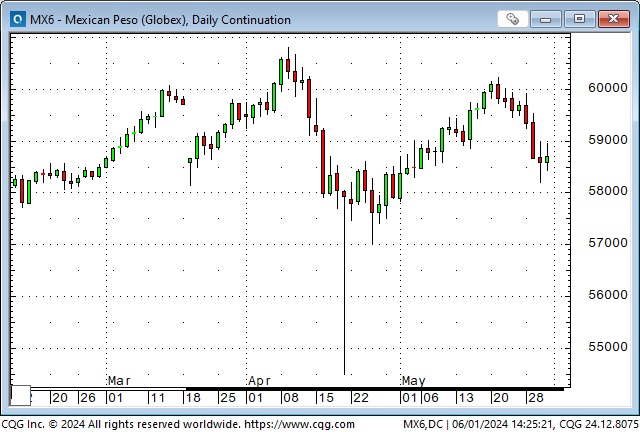

The Mexican Peso hit a historic low during the covid crisis in early 2020 but has since rallied ~50% against the USD. The Peso has benefited from strong economic growth, record exports to the USA, near-shoring developments, inbound remittances from Mexican workers in the USA, and especially from substantial interest rate premiums over other currencies. Banxico’s short rates are now ~11% compared to 5.5% in the US.

The net long positioning of futures market speculators hit a 4-year high in early April but has been modestly reduced since then. (The spike in the MEX on April 19 came on reports of “explosions” in Iran after Iran had launched missiles at Israel – see my April 20 TD Notes for details.) This chart shows a “lower high” in May, and the decline since then may be related to long liquidation ahead of tomorrow’s Federal election.

Stock indices

The S&P traded to all-time highs on Thursday morning, May 23, following Wednesday’s after-the-close NVDA quarterly report. However, the gains didn’t last, as the market rolled over and made new lows for the week (even as NVDA sustained its ~$100 gap higher).

The S&P fell ~160 points from the NVDA-inspired May 23 ATH to this Friday’s lows, then turned on a dime and rallied more than 100 points into month-end.

Metals

Comex August gold hit all-time highs of ~$2,477 on May 20 but then turned lower, creating a Weekly Key Reversal down on the charts. This Friday’s close was the week’s lowest, down ~$140 from last week’s ATH. The sharp recent decline in open interest suggests long liquidation, but COT data shows that the net long spec position increased (as of May 28) to a 26-month high – the highest since the invasion of Ukraine.

Comex July copper soared to an all-time high of ~$5.20 on May 20 but dropped ~60 cents (~12%) to this week’s low. COT data (May 28) showed only a modest reduction in the 3-year high net long spec position.

Energy

OPEC+ meets tomorrow and is expected to maintain production cuts to sustain prices. WTI prices have been choppy in a narrow range for the last four weeks.

The key uranium barometers were higher again this week after Biden banned imports from Russia two weeks ago.

Orange juice bulls get squeezed

Last week, I noted that OJ was the new cocoa, hitting all-time highs about double previous highs. The market gapped higher on Tuesday after the Memorial Day weekend, then fell like a stone Wednesday through Friday. I’ve never traded OJ, but those bars look like limit-down days. Yikes!

My short-term trading

I started this week short gold, S&P and Mexican Peso – trades I established last week. I was also long Swiss Franc calls from May 14.

I covered the short gold on Monday for a gain of $35 oz when it traded above last Friday’s high.

I covered the short S&P on Monday for a tiny profit when it traded above last Friday’s high. I shorted on Tuesday and took profits of 60 points on Thursday. I shorted on Friday and covered for a profit of 25 points when it started to bounce back from the day’s low (and went on to rally 100 points!)

I covered the short Peso for a gain of 110 points on Thursday when the market started to recover from a 150 decline in three days.

My long Swiss calls benefited hugely from the big rally on Thursday and Friday, taking my unrealized P+L on the trade back to breakeven. Theta (time decay) had been working against the calls.

The only position I held into the weekend was the long Swiss calls. My account P+L had one of its best weekly gains of the year.

Thoughts on trading

I bought the Swiss calls with 52 days to expiry and a 35 delta. If the options expire at zero, the maximum risk on the trade is a little more than I like to risk on any one trade. Still, it gave me a way to stay long Swiss without getting stopped out by short-term chop – it gave me a way to sync the time frame of my trading with the time frame of my analysis (I think the Swiss is bottoming here and if it starts to rally there are a lot of shorts which may cover on or before the June contract expiry in mid-June.)

Managing risk

I keep saying that I make money from trading not because I have a great crystal ball but because I’m disciplined about managing risk.

Traders have many risks to manage, and they are all important, but perhaps none more so than size. If your trading size is too big, sooner or later, you’ll get badly hurt.

When I managed other brokers, I told them never to let their clients use more than 50% of their equity to margin positions. Clients who always had the “pedal to the metal” blew up – and often took their broker down with them.

Some of those clients made a lot of money first and thought they were invincible. Google: Archegos Capital / Bill Hwang.

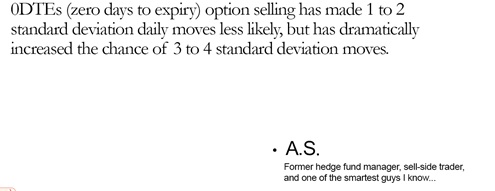

Quote of the week

On my radar

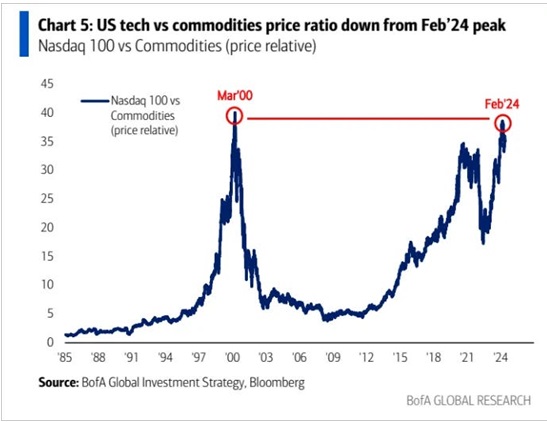

I keep seeing charts that say, “Commodities are cheap relative to stocks.” The implication seems to be that commodities are a “Buy.” Maybe commodities are priced just right, but stocks are way too expensive.

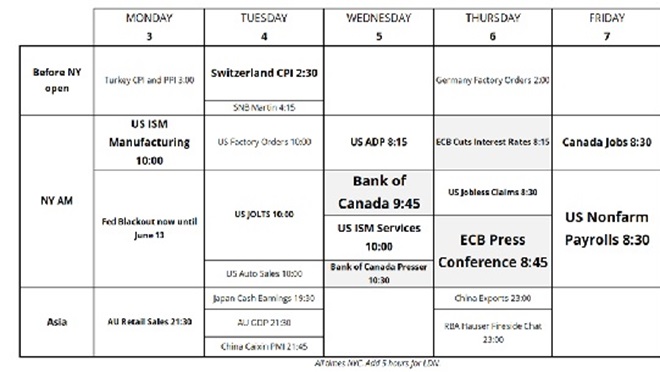

Mexico Federal election tomorrow. Results of India election due Tuesday (it takes a while to count a billion ballots.)

Bank of Canada Wednesday, ECB Thursday.

Lots of employment data.

Here’s Brent Donnelly’s cheat sheet:

The Barney report

“The Barns” inspecting the turf beside the green just outside our house.

Yikes! There seems to be a problem!

Listen to Victor talk about markets with Mike Campbell

On this morning’s Moneytalks show, Mike and I discussed the possibility of the Bank of Canada and the ECB cutting interest rates this coming week. We also talked about how “risk appetite” seems to be “toned down” in some markets, especially in the metals and some stock market sectors. You can listen to the entire show here, including Mike’s interview with Kevin Muir. My spot with Mike starts around the 51-minute mark.

Heads Up Guys

Regular readers know I keep posting links to Headsupguys because I’ve had too many friends who took their own lives. Everybody gets down/depressed at some time. My “get out of jail” activity was to 1) do something for somebody else and 2) get outside. This Twitter post rang a bell for me.

The Archive

READERS CAN ACCESS WEEKLY TRADING DESK NOTES FROM THE PAST SEVEN YEARS BY CLICKING THE GOOD OLD STUFF-ARCHIVE BUTTON ON THE RIGHT SIDE OF THIS PAGE.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new, usually four to six times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Victor Adair June 1st, 2024

Posted In: Victor Adair Blog