June 13, 2024 | Tougher For Longer

Yesterday morning, a milder-than-expected US CPI number boosted hopes that the US Fed may soon start lowering its policy rate. Financial markets pooped on the headline, further loosening financial conditions for some publicly traded companies.

Then, a more hawkish Fed announcement in the afternoon lowered 2024 cut expectations from 75 basis points (bps) in the second half to just 25 bps in November, effectively signalling tougher for longer credit conditions for households and the vast majority of companies.

The Fed forecasts the US unemployment rate to rise to 4.2% in 2025, 80 bps above the 3.4% cycle low in 2022. There has never been a time when the US unemployment rate has risen 80 bps that the US economy was not already 4 to 5 months into a recession. The Fed is incongruently predicting US GDP growth of 2% in 2025.

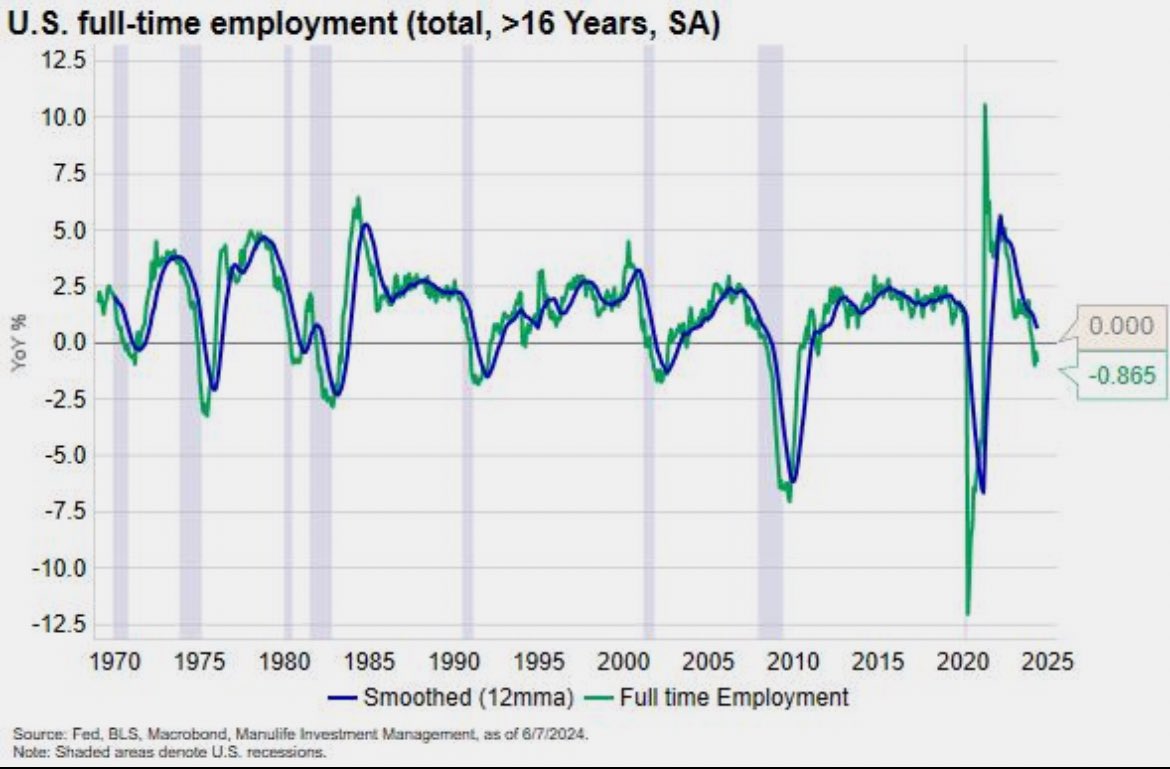

At this point, the unemployment rate has already increased 60bps from the low and full-time employment (green line below) has contracted more than 80bps–again something that’s only happened during past recessions (purple bars below, since 1970).

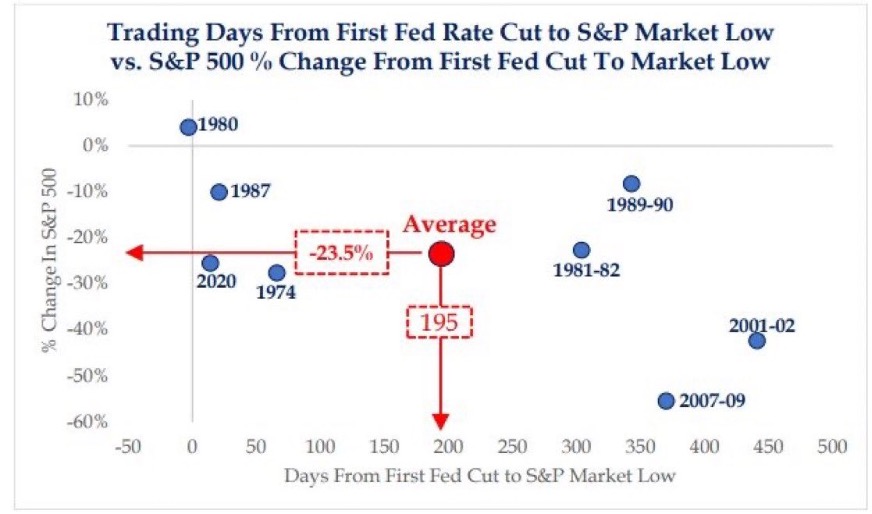

Most importantly, as shown below, courtesy of Barchart, since 1974, the time lag from the first Fed cut to the stock market low has averaged 195 days with an average price decline of 23.5%. In the three incidents when the stock market entered the cutting cycle at valuation levels near as rich as today, the market decline was in the 30% to 50% range (see 1973, 2000, and 2007).

Market cycles tend to be hard on those who lack attention or understanding. Maybe this time will be different.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Danielle Park June 13th, 2024

Posted In: Juggling Dynamite