June 28, 2024 | The Financial Stability Report Highlights Some Warnings About The Health of the Canadian Financial System

The resilience of Canadians and the Canadian financial system is very important to Canadians. The Bank of Canada monitors this, and reports that the financial system is sound.

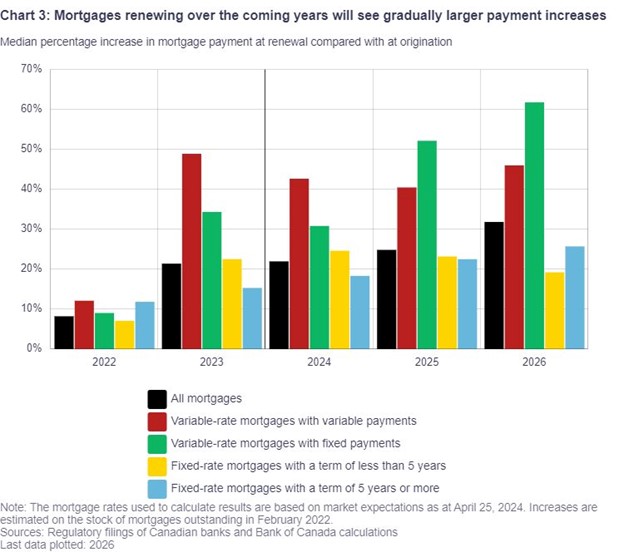

But there are a large number of mortgage renewals and payment adjustments about to hit over the next few years. In a recent speech Tiff Macklem, BOC governor, suggested that about 50 percent of all mortgages are due to reset over the next two years.

Will Canadians adjust easily to the burden of higher interest rates?

In May 2024 the BOC published a “Financial Stability Report.”

In the executive summary the report claims that the “Canada’s financial system remains resilient” and that businesses, households, banks and other financial institutions have “continued to proactively adjust to higher rates.” But in the details, we find a few warning signs from some key indicators of financial health for the banks and other important sectors in the system. And the system has never been tested with much higher rates before now.

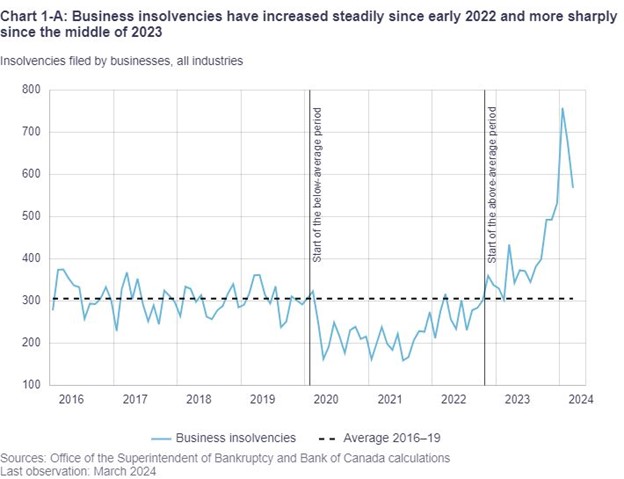

Bankruptcies in the business sector have soared to levels not seen for decades, and it is directly related to higher rates.

What about household borrowers?

There will be a large number of renewals between now and the end of 2026. The green bar shows those with variable mortgages with fixed payments. Most banks offered this option when rates were below 2 percent.

Now these borrowers face a 50-60 percent increase in payments, unless the lender and regulators give them a break. And there is some evidence that many will not be able to pay.

According to Better Dwelling, using data from the banking industry, Bank of Montreal has 21.3 percent of mortgages with amortization periods of more than 35 years, while CIBC is 20 percent; RBC is 19% and TD is 16.5%.

Since a normal mortgage is repaid over a 25-yr term, we have no experience with such a large number of mortgages being forced to repay in a shorter period at higher rates.

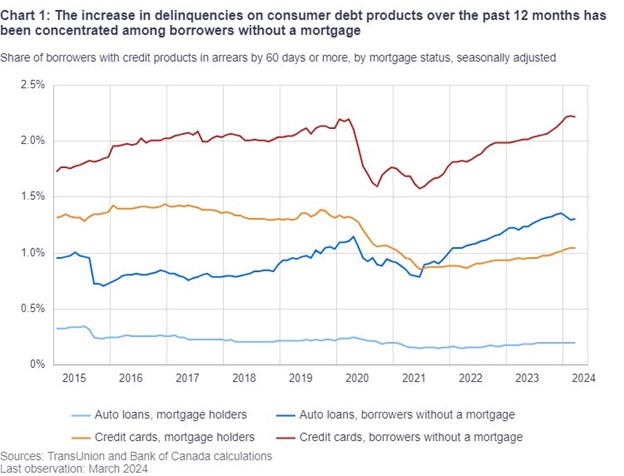

Canadians with credit cards are starting to struggle also. The BOC highlights people without a mortgage, and probably renting a home, are in the most trouble with their credit cards and auto loans.

But mortgage borrowers — even those with new mortgages — could soon be in trouble if there is another recession and unemployment spikes to 9 or 10 percent.

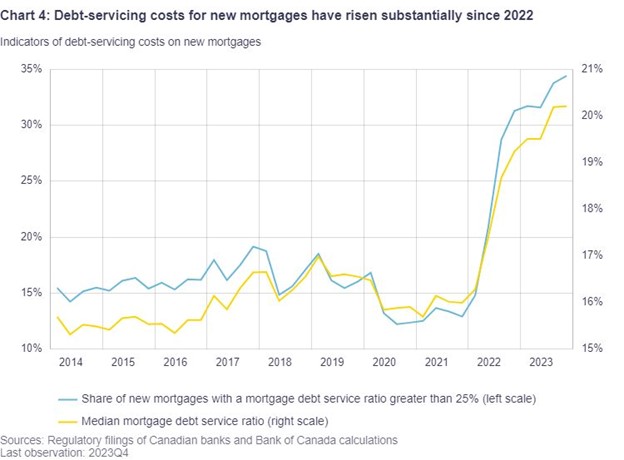

The debt servicing costs for new mortgages have soared to levels higher than anything seen for more than a decade. A debt service ratio of 25 percent is asking for trouble if there’s a recession, or illness or divorce in a household.

So, the Bank of Canada believes that the financial system is resilient, but on closer examination we see signs that the stability of the system is starting to weaken.

The BOC knows that, in the past, Canadians have never failed to repay their mortgages, even in a recession. But, this time, their resilience will be tested to a degree not seen during any recent recession.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Hilliard MacBeth June 28th, 2024

Posted In: Hilliard's Weekend Notebook