June 19, 2024 | Millions of Debt Slaves, Created Right Before Our Eyes

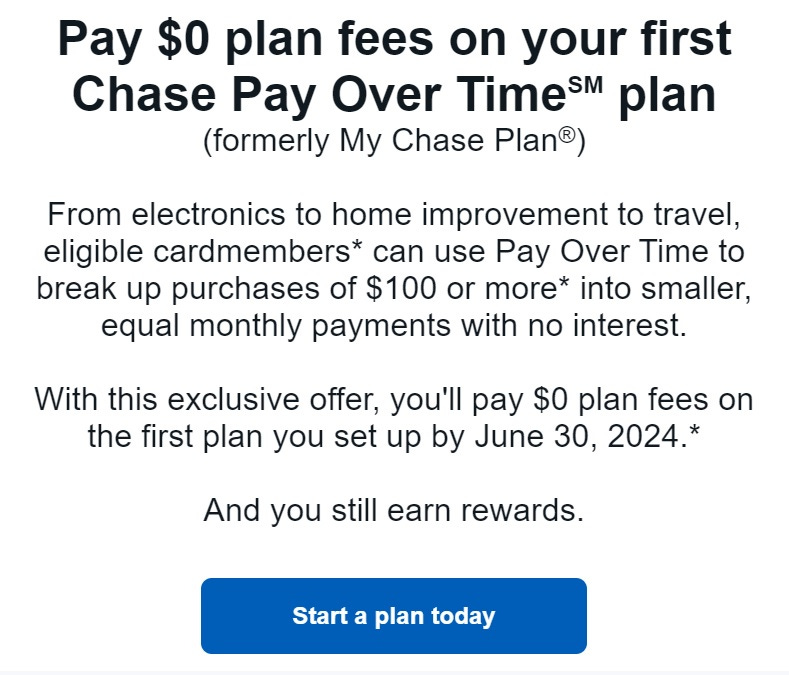

I just got this offer from a credit card:

But it’s not just credit cards:

Buy Now, Pay Later Craze Coming To Apple Pay

(Zero Hedge) – iPhones and iPads will soon be integrated with Affirm’s buy now, pay later (BNPL) feature. This product will soon be available for Apple Pay users.

“This will enable those users checking out online or in-app with Apple Pay on iPhone and iPad to be able to apply to pay over time with Affirm,” the fintech company wrote in the filing.

Meanwhile, the Bank for International Settlements has warned that BNPL adoption is high among young adults, particularly those with low education. The report said this is a troubling trend, given that overuse and poor understanding of the service can be disastrous for consumers and lead to overindebtedness.

And to keep us “credit worthy”…

In sweeping change, Biden administration to ban medical debt from credit reports

(ABC News) – In a sweeping change that could improve millions of Americans’ ability to own a home or buy a car, the Biden administration on Tuesday proposed a rule to ban medical debt from credit reports.

The rule, announced by Vice President Kamala Harris and Consumer Financial Protection Bureau Director Rohit Chopra, comes as President Joe Biden beefs up his efforts to persuade Americans his administration is lowering costs, a chief concern for voters in the upcoming election.

“This is going to be an enormous relief to so many people battling bills when it comes to hospital visits,” Chopra told ABC News in an exclusive interview ahead of the policy announcement.

CFPB’s research estimates that the new rule would allow 22,000 more people to get approved for safe mortgages each year — meaning lenders could also benefit from the positive impact on peoples’ credit scores, by being able to approve more borrowers.

The sweet spot just before default

It’s as if all the normal ways of borrowing have been exhausted, and now the credit-industrial complex is scraping the bottom of the barrel with manipulated reporting requirements and quasi-loans aimed at people who can’t access any other kind of ready cash.

Pushing your customers right up to the edge of insolvency might seem like a curious business practice — until you remember that credit card companies earn most of their profits from late fees and interest on balances carried month-to-month. So the space between marginal solvency and pre-bankruptcy is the sweet spot for today’s lenders.

For the Aristocracy, there’s another benefit: The resulting class of debt slaves is too busy scraping by to cause trouble.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

John Rubino June 19th, 2024

Posted In: John Rubino Substack