June 25, 2024 | Luxury Troubles

Happy Monday Morning!

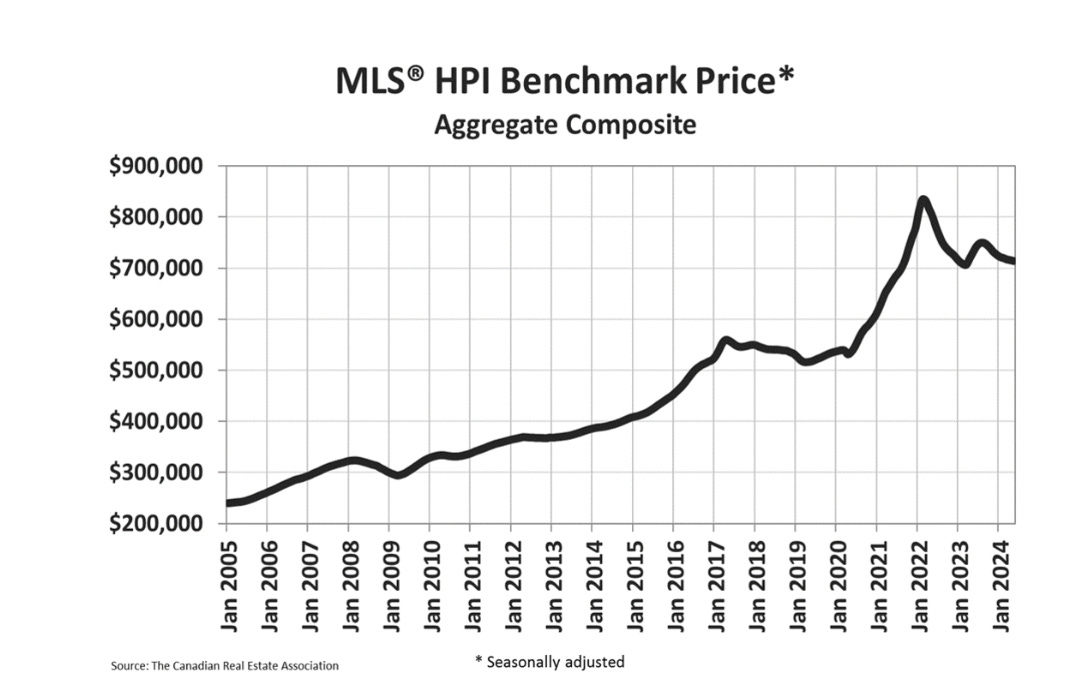

National house prices slid lower in the month of May, falling 2.4% from last year. On a seasonally adjusted basis, the national home price index is now down 14% since peaking in February 2022, marking the steepest decline since the index was created back in 2005, per CREA.

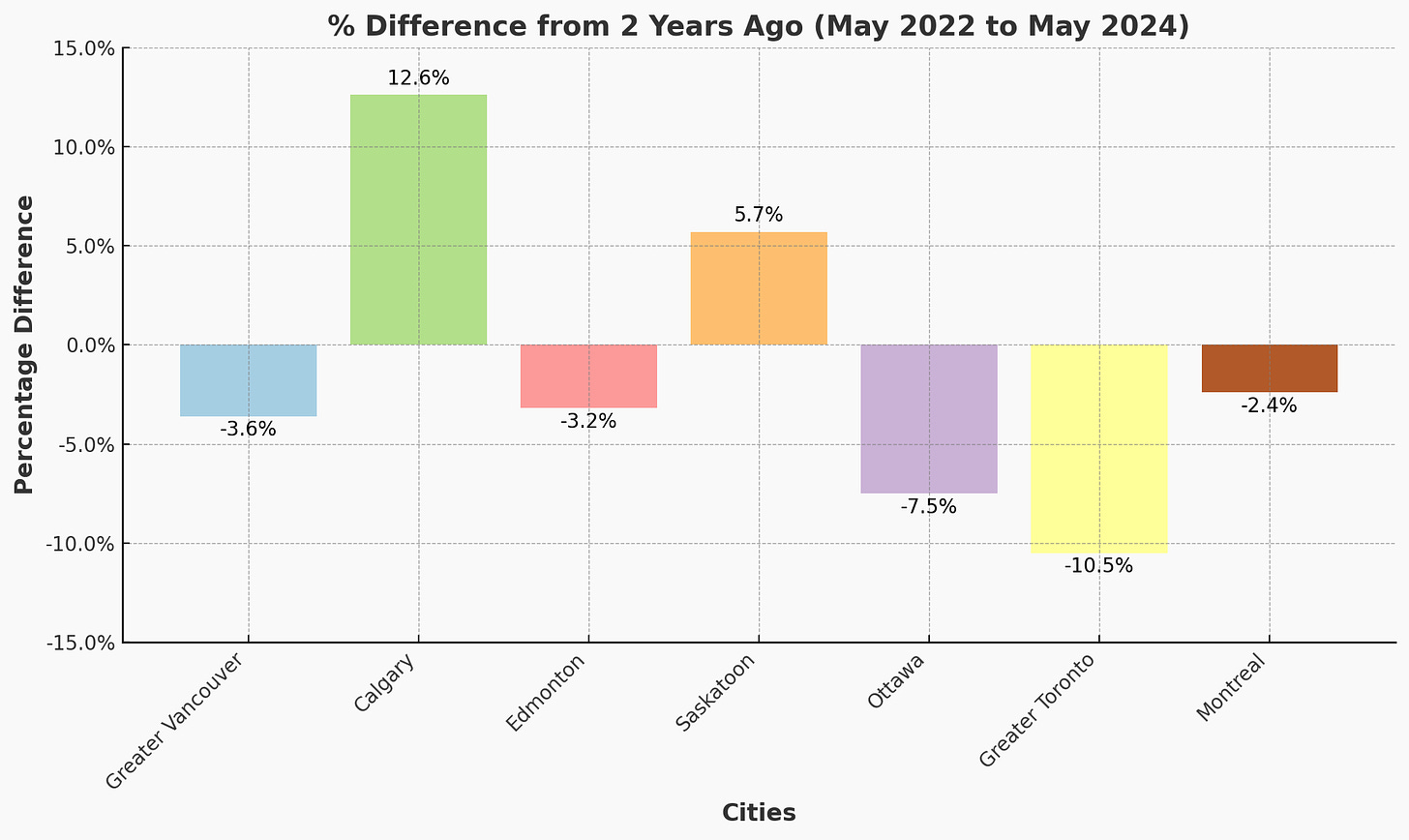

It’s true there’s no such thing as a national housing market. However, the price declines over the past two years have trickled across most major metros, with Calgary remaining the one outlier.

All things considered this is still a pretty modest housing correction considering the Bank of Canada took rates from zero to five in the span of eighteen months. Even the Bank of Canada has been surprised, hence the reluctance to cut rates in any meanigful way.

However, make no mistake, this housing correction can’t be boiled down to a simple national average. They say housing is hyper local, in other words you can’t compare rural Saskatchewan to Downtown Toronto. Every city and product type is performing differently.

For example, in Vancouver the performance of entry level single family houses is wildly different than the luxury condo market. In cities like Vancouver there is a structural shortage of single family houses. Every year the supply contracts as they get wound up into duplexes, townhouses, and condos. We literally do not add net new supply of single family houses. Meanwhile, there is an incredible number of young families chasing the Canadian dream of a 3 bedroom house and a backyard. Even with mortgage rates trippling entry level houses have found a strong bid, often ending up in mulitple offers. Quite simply there is a persistent bid from local end users trying to squeeze into the detached market.

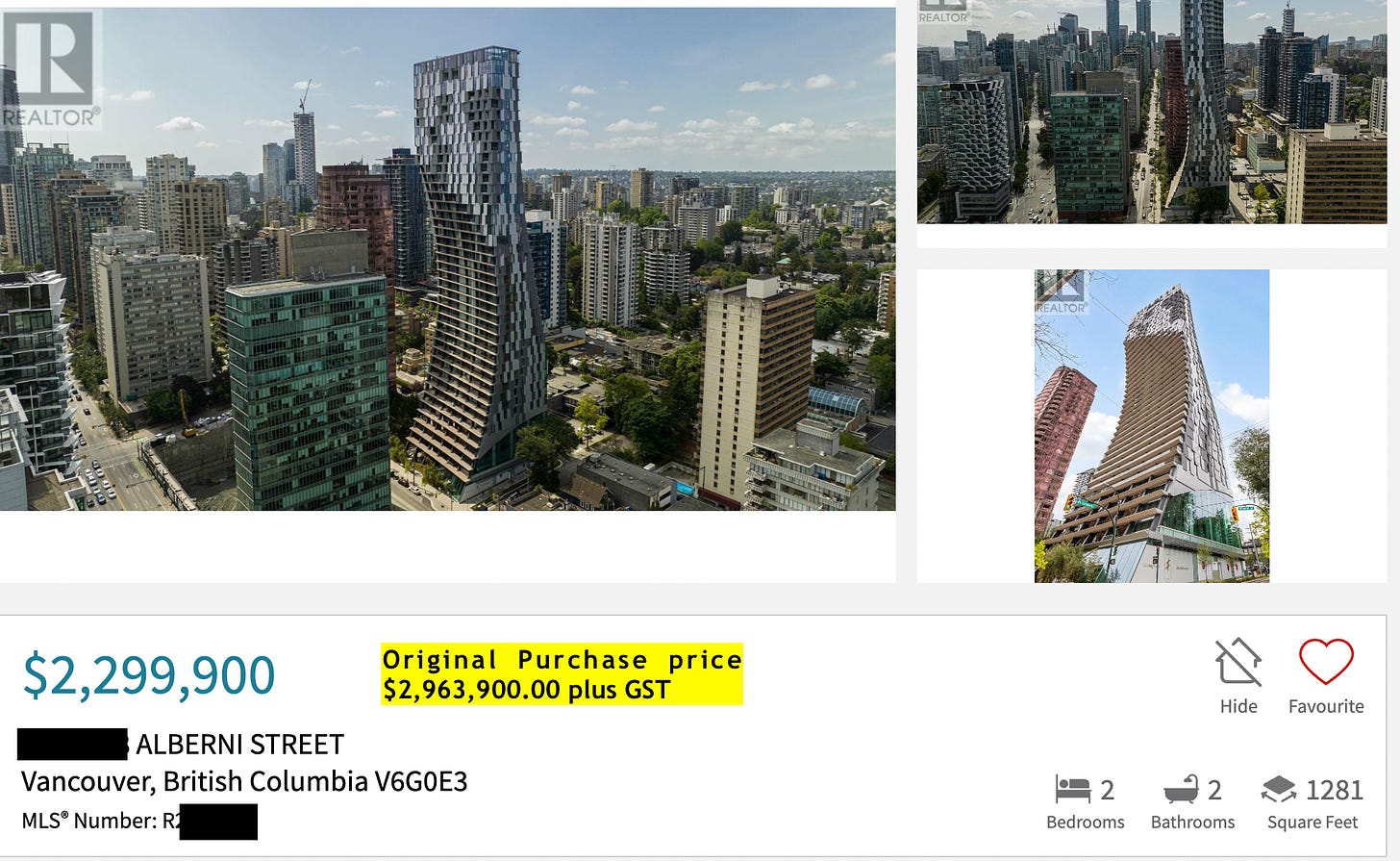

Contrast this with the luxury condo market which has slowed to a standstill after foreign money dried up following a tightening of capital controls, and an onslaught of local taxes. This has only been exacerbated further with the federal foreign buyer ban and the housing crisis developing over in China.

Suffice to say, the local market for $3M condos in Downtown Vancouver is thin, and without the foreign bid we are seeing losses compound. Net of fees, million dollar losses on recently completed luxury high-rise condos are not unheard of.

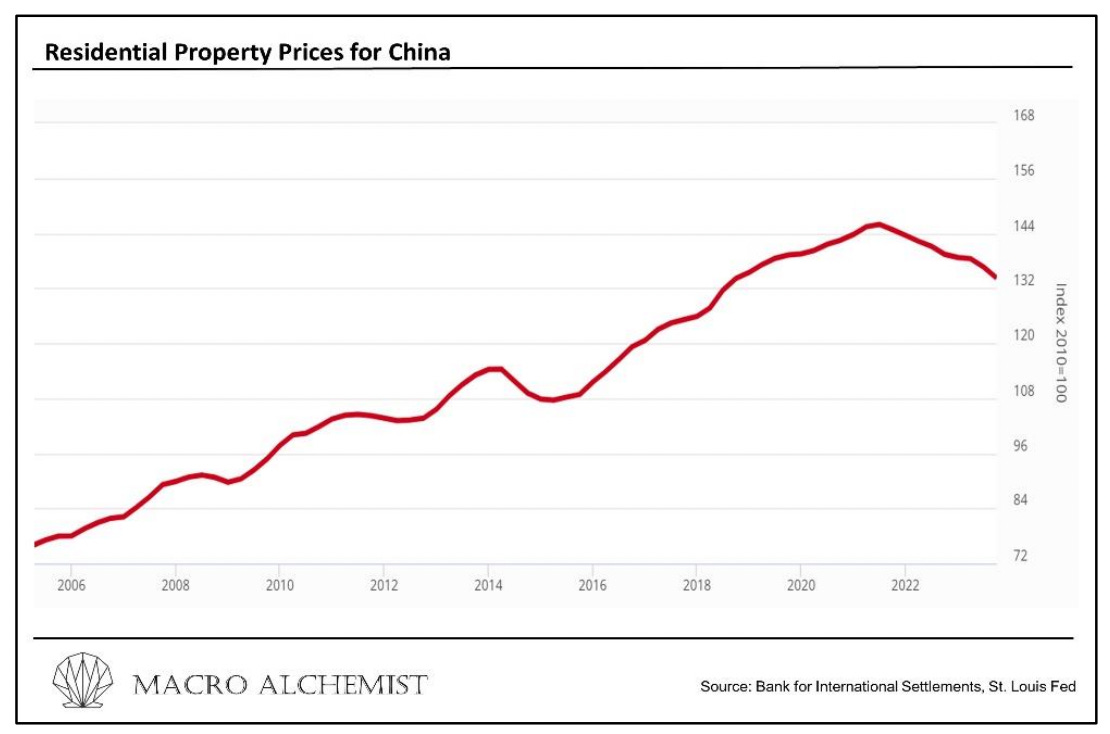

It’s worth debating when the luxury condo market can turn things around, particularly if the Chinese property market doesn’t pull a sharp U-turn. In a recent research piece titled “Who Gets the House?” the unwinding of the Chinese property market risks destabilizing western property markets.

After all, property markets in China, the US, Canada and Australia are connected in many ways:

• China’s property market grew to an unprecedented size, creating unprecedented paper wealth.

• The resulting wealth generation saw an equally unprecedented Chinese appetite to take capital outside of the reach of the Chinese government, investing in houses within liquid (Western) jurisdictions with strong rule of law.

• Commodity exporting economies such as Canada and Australia further benefitting from supplying China’s construction boom.

• The Chinese property juggernaut absorbing massive foreign inventory at inflated prices, forcing Western locals to pay up in their own markets to compete against Chinese investors.

• Historically low global interest rates, against a backdrop of globalization, enabling property markets to rise in unison.

• Globalization enabling free capital flow between these nations.

• The more debt the Chinese property market accumulated, the more the need for debt arose in the Western property markets in order for local buyers to compete with Chinese buyers.

The higher Chinese property prices went (valued at $50 trillion $USD), the more wealth was generated that could then be invested in other property markets around the world. The boom, which was fuelled by a mountain of debt is now unwinding.

What happens if further Chinese wealth destruction necessitates Chinese liquidiation of foreign housing ownership? Contributing to China’s real estate downturn is the fact that globalization is now reversing.

It’s worth considering which parts of the Canadian housing market would be more impacted under such a scenario.

I suspect the blowback could be harder for luxury condos in Vancouver than it would for a bungalow in Regina, Saskatchewan. Let’s watch.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Steve Saretsky June 25th, 2024

Posted In: Steve Saretsky Blog