June 6, 2024 | Eyes Wide Open as Bank of Canada Blinks

Yesterday, the Bank of Canada (BOC) blinked on inflation fears and responded to weak growth and rising unemployment with the first rate cut in four years and the first since the epic tightening cycle began 27 months ago in March 2022. Markets are pricing in another 50 bps of BOC rate cuts by year-end. Canada is the first G7 country to ease; others typically follow suit.

The BOC forecasted GDP growth to be 2.8% annualized for the first quarter, and the latest read came in at 1.7%, with the year-over-year growth rate at a paltry .5% annualized. At the same time, a 3.2% year-over-year population growth saw per capita GDP contract by 2.6% year-over-year, a decline that has never been seen outside of a recession.

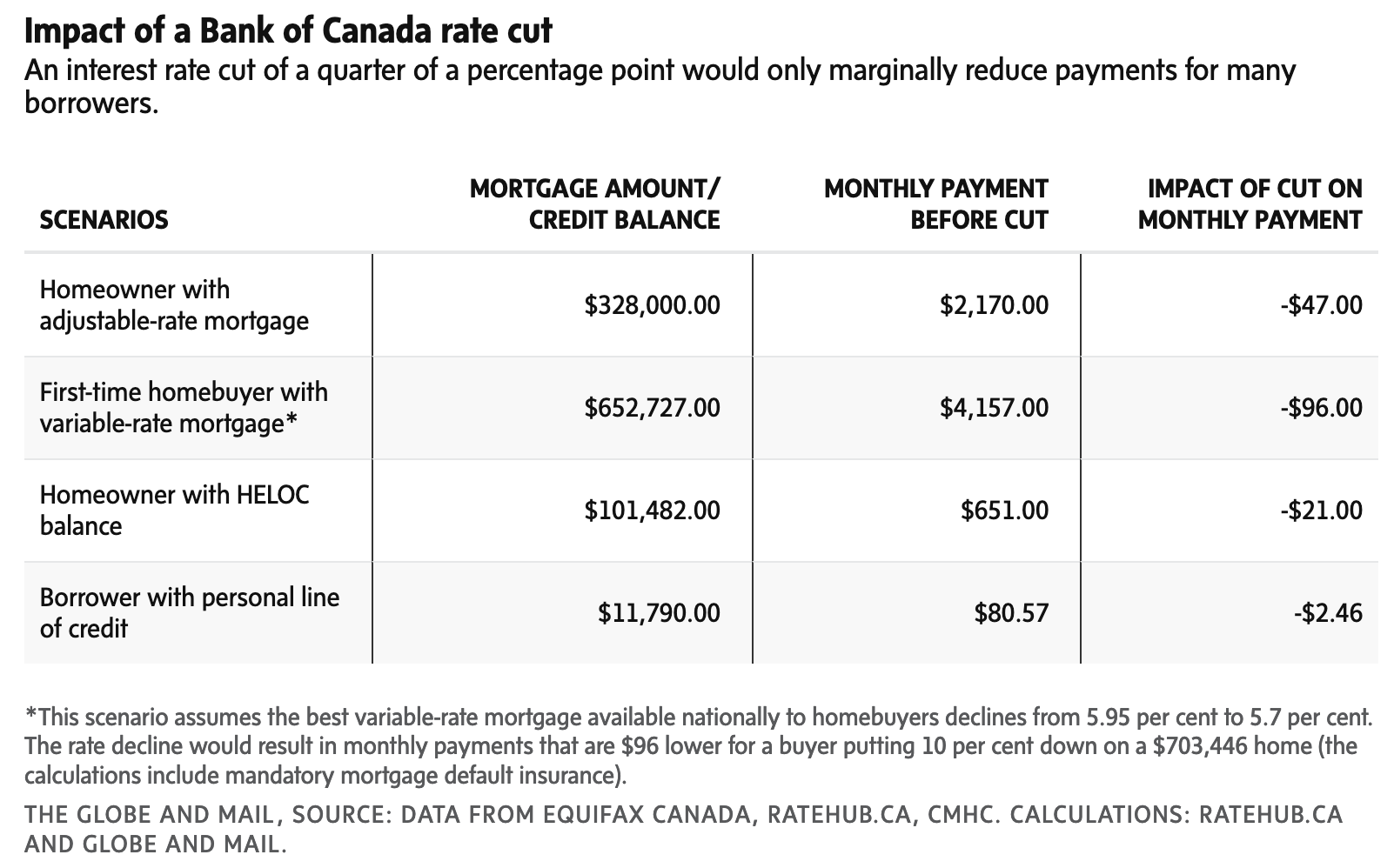

Central bank rate cuts help lower variable-rate debt costs but will not provide the urgent debt relief many seek. The table below, courtesy of the Globe and Mail, shows the marginal reduction in monthly payments from this week’s 25 bp cut. See By the Numbers: How a Bank of Canada rate cut will affect mortgages and other debt payments.

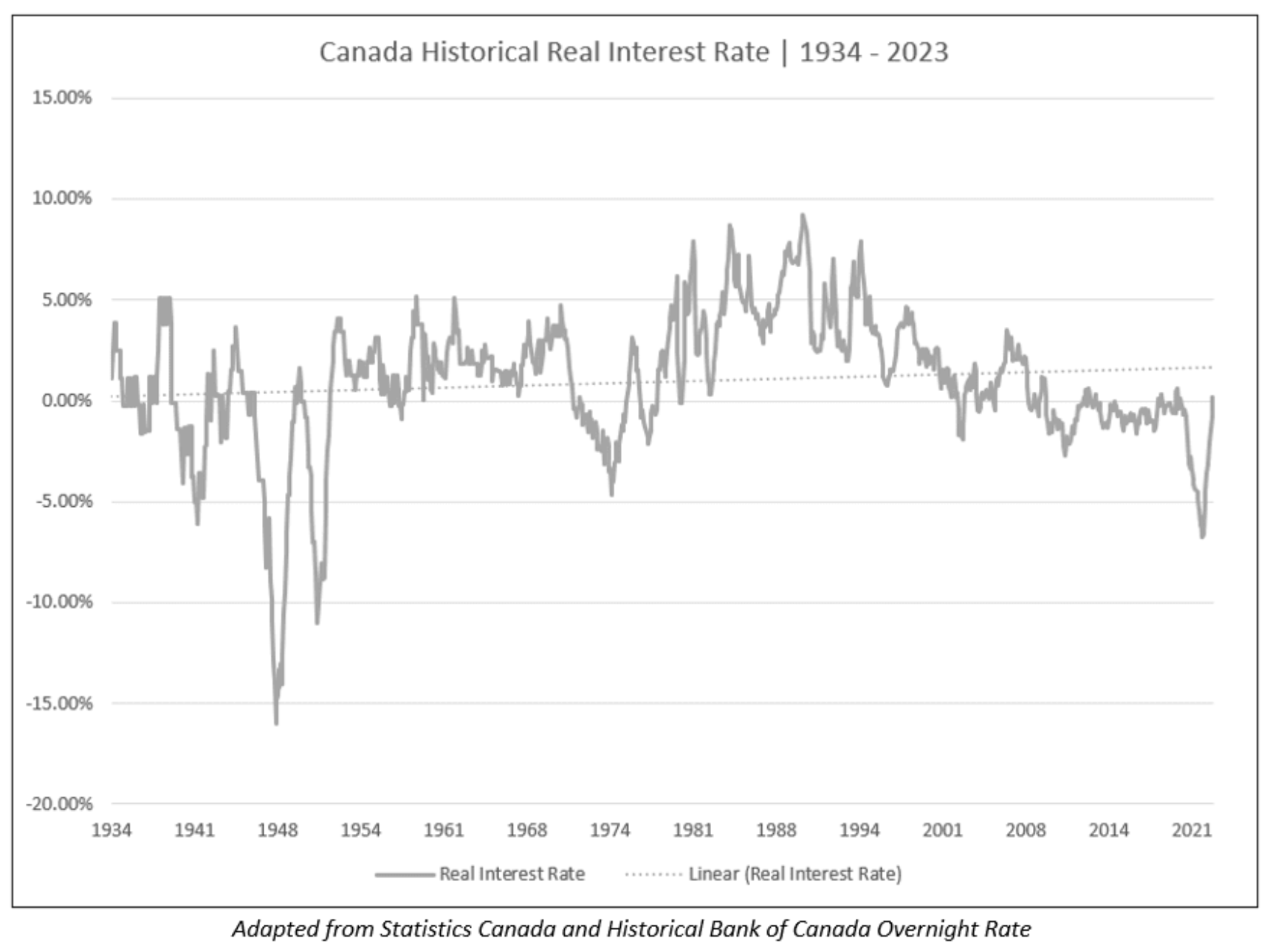

Unfortunately, in the 20 years between 2002 and 2022, real interest rates (overnight rate minus CPI shown below courtesy of Quality Appraisals) were primarily held below zero, which was highly stimulative for debt addition and credit-fueled excess consumption.

This month, with an overnight rate of 4.75% and three-month annualized CPI measures averaging 1.85%, the real rate of 2.9% is the highest since 2007 and 2000 before that. Past housing market downturns were preceded by periods of similarly high real interest rates.

Most Canadians have fixed-term loans that don’t change with overnight rates. Fixed-term rates are set by the government bond market, where yields/rates fall as prices rise and vice versa. Government bond prices have been rallying as we expected, which will help lower new fixed loan rates on offer. Whether it relieves existing debtors depends on when they took out the original loans. If they originated during the ultra-low rate era before 2023, they are still in for a rate shock when loans come up for renewal in the months ahead.

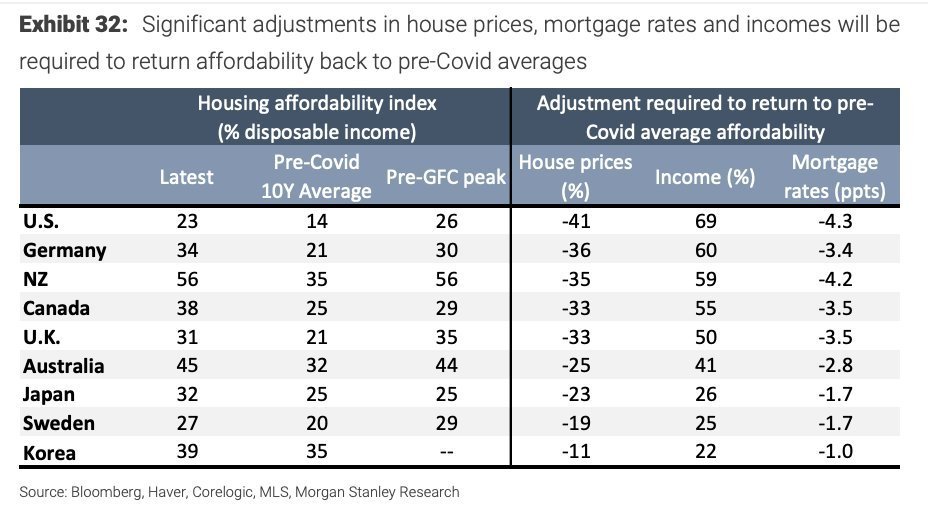

Courtesy of Lance Lambert, the chart below shows the reduction in mortgage rates or home prices/increase in household income needed for home affordability to return to pre-COVID norms in Canada and other peer countries. In short, barring drastic changes in one or all of these variables, home affordability will remain crushing for the masses. Significantly more has to give, probably on all three fronts. It’s typical for government bond prices to rise through central bank cutting cycles, and it’s usual for stocks to rally at the outset before falling, along with economic activity, employment, and corporate profits.

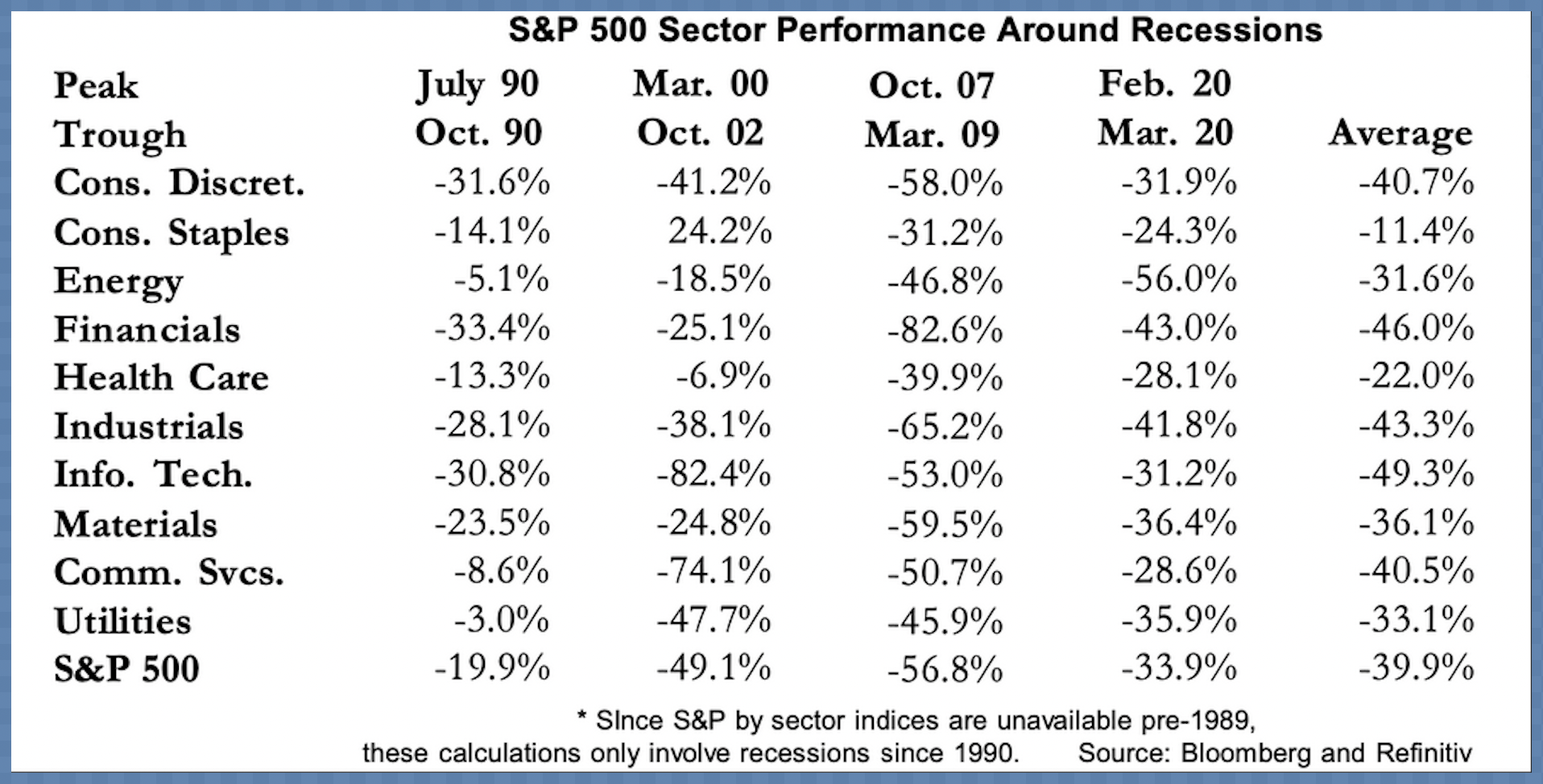

It’s typical for government bond prices to rise through central bank cutting cycles, and it’s usual for stocks to rally at the outset before falling, along with economic activity, employment, and corporate profits.

Despite what the sell side says, the most punishing parts of equity bear markets traditionally happen during central bank cutting cycles, not before. And dividend-paying stocks lose, too (chart below, courtesy of A. Gary Shilling). Eyes wide open.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Danielle Park June 6th, 2024

Posted In: Juggling Dynamite