June 26, 2024 | Easy Money Has Yielded a Vicious Payback Period

Interest rates and high debt levels are biting hard in Canada; the economy is weak, and layoffs are rising.

Toronto’s new home sales were down 71% compared to May 2023, with new condo sales down 75% and new single-family home sales down 65%. The same period saw an increase of 20,427 new home listings in May (16,845 condos and 3,582 single-family homes) compared with 936 new home sales (539 condominium units and 397 single-family homes), according to the latest Altus Group analysts and the Building Industry and Land Development Association report.

At the current sales pace, the existing listings would take 14.5 months to sell. See, ‘Nothing is moving’: GTA sales of newly built homes plummet in May.

Lower home prices are disinflationary and part of what the Bank of Canada has been targeting. Unfortunately, rents and higher mortgage rates are working at cross-purposes.

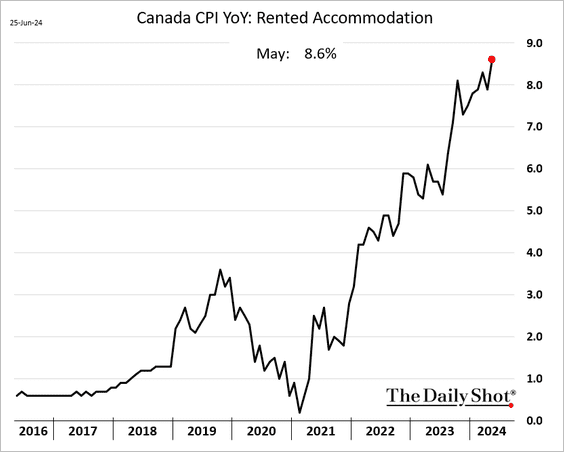

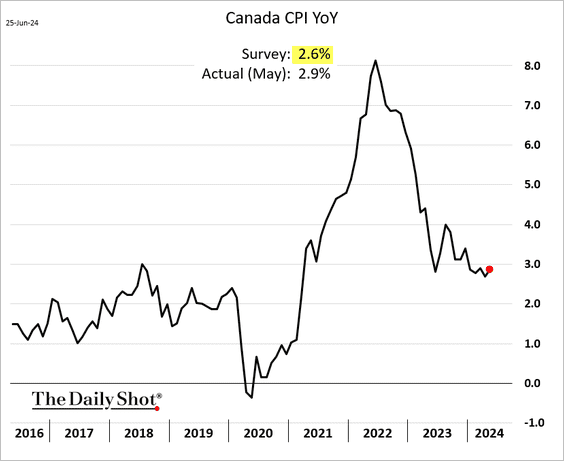

The masses remain priced out of home ownership, and landlords are trying to cover higher carrying costs with higher rents. An 8.6% average rent increase year-over-year in May (on the lower right since 2016, courtesy of The Daily Shot) helped push the core Consumer Price Inflation Index (CPI) up 2.9% year-over-year (on the lower left) vs. 2.6% estimated.

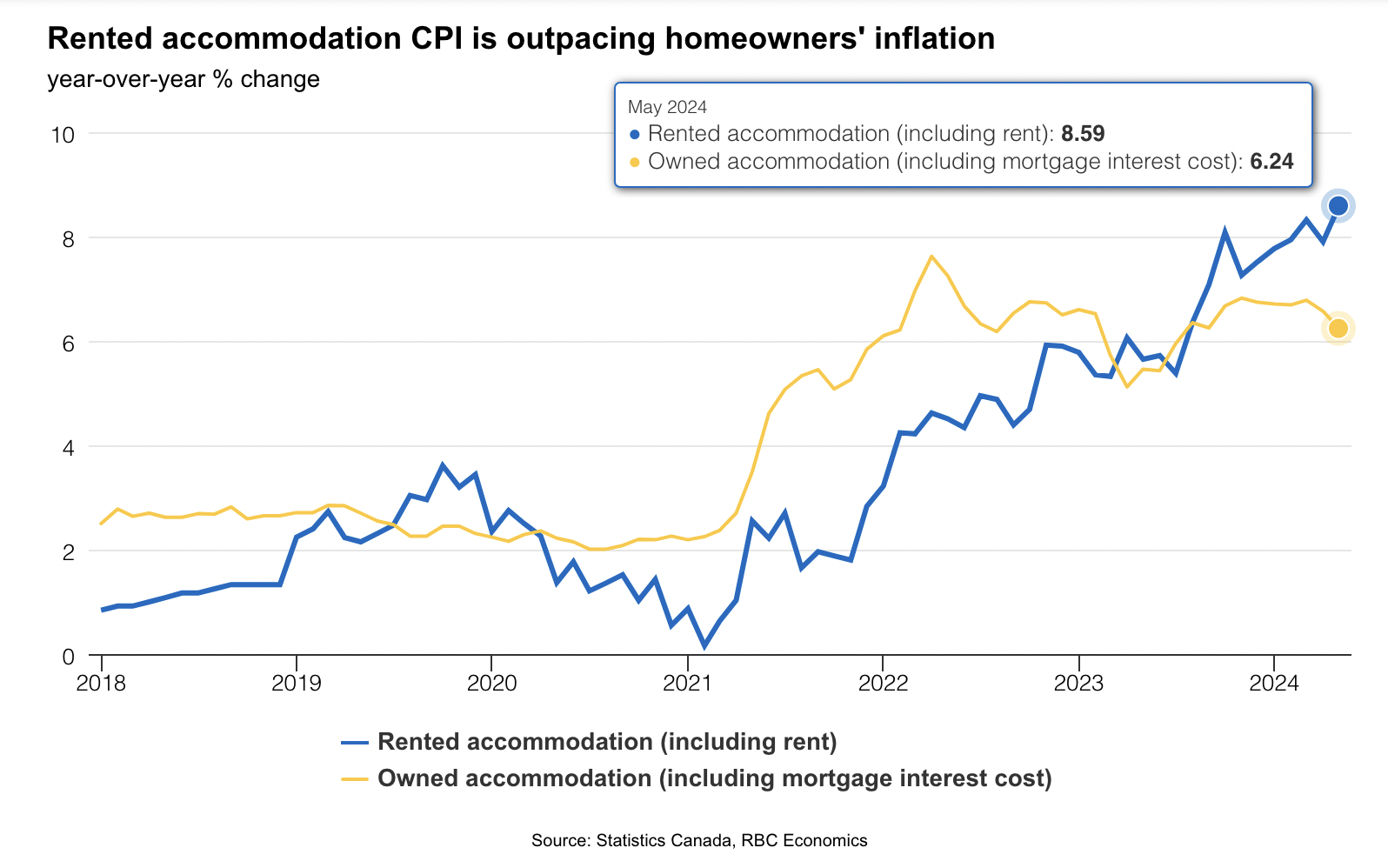

The problem is that shelter costs comprise 30% of Canada’s CPI basket. Twenty-four percent of shelter inflation is driven by changes in average rents (blue line below since 2018, courtesy of RBC), and 13% by mortgage interest costs (yellow line).

As the inflation rate has fallen since last fall, Treasury bond prices have risen, lowering their yields and starting to bring down interest rates in the banking system. Lower rates help reduce the payment shock as thousands of ultra-low-rate pandemic-era loans come up for renewal.

But yesterday’s CPI surprise–the first month-over-month increase in five months—lowered the odds that the Bank of Canada will ease overnight rates again at its July 24 meeting. Treasury bonds have sold off sharply on the news (yields higher), pushing interest rates back up.

Higher rates and rents drive shelter inflation, constraining rate-cutting room and driving less spending, more layoffs, and even more economic lethargy. The Bank of Canada wants to lower rates, but quick fixes are not in the cards here.

Years of recklessly low interest rates have made this mess, and the payback period is vicious.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Danielle Park June 26th, 2024

Posted In: Juggling Dynamite