June 7, 2024 | Bank of Canada Cuts Rates and Sends The Market a Signal

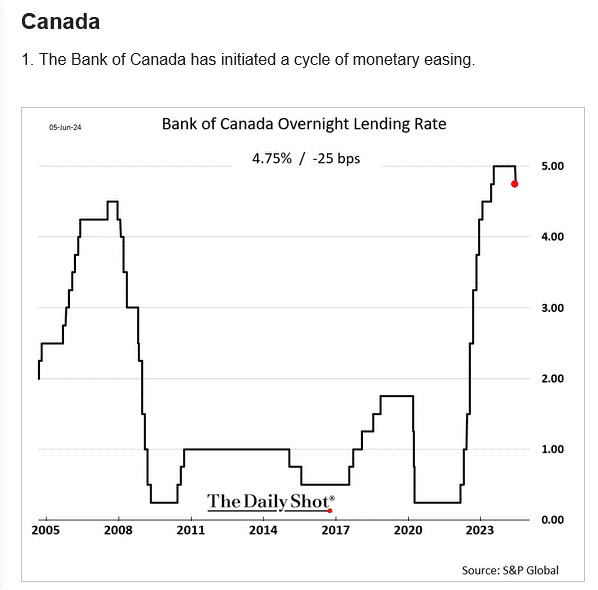

The Bank of Canada cut interest rates by 25 bps on Wednesday and the ECB made a similar cut on Thursday. This marks a significant moment in the history of interest rate policy changes and could be a turning point. CPI Inflation has moderated enough (2.7 percent) to allow cuts without a loss of credibility.

Should we trust the Bank of Canada?

The Bank of Canada press release.

The central banks of Canada and the U.S. and elsewhere lost a lot of credibility over the last twenty years. Much of their reputation for prudent management of inflation and full employment was undeserved, but the difficulties that central bankers have in making sound decisions was put under the spotlight in 2008 and when inflation soared in 2021 to 2023. The central bankers did not look good.

One famous gaff was made by the head of the Bank of Canada when he said in July 2020 that rates would stay low for a long time:

“If you’ve got a mortgage or if you’re considering making a major purchase, or if you’re a business and you’re considering making an investment you can be confident rates will be low for a long time.”

Tiff Macklem, governor of the Bank of Canada.

And again, in November 2021, Macklem misjudged the situation:

“All these factors have driven prices up, but none of them are likely to last. So, we shouldn’t overreact to these temporary price increases.” Macklem in a National Post editorial.

At that time, central bankers adopted a mantra about inflation, calling it “temporary, transient and transitory”.

And in March 2022, less than two years after the “low for a long time” statement, the Bank of Canada followed the U.S. Fed into a long period of rapid interest rate increases because Canadian inflation had soared to 8.1 percent and higher elsewhere.

Rates went from 0.25 to 5 percent over sixteen months. Rates stayed at the recent peak of 5 percent for 11 months.

Rates stayed too low for too long (2009 to 2020) and then shot up too fast (2022-23).

Just before the Financial Crisis started, a small hike of 0.25 percent in July 2007 by the Bank of Canada was in response to a worry about too strong economic growth. That hike was quickly reversed.

Similarly, this week’s rate cut isn’t likely to be an accurate forecast of what is coming. The crystal ball is very murky.

And now we are told that inflation might be under control, and we can expect rates to come down.

We know that Canada has experienced rapid population growth with very little GDP growth. Some economists are suggesting that a recession is underway.

If this small decrease is the first in a long series of Bank of Canada rates cuts it will be because a recession started recently or is about to start, not because the BOC has any special insight into what is likely to happen next.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Hilliard MacBeth June 7th, 2024

Posted In: Hilliard's Weekend Notebook