June 17, 2024 | A Heist of Tax Dollars

Happy Monday Morning!

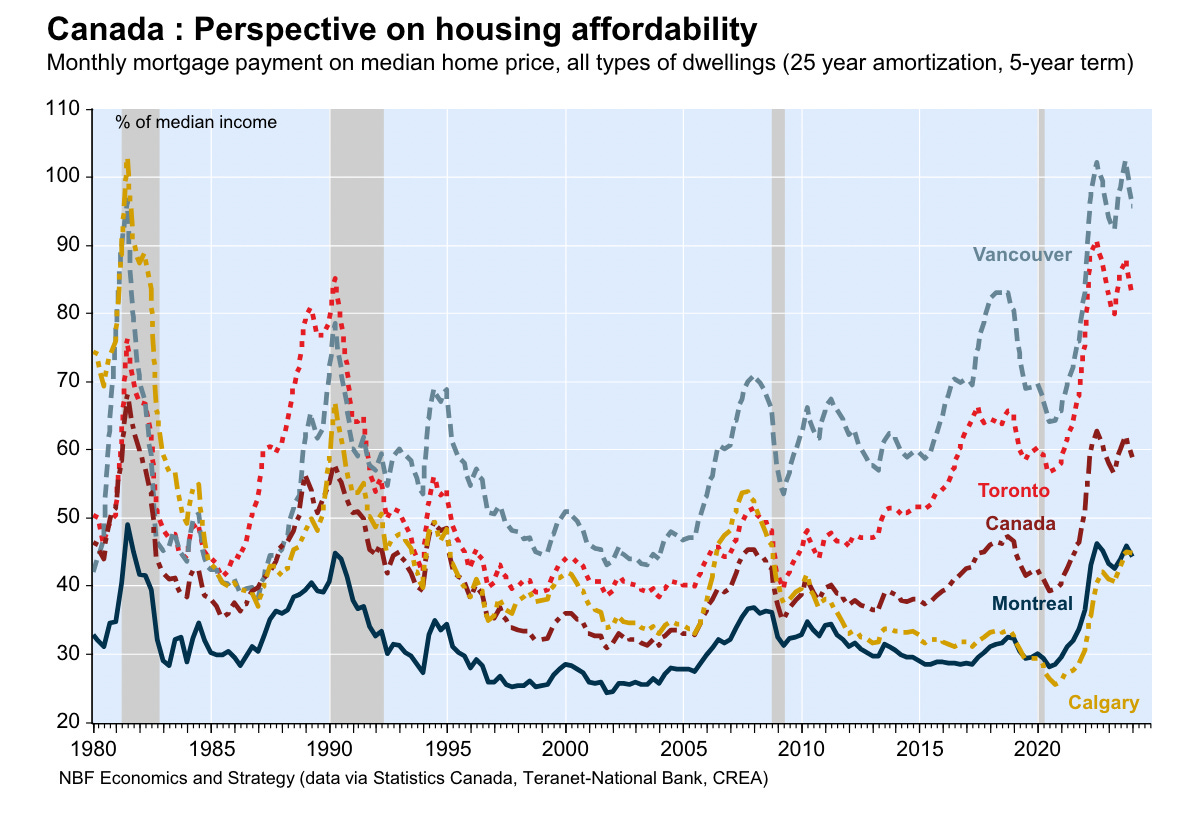

It was just a few weeks ago when PM Trudeau lamented on the need for affordable housing while at the same time saying housing needs to retain value since it makes up such a large part of people’s retirements. In other words, the prime minister is trying to ride two horses with one ass.

Of course there are only a couple of ways to make housing more affordable. Either prices need to drop or incomes need to rise at a faster pace than home prices for a sustained period of time. The latter is no quick fix, and it will take years to see any meaningful improvement in affordability.

If you assume incomes are rising by 3% per year, then you’d seemingly want house prices growing even less than that, the same goes for rents. This becomes increasingly more impossible when the population is growing by 1.2 million per year, but I digress.

We need more new housing supply to arrest the level of house price growth. If you can ramp up housing completions you can slow the level of price appreciation, perhaps to a level where incomes can actually keep pace. This is what the government is betting on, and makes up the core of their housing platform. From the removal of GST on purpose built-rental housing, to the housing accelerator fund, supply cometh, or so we are told.

Remember, The Trudeau government says they are going to build 3.9 million homes by 2031. The record high for annual housing completions in this country is 274,000 set back in 1974. The federal government is promising 3.9M homes by 2031. That’s more than DOUBLE the record high, and you’d have to do it 7 years straight with interest rates at their highest levels in 20 years!

But supply is coming and the feds are hoping a $4B housing accelerator slush fund will do the trick. Here’s the nuts and bolts on the accelerator fund:

- Municipalities apply for funding from the $4 billion federal fund in exchange for implementing measures to boost housing supply faster than historical averages.

- Eligible initiatives include increasing densification, speeding up approval times, tackling NIMBYism, establishing inclusionary zoning, encouraging transit-oriented development, and investing in e-permitting systems.

- Funding is flexible and can support capacity increases, land purchases, infrastructure upgrades, policy changes like inclusionary zoning, etc.

- Cities receive 25% of funds upfront upon signing the deal, and the remaining 75% in installments tied to achieving milestones over 4 years until 2026-27.

Sounds great, let’s check in on the results, shall we.

In December 2023, the City of Toronto announced that it will receive $471 million in funding from the program.

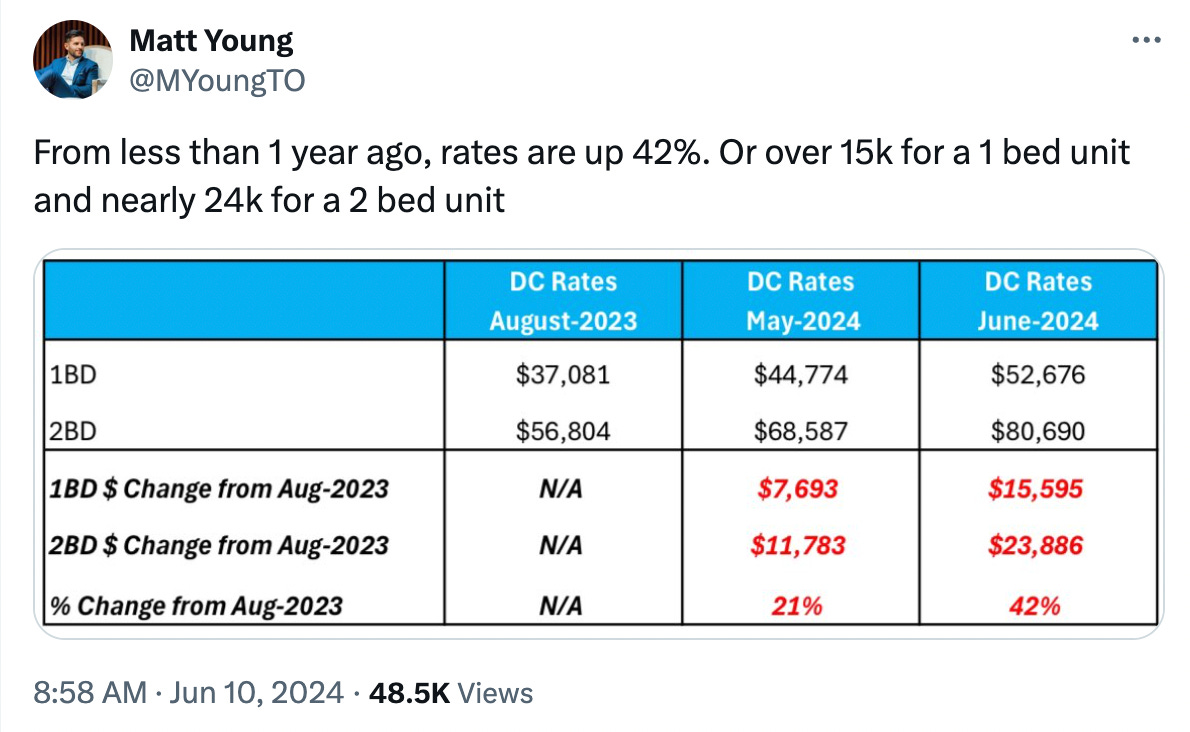

On May 1, development charges on Toronto condos increased 20.7%, adding millions to the cost of a new development.

Just one month later, on June 06, the city of Toronto announced Bill 185, Cutting Red Tape to Build More Homes Act. The bill to cut red tape comes with another increase in fees!

You can’t make this stuff up. The cutting the red tape bill will increase development fees once again, raising the annual increase in development fees by a whopping 42%. Development fees for a one bedroom condo in Toronto are now $52,676, and $80,690 for a two bedroom.

Fees and taxes which include HST, Development charges, Educational levy’s, Community Benefits Charges, Parkland Charges, Land Transfer Tax, Application Fees, Permit Fees, and Property taxes now account for 30% of the cost of a new housing unit, and the bloat is only growing with every cheque the feds are stroking.

But wait, there’s more.

The city of Burnaby was recently approved for $43M of “housing accelerator” dollars. They then turned around and jacked their development fees for high density by nearly $50k per unit this year. You are not misreading, they approved a FIFTY THOUSAND DOLLAR INCREASE per unit.

This leaves us with several questions. How is this making housing more affordable, and how will this spur more development, not less?

The housing accelerator fund is turning out to be nothing more than a heist of tax dollars flowing from the feds to the municipalities.

If you’re wondering why we are in the midst of a housing crisis that is not only chronic in nature, but getting worse it’s time we start asking ourselves some hard questions. Taxes and fees are 30% of the proforma and growing, there’s really nothing else to say.

Housing affordability is a lie, but it does win a few votes. We have tasked the same people who created the problem to fix the problem, don’t be surprised if the results are the same.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Steve Saretsky June 17th, 2024

Posted In: Steve Saretsky Blog