May 25, 2024 | Trading Desk Notes For May 25, 2024

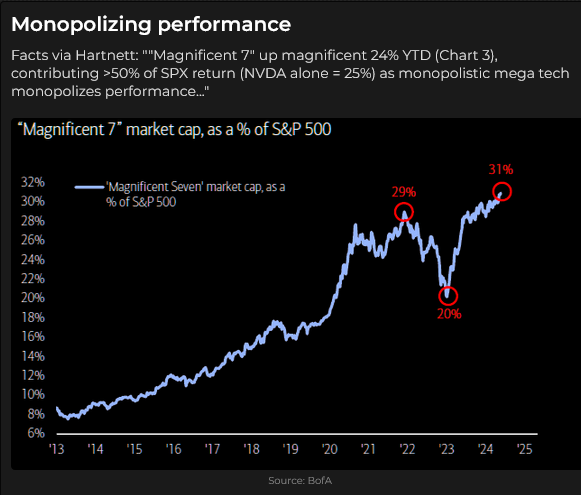

Divergence: while NVDA soared on Thursday, all 30 stocks in the DJIA closed lower on the day (for the first time in 2024)

NVDA’s quarterly report on Wednesday was expected to be good. Still, the possibility of it being “less bullish than expected” likely sidelined many bullish traders ahead of the release date because it is the “most important stock in the world.”

The report exceeded expectations, and the share price rose >$100 (~10.5%) on Thursday to new All-Time highs, up >100% YTD with a market cap of ~$2.6 trillion.

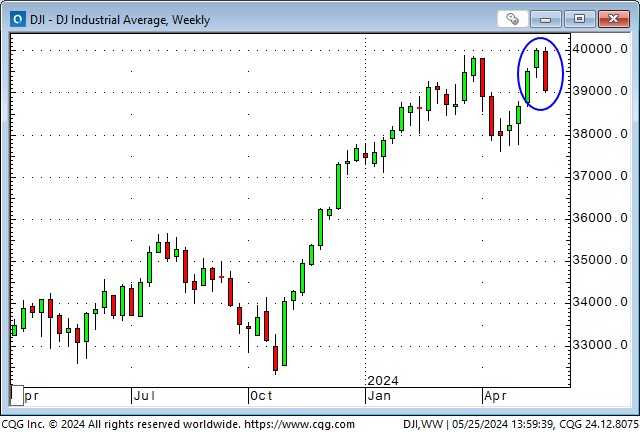

The bullish enthusiasm unleashed by NVDA’s spectacular performance helped the S&P and the NAZ rally to new All-Time highs Thursday morning, but – both indices reversed hard and fell to new lows for the week. Both indices registered a daily key reversal down from ATH on Thursday.

The venerable DJIA (cash index) traded to new All-Time highs Monday morning but closed the week >1,000 points (2.5%) lower, creating a weekly key reversal down from the ATH.

The divergence between NVDA sustaining its rally to ATH while the indices fell on Thursday may be attributed to the “reemergence” of “higher for longer” market sentiment following Wednesday’s Fed minutes and Thursday’s robust S&P PMI data. (Or maybe, after a sizzling 400-point (~8%) rally from the April lows, the market needed a minor one-day correction.)

Interest rates

Market sentiment has oscillated between believing that “higher for longer” was a fact of life or was “yesterday’s news,” but this week, the sentiment seemed resigned to thinking that the Fed was “in no hurry” to cut rates and (OMG) the Fed might even raise rates if inflation started to trend higher.

Currencies

With sentiment swinging back to “higher for longer,” it is no surprise that the US Dollar index rose this week.

The Canadian dollar fell ~80 points Monday to Thursday this week as interest rate spreads worked against the CAD (US rates are expected to stay higher for longer, while some analysts expect the BoC to cut sooner than the Fed because interest rates, especially short-dated mortgage rates, are seen as a significant burden for consumers.)

Open interest in CAD surged this week, up 45,000 contracts (~20%) since last Friday, reaching All-Time highs (X delivery spikes). COT data (as of Tuesday’s close) showed that net short speculative positioning surged to a 7-year high.

The CAD rallied on Friday, which seemed tied to the return of “risk-on” sentiment as the S&P and NAZ bounced back from Thursday’s tumble. (I’ve often noted that the pricing of CADUSD is more a function of “things” outside of Canada rather than “Canada-specific” news.)

The Euro rallied to an All-Time high weekly close against the Japanese Yen this week. The Euro has risen ~50% against the Yen since 2020.

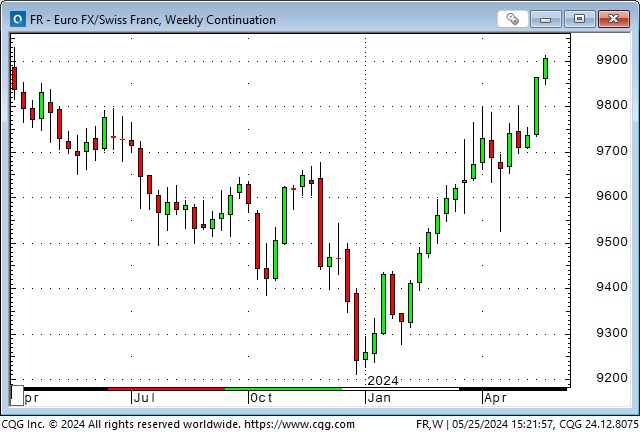

The Euro fell to an All-Time low against the Swiss Franc in December but has rallied ~7.5% since then. (The CHF was hitting All-Time highs against many currencies in December, and I believe that the SNB signalled back then that they wanted to weaken the Franc to help Swiss businesses and exporters. They unexpectedly cut interest rates in March, further undermining the Franc.)

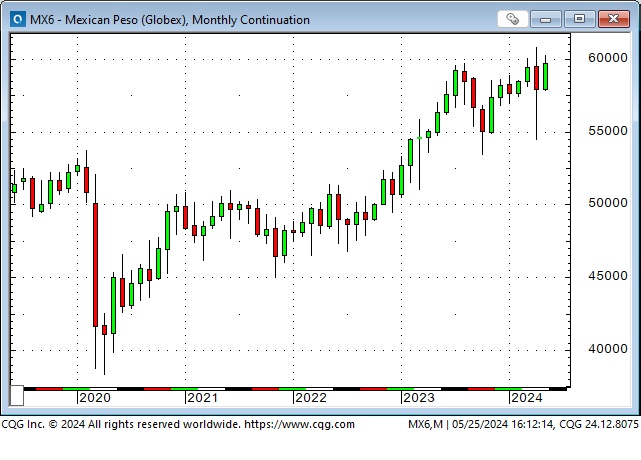

The Mexican Peso hit 9-year highs against the USD in April and has rallied ~50% since hitting historic lows during the covid panic in early 2020. Current short-term Mexican interest rates of ~11% compared to ~5% in the US have helped boost the Peso.

Mexico is scheduled to hold a national election on Sunday, June 2. Claudia Sheinbaum is expected to become the first female Mexican President, taking over from Andres Obrador. The FT quoted her this week as saying that the Mexican free market economy geared towards trade with the US “brought atrocious poverty and inequality.”

Since October, speculators have built the most significant net long position in the Peso since 2020, probably with an eye toward the interest rate spread. They may be vulnerable to a change in Mexican politics.

Metals

Comex June gold hit an All-Time high on Monday of ~$2,454 but then fell ~$130 to Friday’s lows – creating a weekly Key Reversal down.

Comex July silver soared to a 12-year high of ~$32.50 on Monday and then fell back ~$2.

Comex July copper reached an All-Time high of ~$4.20 on Monday and then reversed ~45 cents (~8.5%) by Friday’s close.

COT data as of Tuesday, May 21 (released on May 24) showed that net long speculative positioning in gold was at a 2-year high (the highest since the invasion of Ukraine), silver was at a 4-year high, and copper was at a 3-year high.

Energy

WTI traded lower every day this week, touching a 3-month low of ~$76.15 on Friday before reversing.

Front-month Nymex Nat Gas traded to a 4-month high this week but reversed hard on Thursday/Friday.

Many uranium issues reached multi-year highs this week after Biden banned Russian imports last week.

Orange juice is the new cocoa

OJ futures hit All-Time highs this week – about double the highs of the last twenty years.

My short-term trading

I shorted gold on Wednesday after it broke below Monday and Tuesday lows and then broke below $2,400. I held the trade into the weekend.

I shorted the S&P on Wednesday when it began falling after the scheduled release of the “hawkish” Fed minutes. About two hours later, the market spiked higher on the NVDA quarterly report, stopping me for a slight loss.

I shorted the S&P again on Thursday morning after it reversed from making new ATH on the NVDA news and held that trade into the weekend.

I shorted the Mexican Peso on Wednesday after it had a daily Key Reversal down on Tuesday, which created a “lower high” compared to the April high. I kept the trade into the weekend.

I still hold my long July Swiss Franc calls, established after the CHF had a weekly Key Reversal up. However, even though I was prepared to keep this trade into June, I’m having second thoughts!

My net realized and unrealized P+L had a modest gain this week.

The Barney report

Barney and I have been “home alone” this week as my wife tends to family matters in Vancouver. We’ve had mixed weather this week, so we’ve been out walking in excellent sunny conditions and dreadful rainy conditions, but with Barney, we’re out at least three times a day, regardless of the weather.

When Barney gets tired of waiting for me to leave my computers, he will propose a game of catch the ball or catch the stick.

Listen to Victor talk about markets with Mike Campbell

On this morning’s Moneytalks show, Mike and I discussed the dramatic price action across markets following NVDA’s quarterly report. We also discussed the wild ups and downs in the metals markets. You can listen to the entire show here. My segment with Mike starts around the 54.30-minute mark.

The Archive

READERS CAN ACCESS WEEKLY TRADING DESK NOTES FROM THE PAST SEVEN YEARS BY CLICKING THE GOOD OLD STUFF-ARCHIVE BUTTON ON THE RIGHT SIDE OF THIS PAGE.

Headsupguys

There’s a reason I put a link to Headsupguys in my Notes every week. I’ve had friends who took their own lives, and Headsupguys helps men struggling with depression.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new, usually four to six times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Victor Adair May 25th, 2024

Posted In: Victor Adair Blog