May 11, 2024 | Trading Desk Notes For May 11, 2024

Despite a quiet, low VOL week, the leading stock indices continued to rally, with the European benchmark index closing at all-time highs.

Last week was chockablock with data and event risk; price action was wickedly choppy, and stocks rose. This week was so quiet that you sometimes wondered if the markets were open – and stocks rose. (VVIX fell to a 9-year low.) Next week, the CPI number on Wednesday morning is looming as a huge event risk—a lower-than-expected print could drive American stock indices to new all-time highs (on hopes of Fed easing.)

Last week, I noted that softer economic and employment data challenged the dominant recent theme of “the Fed will be higher for longer,” causing bond yields and the USD to fall.

This week, the University of Michigan reported a sharp drop in consumer sentiment. If CPI hints at inflation coming down, we could see dramatic repricing across markets given the recent softer economic and employment data and worried consumers.

Interest rates

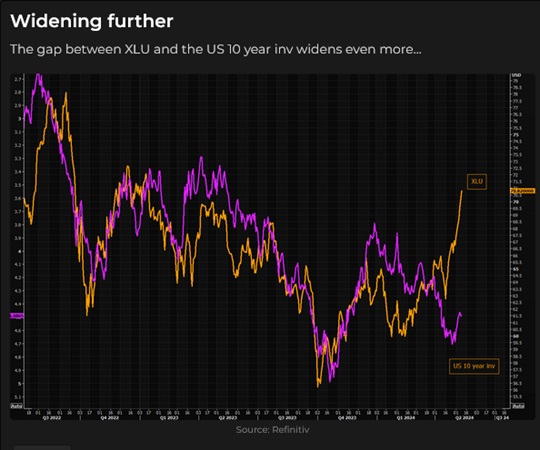

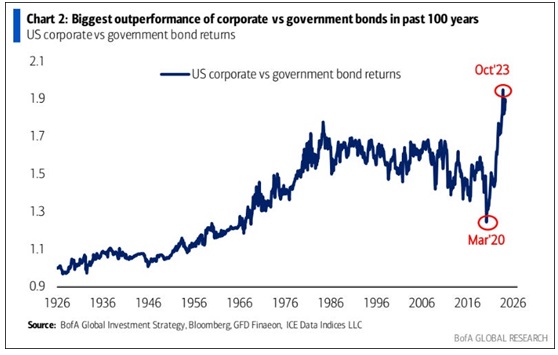

Utilities and corporate bonds have been having a great year, with the yield spread of corps over govies ultra-tight. Is this a function of investors reaching for yield?

Currencies

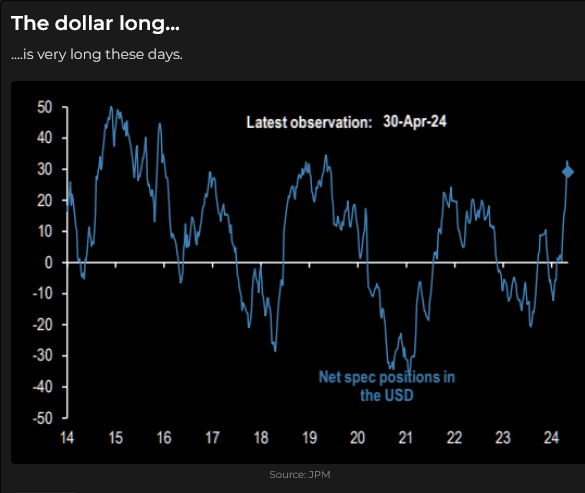

The US Dollar Index has rallied more than 5% since late December, with a good part of the rally due to the USD yield premium over other countries. (The “carry” makes it challenging to be long Swiss or Yen against the USD.) In addition, the notion that the Fed would stay “higher for longer” than other central banks has boosted the USD.

Speculator positioning has become aggressively bullish on the USD, especially against the JPY, CHF and CAD.

Precious metals

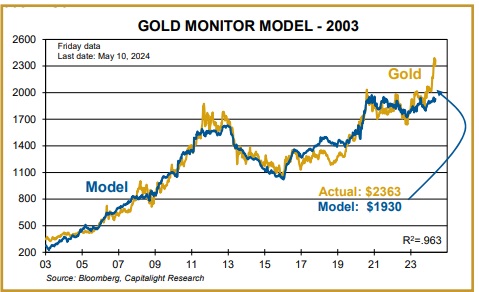

Gold soared to all-time highs against all fiat currencies in mid-April, corrected ~$150 to last week’s lows, and rebounded ~$100 to this week’s high.

Silver had a similar price pattern to gold, but (as usual) it was more dramatic!

I’ve frequently written about the breakdown in the (negative) correlation between gold and the USD/interest rates. Historically, a strong USD and high real interest rates were toxic for gold, but that hasn’t been the case for the past 18 months (or so), particularly YTD. The fact that gold has been rising even though the USD has been strong and real rates have been trending higher over the past two years indicates that “something else” is impacting the gold market.

The “something else” is frequently identified as record central bank buying. More recently, leveraged retail buying on the Shanghai Futures exchange drove prices to record highs.

My friend of more than thirty years, Martin Murenbeeld, a world-renowned gold analyst, writes in his most recent weekly Gold Monitor that gold “may well have risen by some $400 relative to its price under previous – pre-Ukraine invasion – circumstances on account of new geopolitical factors. More to the point, we do not see these factors dissipating; we are in a new environment – post-Ukraine invasion! And the world has changed.”

Copper

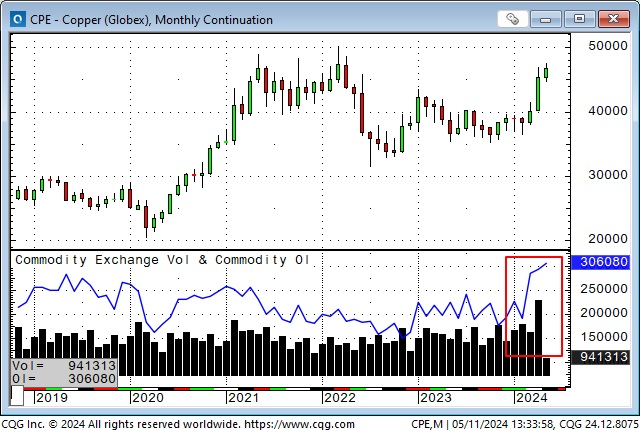

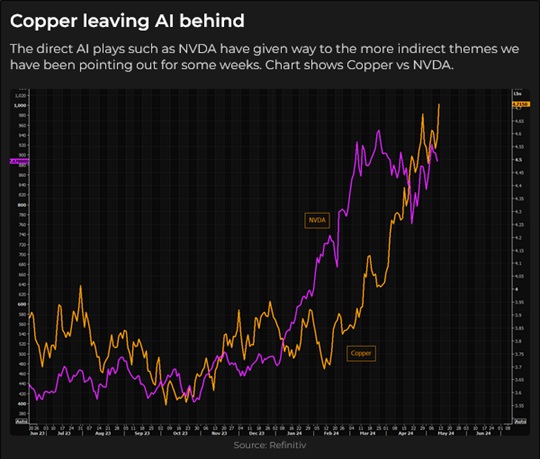

Comex copper futures rallied to 2-year highs in April on an all-time high monthly volume. Open interest is at all-time highs. Prices have continued to rally in May, reaching $4.75 a pound, a gain of ~30% from February’s lows and just 25 cents shy of the all-time highs made in March of 2022 following the invasion of Ukraine.

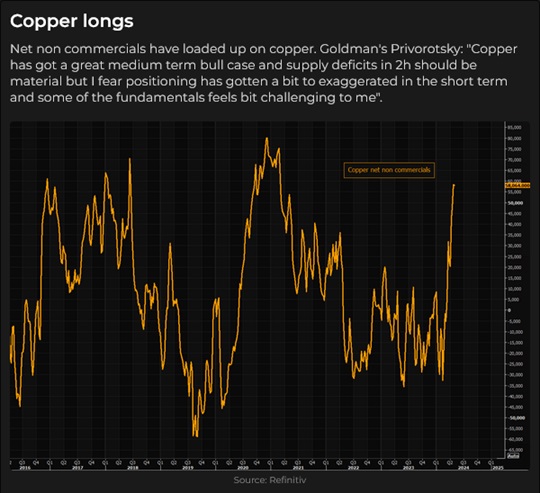

Speculators have been aggressive buyers of copper over the past six weeks, taking their net long positioning to a 3-year high.

The copper miners ETF, COPX, reached 13-year highs this week, outperforming the metal. Note the record volumes in March and April.

Energy

WTI futures have trended lower from their mid-April highs, perhaps due to reduced geopolitical tensions following Israel and Iran’s direct attacks on each other. OPEC+ is expected to maintain its “production cutback” quotas.

Some uranium plays traded to new highs this week.

My short-term trading

I started this week with no positions and stayed on the sidelines until Thursday, when I bought the CAD and the Swiss. My (short-term) macro view is that markets realize that “the Fed will be higher for longer” is fully priced in and that there is an asymmetrical risk that positions taken on that view will be unwound.

Speculators have aggressively shorted CAD and CHF over the past 2-3 months, taking their net short positioning to 7-year and 5-year highs, respectively. If the USD starts to weaken, speculators may begin to buy back their short positions. I held the positions into the weekend. My P+L was about flat on the week.

On my radar

The CPI report early Wednesday morning is the key scheduled event risk of the week. Some analysts are expecting “shelter” costs to come down.

PPI is Tuesday, and Powell is scheduled to speak on Tuesday.

We reached “peak no-landing” last week and backed further away from that expectation this week. Just as the market was too aggressive in expecting 6+ cuts from the Fed in January, I think the market is now underpricing the risk of an economic and employment slowdown (and a further deterioration of consumer sentiment) with concomitant easing signals from the Fed.

Quote of the week

The Barney report

Barney will try to lure me into playing with him when I’ve been sitting at my desk too long. He has been patient today as I write these Notes, but he’s reached his limit and is trying to entice me by showing up with a facecloth – something we both know he’s not supposed to touch.

Listen to Victor talk about markets with Mike Campbell

On the Moneytalks show this morning, Mike and I discussed how the market is having mood swings between the Fed staying higher for longer and the Fed “changing their tune” as the economy softens, unemployment rises, and consumers cut back on their spending. We also discussed gold, copper and the notoriously volatile Canadian employment reports! You can listen to the entire show here. My spot with Mike starts around the 1-hour, 2-minute mark.

The Archive

READERS CAN ACCESS WEEKLY TRADING DESK NOTES FROM THE PAST SEVEN YEARS BY CLICKING THE GOOD OLD STUFF-ARCHIVE BUTTON ON THE RIGHT SIDE OF THIS PAGE.

Headsupguys

There’s a reason I put a link to Headsupguys in my Notes every week. I’ve had friends who took their own lives, and Headsupguys helps men struggling with depression.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new, usually four to six times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Victor Adair May 11th, 2024

Posted In: Victor Adair Blog