May 10, 2024 | The U.S. Government Sliding Deeper and Deeper into Debt

The U.S. federal government will set a new record for borrowing this year, in the trillions of dollars.

Government deficits reached a record high in 2020, due to government help to the private sector during COVID. But now, even without a crisis, the deficit has soared to new high levels.

Will income taxes increase?

The November election looms large this year. The spending binge will not end before the election obviously. But will spending be curtailed and taxes hiked after the election?

Candidate Trump has promised to extend and increase the large tax cuts he enacted in 2017. Those cuts are set to expire at the end of 2025 and if extended would cost $4 trillion in foregone revenue over ten years. The total debt is $34.6 trillion.

These gargantuan numbers are difficult to comprehend so let’s take a look the borrowing required to finance them, compared to previous cycles. Warning: Some disturbing facts:

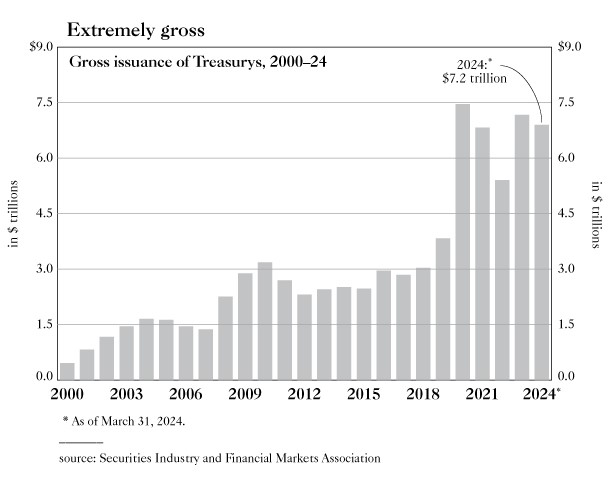

Grant’s Interest Rate Observer wrote on this topic recently. For these large deficits to be financed borrowing must increase. Here is Treasury issuance since 2000:

Source: Grant’s Interest Rate Observer

The bars are annual numbers except 2024, which is for 3 months, to end of March.

Borrowing by the U.S. Treasury is much larger than the deficit, as the Treasury must roll over maturing Treasuries. So the total issuance is roughly equal to the maturing securities plus the shortfall of government revenue minus expenditures. Maturing securities are about $9 trillion this year and the deficit for 2024 is estimated to be about $2 trillion by the Congressional Budget Office.

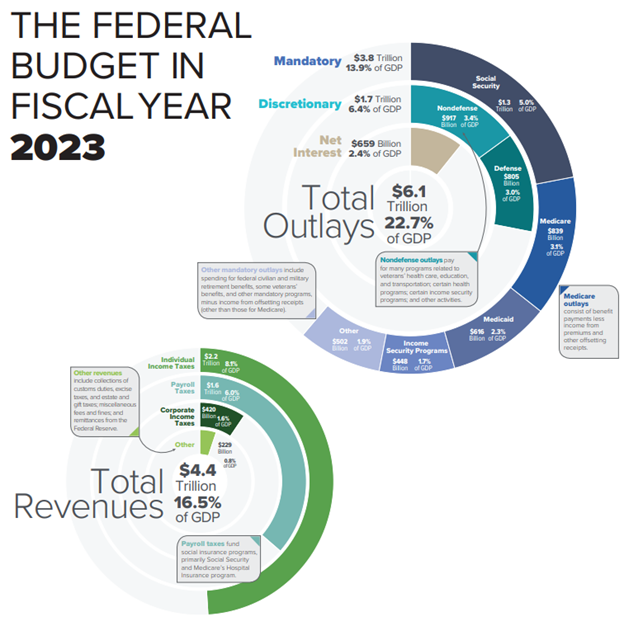

Deep spending cuts alone would be insufficient. Canceling the $800 billion defense spending cost would reduce the deficit by less than half. Mandatory outlays, required by law, are interest payments and programs like Social Security and Medicare. In 2024 those outlays will equal government revenues. This means discretionary spending, which includes defense, would have to be cut to zero and even that would not balance the budget:

Source: Congressional Budget Office

With total revenues only 16.5 percent of GDP and total expenditures close to 23 percent, it’s an untenable situation.

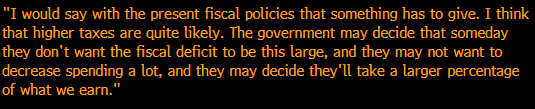

Warren Buffett of Berkshire discussed this urgent problem at his annual shareholder meeting May 4th:

Source: Bloomberg

The biggest political debate will be over the tax cuts from 2017 that are set to expire at year-end 2025. The most expensive cut was Trump’s corporate rate reduction from 35 percent to 21 percent. Trump wants to extend those cuts and lower the rate even further to 15 percent. Biden is suggesting raising the corporate tax rate to 28 percent and raising personal income taxes on those earning over $400,000 annually.

The reality is that large deficits and borrowings by the Treasury are more important than anything the Federal Reserve does. The large gap between revenues and expenditures must be narrowed and the least disruptive way to do that is through higher taxes. But it is hard to imagine a deal to raise taxes, unless there is a crisis.

But, as Buffett says, something has to give.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Hilliard MacBeth May 10th, 2024

Posted In: Hilliard's Weekend Notebook