May 20, 2024 | The Lost Decade

Happy Monday Morning!

It’s a big week for central bank watchers and debt holders alike. The CPI report for the month of April drops tomorrow, it’s the last CPI before the Bank of Canada meets on June 05. Markets are currently pricing in just shy of 50% odds that Tiff cuts in June. It’s a coin toss, but either way Tiff will have a difficult decision to make.

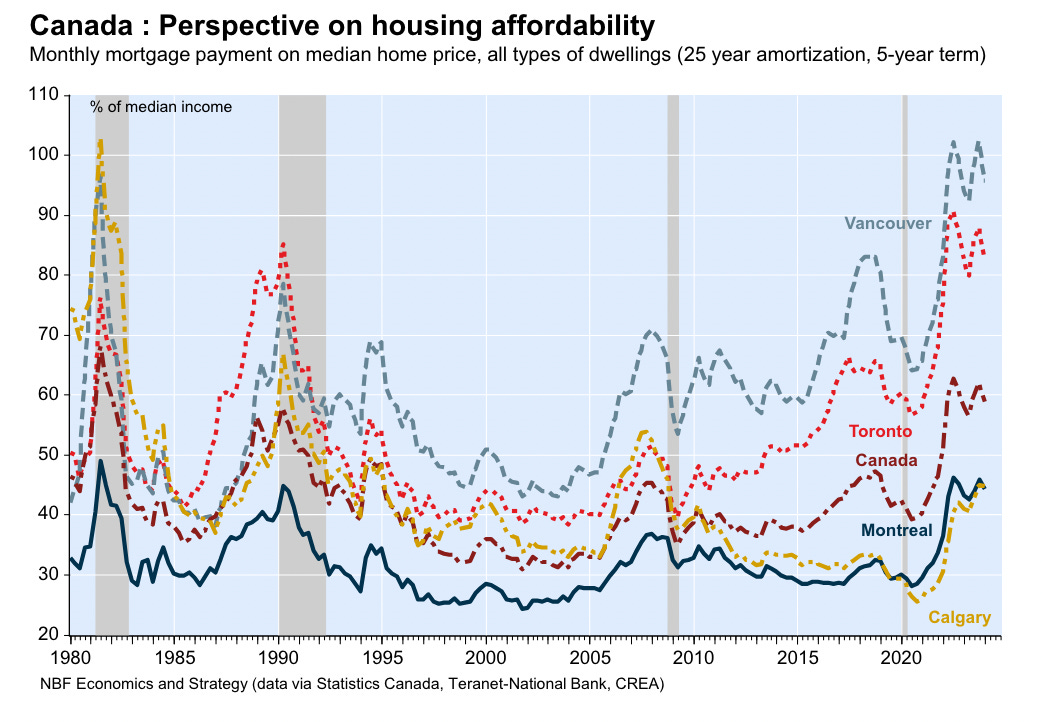

Highly levered households are in desperate need of a rate cut but it looks increasingly likely our neighbours to the south aren’t moving to cut rates anytime soon. So will the Canadian dollar be the sacrificial lamb? It’s already down nearly 3% against the dollar this year.

“As a rule of thumb, a 10% fall in the loonie would boost core goods prices by 2.5%,” noted Olivia Cross, economist at Capital Economics. Further noting that core goods make up about 30% of the Canadian CPI basket.

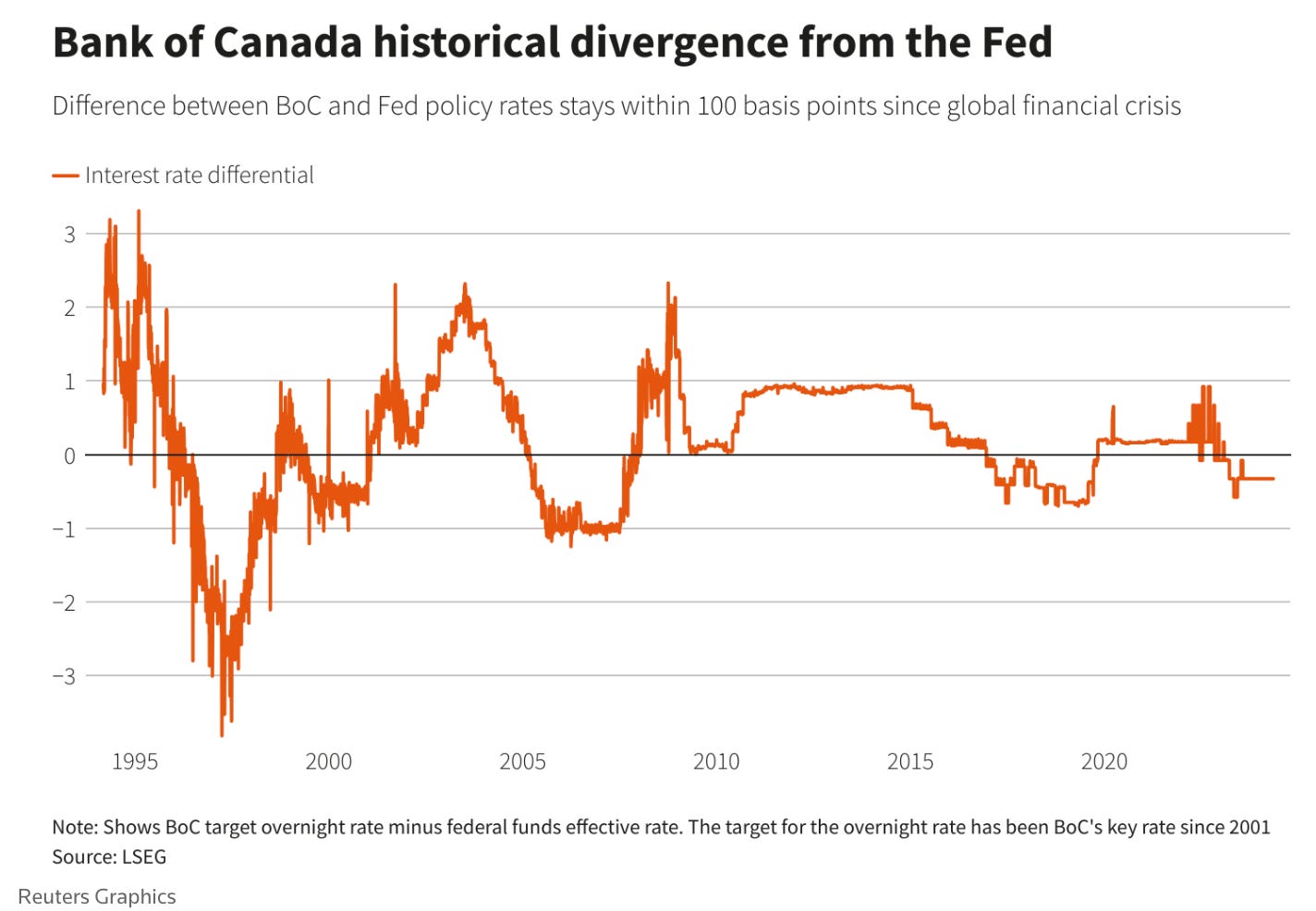

The interest rate gap has stayed within 100 basis points since the global financial crisis of 2008-09. Still, that level may not be a binding constraint if the Canadian outlook deteriorates over the second half of 2024, notes Robert Both, a senior macro strategist at TD Securities.

Suffice to say there’s a lot riding on this CPI print on Tuesday. Many sellers we chat with today are holding their breath, delaying price cuts in hopes that this summer will bring rate cuts and renewed optimism for the housing market. After all, housing slumps are always short lived in Canada, right?

As my friend Ben Rabidoux notes, this is already a historic housing downturn in Canada. Unless you live in Calgary.

Memories are short. Calgary real estate prices went nowhere for more than a decade. Funny story, the first investment property I ever bought in Calgary was a detached house in the inner city. I bought it for $420,000 in 2019, which was the same price the previous owner had paid back in 2007. Twelve years of dead money!

Think that can’t happen in Vancouver and Toronto? It did in the 1990’s. A lost decade. In fact, adjusted for inflation, it took 22 years for Toronto real estate prices to recover in REAL terms after it peaked in 1989.

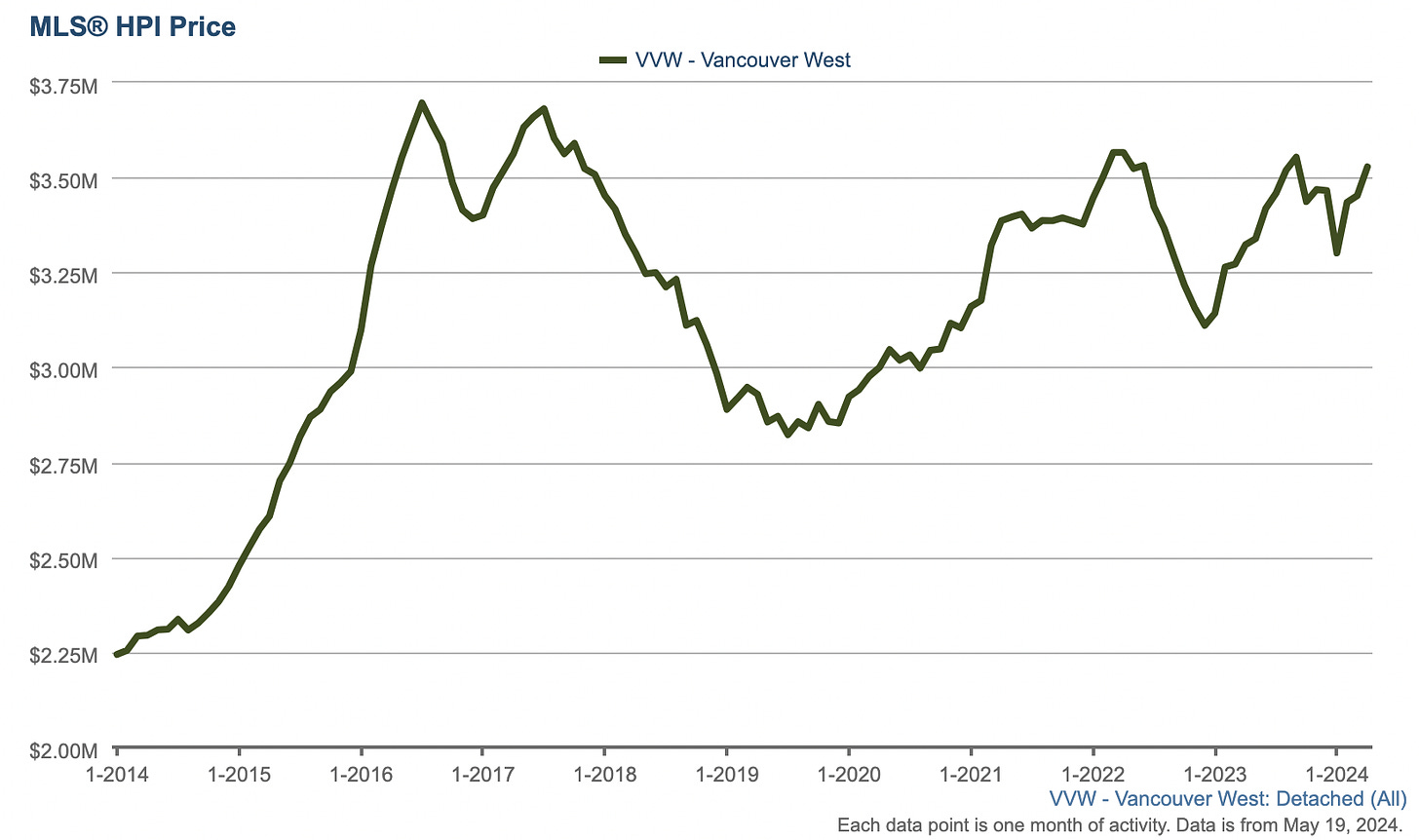

In Vancouver some segments are already enduring their own version of a lost decade. Detached houses on the west side of Vancouver peaked in 2016 and have bounced around since, ultimately no higher today than they were eight years ago.

The same story is playing out for condos downtown. They peaked in 2018 and have moved sideways for six years.

It’s rather interesting to see prime real estate in the heart of the city stagnate. Meanwhile, houses in Surrey, Langley, and Abbotsford have more than doubled since 2016, and i’m told they’re going higher once Macklem starts cutting.

If history is any guide, trees don’t grow to the sky and eventually other segments of the market will succumb to gravity too.

Suburban houses peaked in 2022 and have yet to fully recover. Remember, even a 100bps of rate cuts from the BoC brings the typical variable rate mortgage into the low 5’s which is exactly where fixed rates sit today. Will that be enough to avoid years of stagnation?

For many housing speculators a lost decade would be devastating, but on the flip side it would slowly allow incomes to catch up and housing affordability to gradually improve.

When you frame it that way, a lost decade doesn’t seem so bad.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Steve Saretsky May 20th, 2024

Posted In: Steve Saretsky Blog