May 27, 2024 | Hoping for the Cut

Happy monday morning!

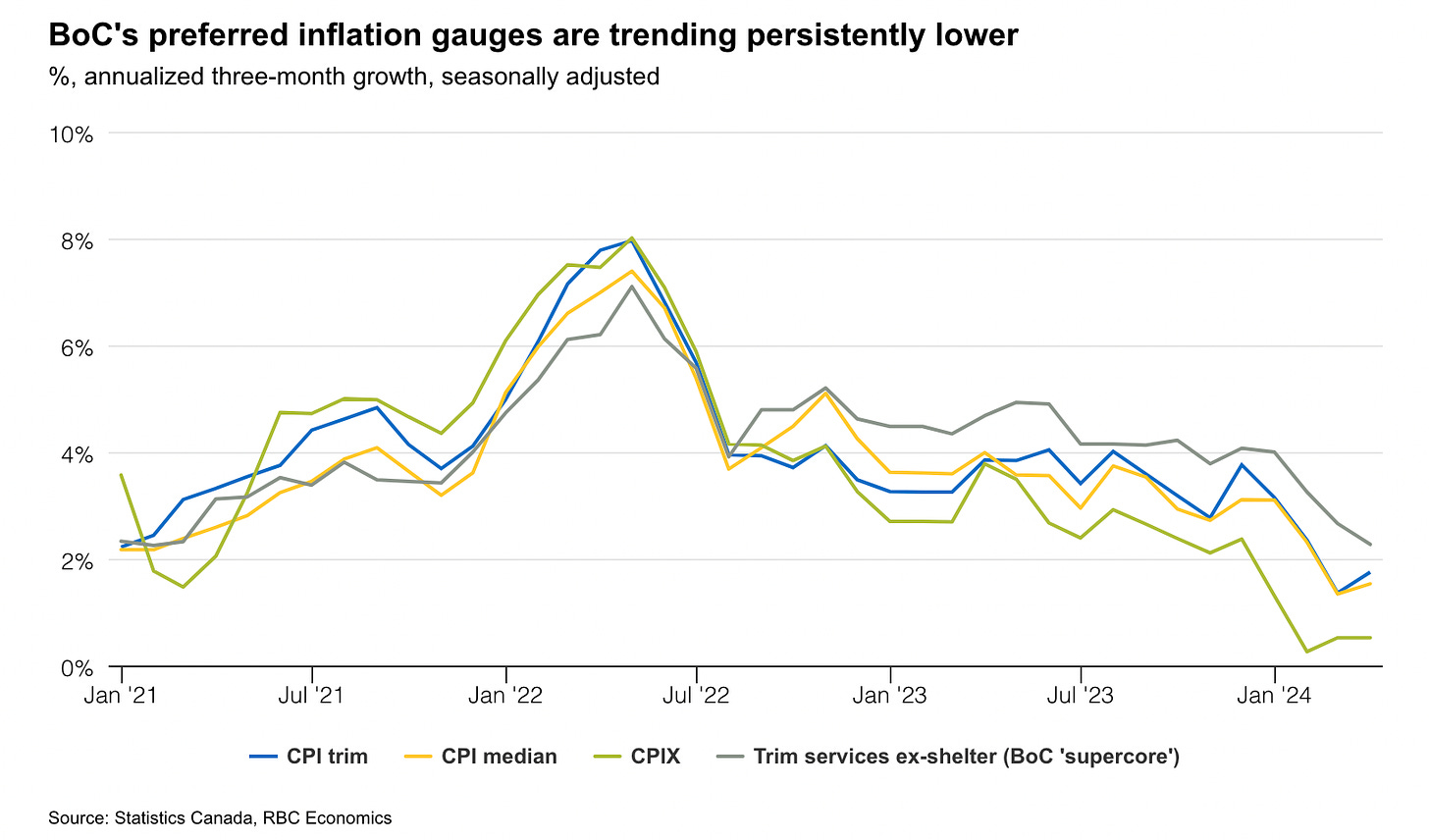

The Bank of Canada got the news they needed ahead of their rate announcement on June 05. CPI inflation decelerated to 2.7% year-over-year in April, down from 2.9% in March, and remaining below the upper end of the Bank of Canada’s 1% to 3% target range for the fourth consecutive month. The BoC’s closely-watched 3-month core measure was just 1.65%.

Markets are now pricing in about 60% odds of a rate cut from the Bank of Canada next week, and are fully expecting 25bps of cuts by July.

Rate relief is on the way, which is music to the ears of OSFI’s Peter Routledge. In his annual risk outlook, the banking regulator flagged real estate secured lending and mortgages as the top risks to the country’s financial system.

Of course none of this is news for our regular readers. However, let’s turn the mic over to Mr. Routledge.

“We expect that elevated interest rates and market volatility will result in continued higher borrowing costs, increased mortgage renewal/refinancing risk, decreased consumer spending and business investment.”

“There are signs higher mortgage payments are taking up a larger part of some households’ income, leading to increases in the number of borrowers not being able to make payments on other loans and debts.”

OSFI notes that 76% of the mortgages outstanding as of February 2024 will be coming up for renewal by the end of 2026.

Keep in mind, about 50% of Canadians have already seen a monthly payment increase. Many are already adjusting, albeit perhaps uncomfortably. We’ve seen a huge spike in 3 year fixed rate mortgages, as Canadians seek out short term security while also betting on more favourable rates several years from now. What if that outcome doesn’t materialize?

For some the option will be to sell. We’re already seeing that, particularly in the condo market. Investors facing surging mortgage interest rates with no ability to pass that along to tenants due to poorly drafted tenancy laws are facing sudden negative cash flow situations that are further deepening amidst rising strata fees, insurance rates, and property taxes.

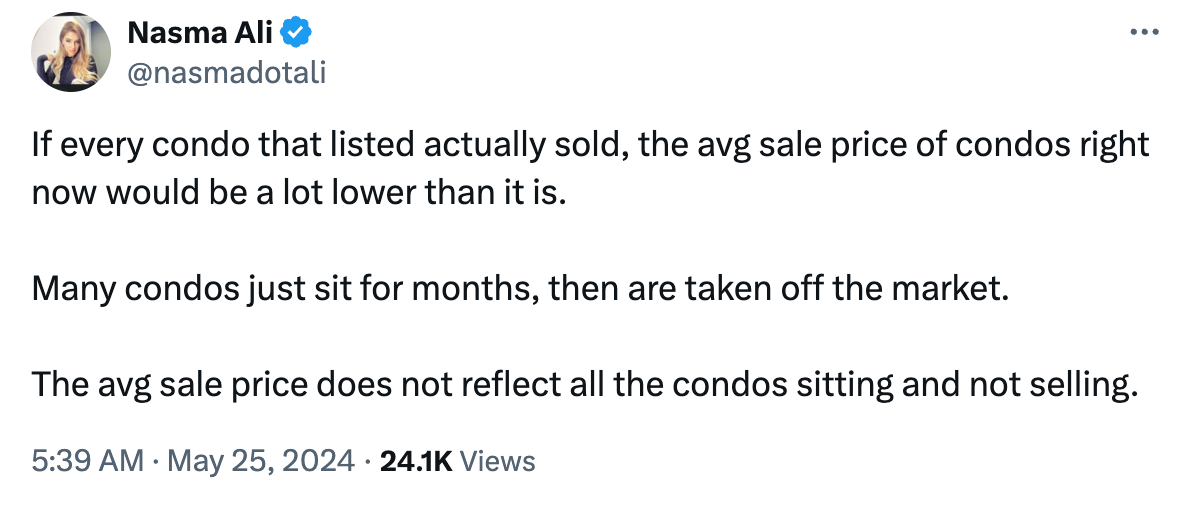

Inventory is building in the condo market, and prices are coming down. For some segments of the condo market, things have suddenly gone no bid. Market conditions today feel a lot like the summer of 2022, when Tiff froze the market by jacking rates 100bps in his July presser. You can drop your price but there’s still no guarantee of an offer.

This is not just a Vancouver phenomenon, top producing Toronto Realtor, Nasma Ali, is seeing the same.

Condos have to be well located, move in ready, and priced sharp in order to sell. If you’re carrying an older product, that’s not updated, or in a less desirable location- chances are you’re simply languishing on the market.

Now take all the information i’ve just presented here and imagine you’re a developer contemplating deploying hundreds of millions of dollars launching a new condo tower.

“For every crane that comes down, one isn’t going up,” says Richard Lyall, president of the Residential Construction Council of Ontario (RESCON).

The hope is that long-anticipated drops in interest rates will come to the rescue, if even just a little. But, in this economy, rate drops may not be enough. “Our problems go much deeper than interest rates,” says Lyall. “Affordability is 30% of gross income and we’re above 60% now, so we’re way off the mark. When people start looking for different definitions of affordability, you know you have a problem.”

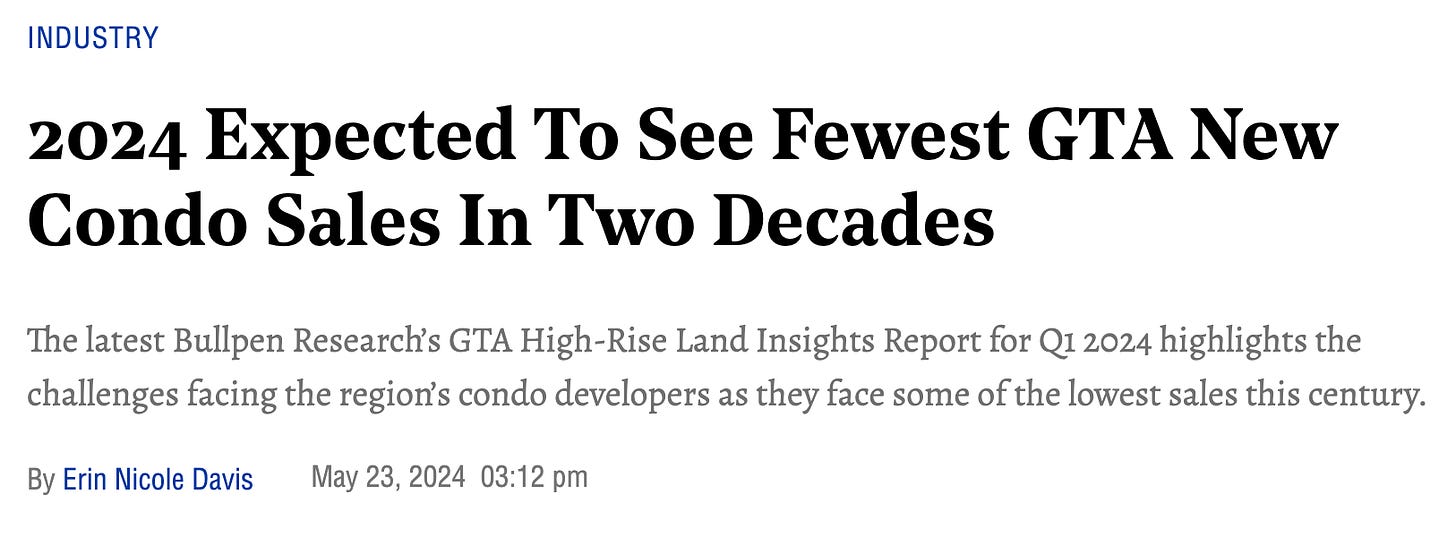

Bullpen Consulting, a boutique Real Estate advisory firm in Toronto, is projecting that 2024 will mark the lowest year for new condo sales in the GTA over the past two decades.

“This downturn is anticipated to be more prolonged than those observed in 2009 and 2013. To stimulate significant investor interest in the new condo market, several rate cuts and sustained growth in resale prices will be necessary.”

As you can see, there’s a lot of hope riding on the BoC to begin cutting rates, and quickly. Although i’m often reminded that hope is not an investment strategy.

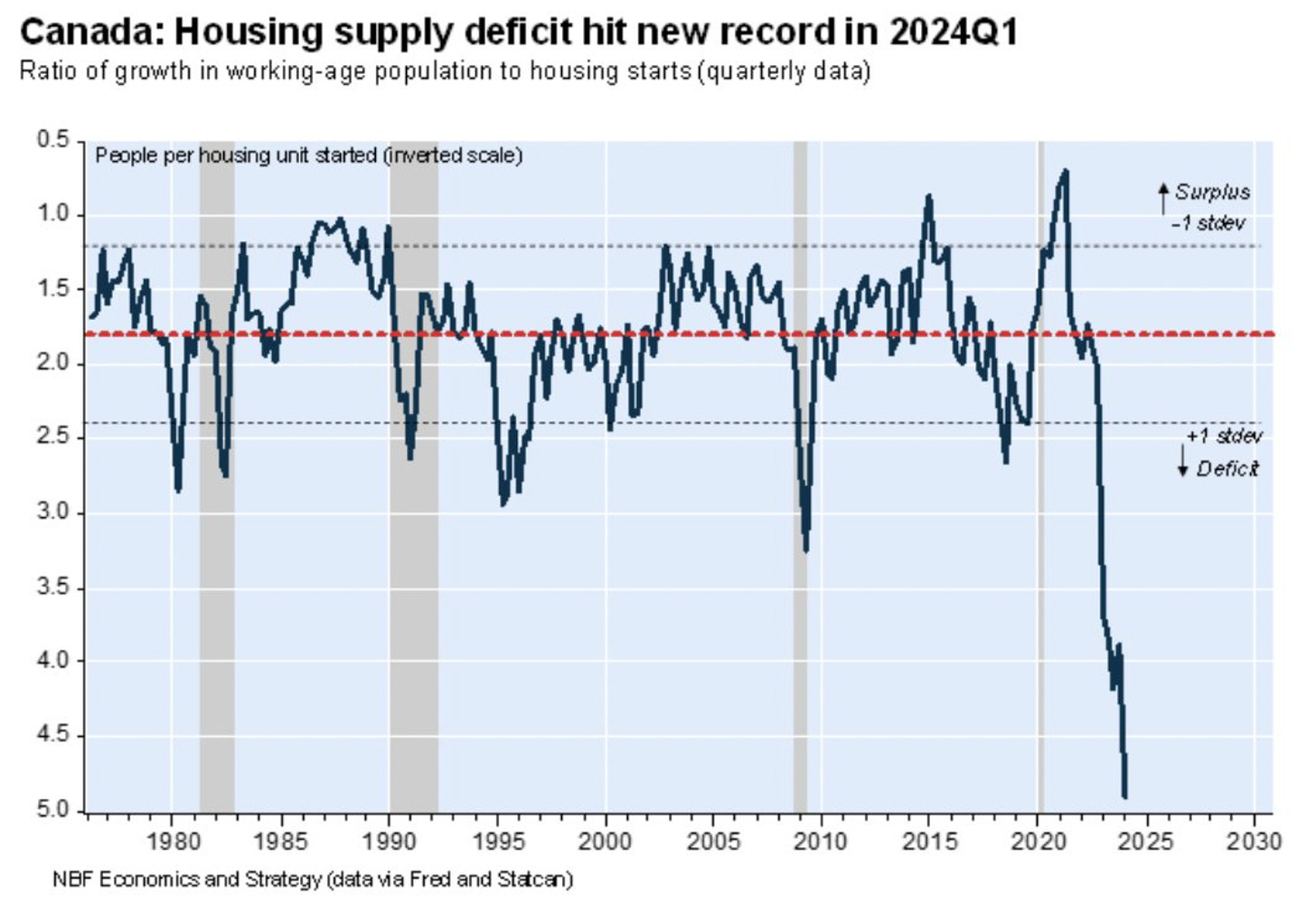

In the near term there’s a glut of condo supply, and that looks unlikely to change even with a cut or two from the BoC. However, from a longer term structural perspective we are continuing to dig our own grave.

A report from National Bank this week notes, the demographic shock is getting worse in Canada. The working-age population (aged 15 and over) rose by over 100,000 in April, bringing the total to over 410,000 after 4 months in 2024, just as housing starts crash.

There is no way this can continue, and I suspect population growth will be the next shoe to drop.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Steve Saretsky May 27th, 2024

Posted In: Steve Saretsky Blog