May 31, 2024 | German Property Price Crash Will Not Become a Crisis

Germany property prices are plummeting. Prices for commercial properties and multi-family buildings are dropping with insolvencies and foreclosures soaring. Even house prices are falling.

The housing market in Germany is very different from the U.S., Canada and Australia, particularly in the terms and amount of financing available to buy a house for a first-time buyer.

Germany also has a very robust social housing system, ensuring that renters have homes and are protected with legislation.

For those reasons German people have been much more likely to rent and to remain renters throughout their lifetimes.

So can there be a housing bubble bursting now?

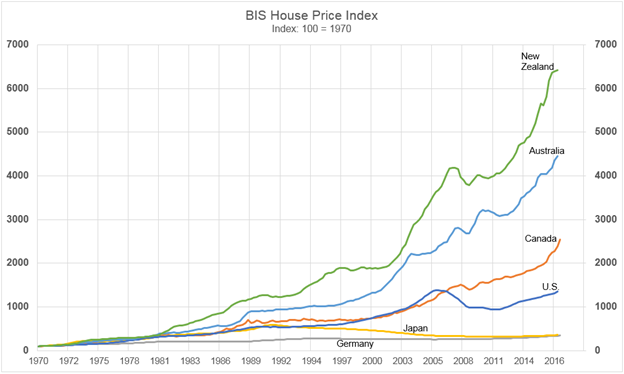

When I wrote the second edition of “When the Bubble Bursts: Surviving the Canadian Real Estate Crash” in 2018 I included a chart on some real estate price trends in several countries. This is what it looked like at that time:

Source: Bank for International Settlements

You might be able to see a flat line (no price changes) at the bottom labeled Germany. Japan is also at the bottom, but Japan had a housing bubble that peaked in 1989, along with the stock market and those asset classes had been deflating for more than two decades when the book came out.

When I researched the book on the Canadian housing bubble, I became curious about Germany as a counter-factual to the housing bubbles I found elsewhere. Germany appeared to be a special case.

Articles mentioned that only about 45 percent of German households owned their homes, compared to 66 percent in the U.S., Canada and Australia.

I learned that German lenders had much stricter requirements for mortgage loans, demanding down payments of 30 percent or more.

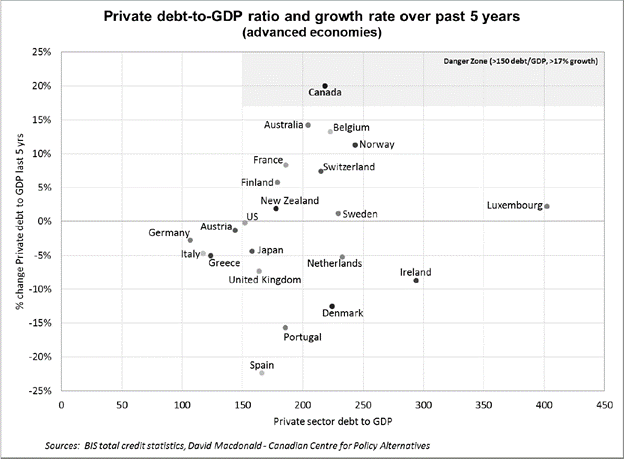

Germans carried much lower household debts. In the U.S., Australia and Canada the housing bubbles are driven by household debt. In fact, Canada and Australia have some of the highest household debt to GDP ratios in the world, and we would expect that, since home ownership involves lots of debt.

Private sector debt to GDP is a problem in Canada and elsewhere, but not in Germany.

Canada is clearly in the danger zone, with elevated private sector debt to GDP of 220 percent and a 20 percent increase over five years. Germany in 2017 had one of the least indebted private sectors.

What are the chances of a housing bubble bursting in Germany?

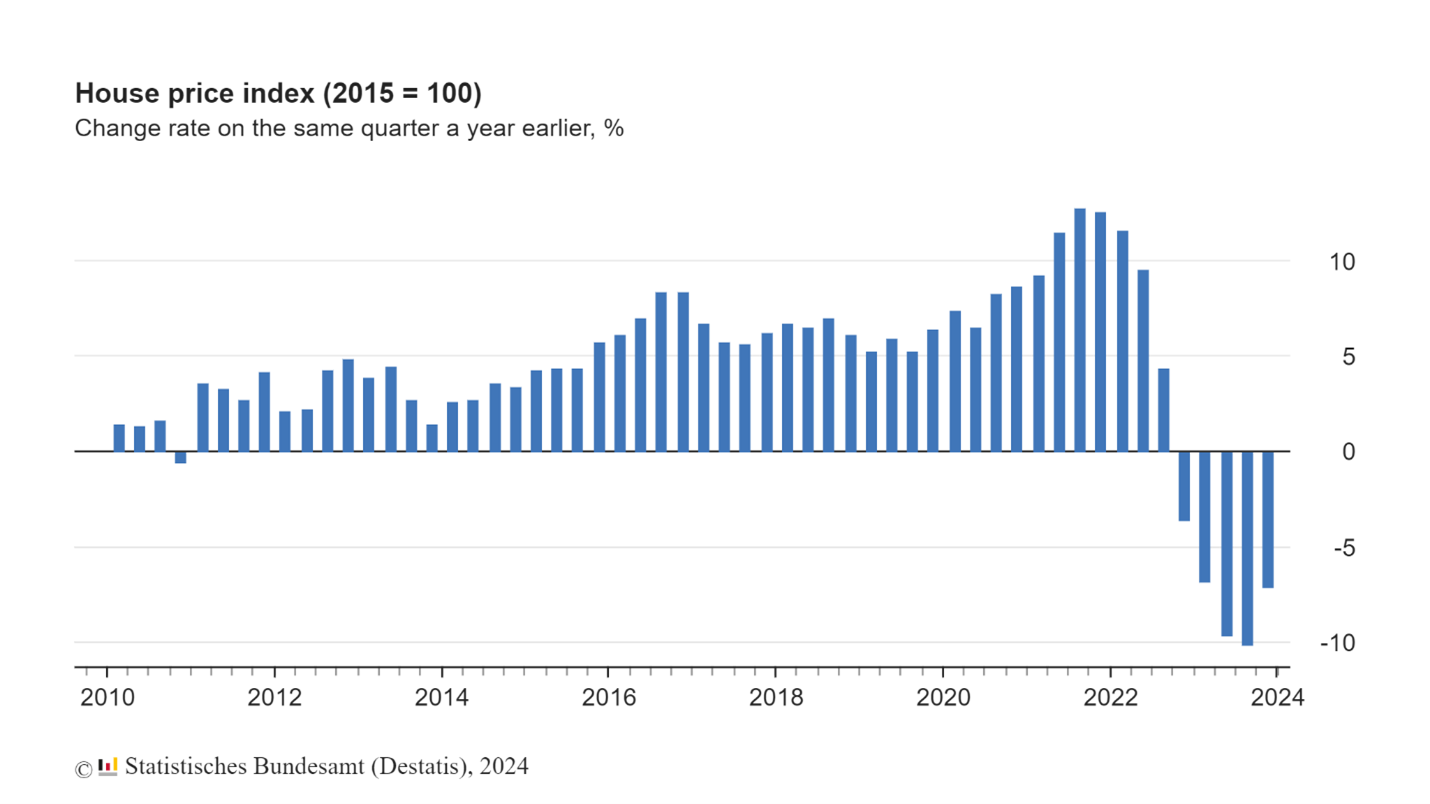

Some people residing in Germany are worried about house prices falling. We can see why here:

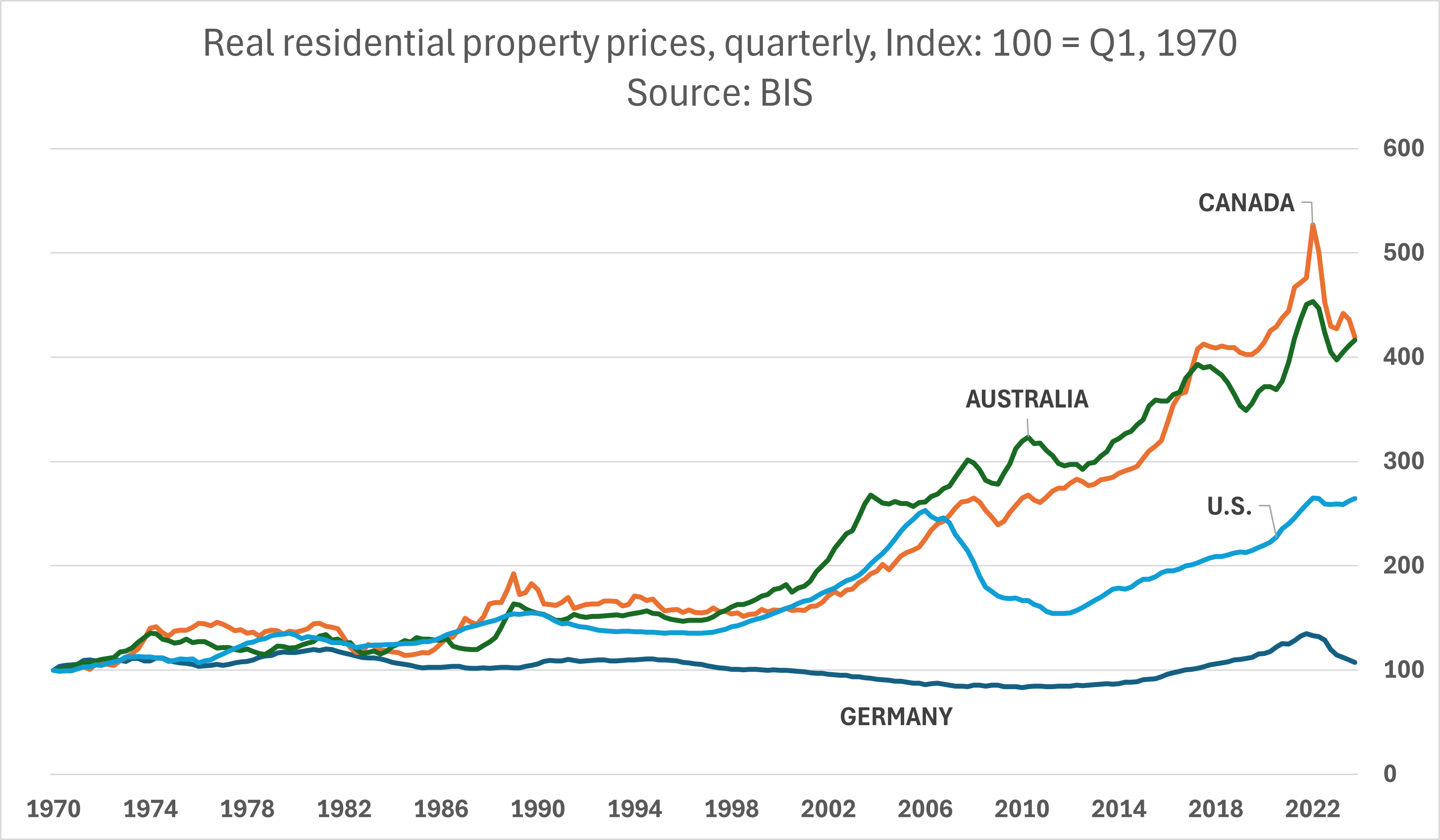

But the long-term view shows that there should be no problem. German house prices have been relatively stable over the decades since 1970.

Source: Bank for International Settlements

On both house price charts, we see a sharp uptick in Germany since 2014 followed by a significant decline starting in 2023. But these price fluctuations will not precipitate a crisis in Germany because homeowners do not carry a high debt burden.

On the other hand, in Canada and Australia we can see the relative enormity of those bubbles, which will lead to crashes as household debts are much bigger.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Hilliard MacBeth May 31st, 2024

Posted In: Hilliard's Weekend Notebook