April 8, 2024 | Zoning for Cash

Happy Monday Morning!

It’s budget season, and the fiscal taps are wide open, flush with new promises and billions in new spending. This will make life more difficult for Macklem and friends at the Bank of Canada who are still fighting the last mile on inflation. They’re on deck this week, no cut expected. It seems rate cuts continue to be pushed further and further out, inflicting additional pain on highly levered households.

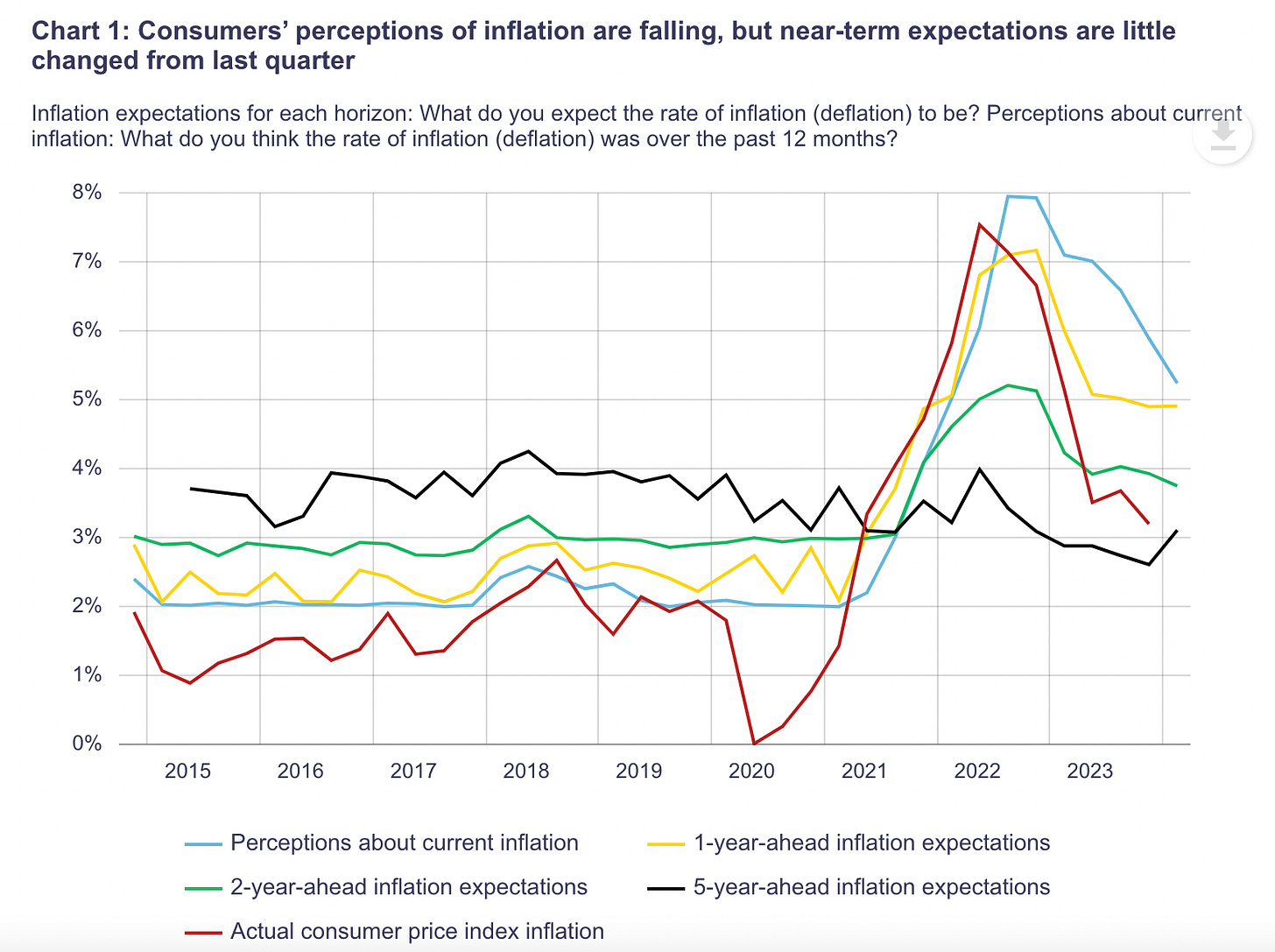

According to the most recent consumer survey by the BoC, Canadians feel inflation is currently running at 5.25% with one year ahead inflation expectations running at 4.92%. Inflation expectations are certainly anchored higher.

The reality is, even if the BoC cuts rates by 100bps this year, that would leave the prime rate at 6.2%, and the typical variable rate mortgage would still hover in the mid 5’s. Probably not the relief valve households or developers are hoping for. It is thus no surprise that housing starts continue to slide lower after peaking in 2021, and that will only continue in the years ahead.

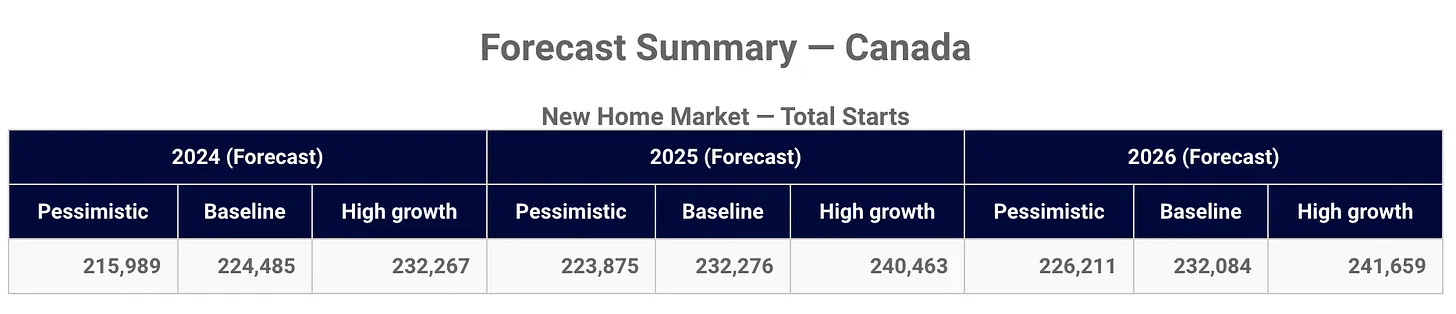

Per a recent forecast from CMHC, housing starts are not expected to stop falling until next year, but even then they will continue running well below recent levels of the past few years.

However, given what’s happening in the Toronto pre-construction market those assumptions might still be too optimistic. Pre-sales lead housing starts and pre-sales are in the gutter. New condo sales were down 50% year-over-year in February and the twelve month total is running at 12,000 units sold, down from a peak of more than 32,000!

Cue the bazooka!

There’s a whopping $21B coming from the feds to fund new housing construction, already announced in the new budget, and there’s more coming. It all sounds promising but there are some important distinctions here.

First, another $15B allocated to CMHC’s apartment construction loan program. This is not a new program, but rather a top-up of funds. It’s been a wildly popular program that ultimately provides cheap construction loans and take-out financing loans to developers of rental construction. It is pretty much the only reason rental is being built today. Regardless of ones political views, this is good policy.

Where things get tricky is with the $6B program proposed for housing infrastructure. Of the $6 billion in the fund, $1 billion will go directly to municipalities for “urgent infrastructure needs.” The other $5B will go to provinces, but only if they commit to multiplex zoning and freeze development charges for the next three years.

Seems fair, but pretty much everything the feds have proposed in recent weeks, from the renters bill of rights, a national housing catalog of building plans, and now an infrastructure slush fund all hinges on provinces and municipalities bending the knee to an unpopular government. Will they willingly give up control for dollars?

Remember, just a few months ago JT noted, “I’ll be blunt as well — housing isn’t a primary federal responsibility.”

He’s now making it a federal responsibility. You give me zoning and approve my catalog of building plans and i’ll give you cash.

These are the types of bold strategies that could have actually moved the needle on housing supply, it’s a shame he waited nine years to do it, and after provincial relationships deteriorated. Alberta and Ontario have already balked at the proposal, and i’m sure others will follow.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Steve Saretsky April 8th, 2024

Posted In: Steve Saretsky Blog