April 4, 2024 | Impossible Home Prices Are The Problem

The median Canadian household income of $85k (Dec 2023) now qualifies for a maximum home price of $496k (assuming 20% down, 25-year amortization, and current mortgage rates (5-year fixed). That’s a problem since the avAdd New Posterage home price is $796k, an impossible 9.4x the median household income. The long-standing affordability rule is a home price no more than 3 to 4x annual household income.

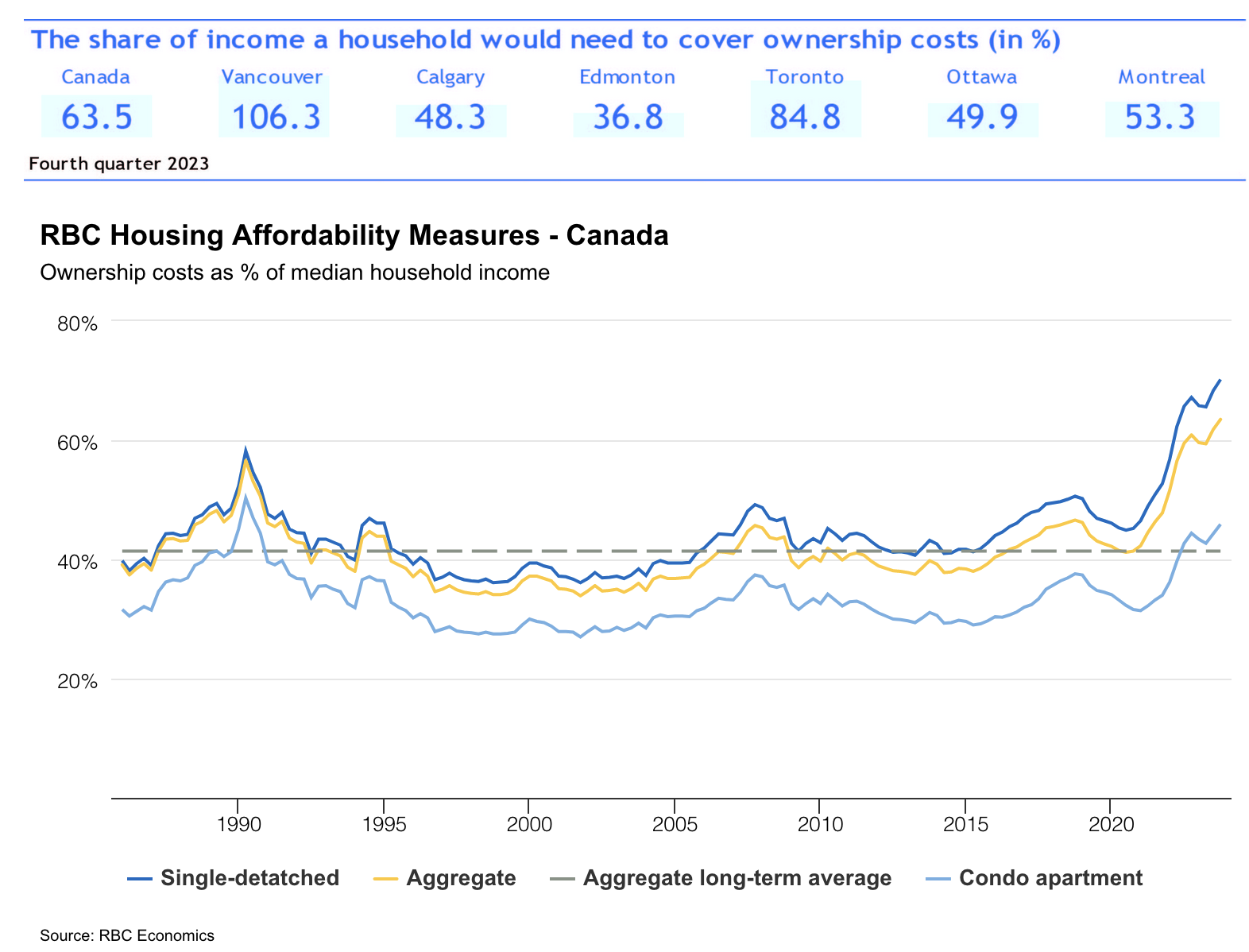

In the graph below (courtesy of RBC), we can see that when mortgage rates were sub 3% in 2019-21, the median household income of around 80k qualified to buy a maximum home price of $652K, roughly in line with the then average Canadian home price of $636K. But this was still a crippling 8x the median household income.

Then prices went parabolic, and interest rates tripled in 18 months. Now, Canada is paying for years of reckless policies and behaviours with the Toughest Time Ever to Afford a Home. Costs of the epic misallocation of resources continue to compound through reduced productivity and less cash for everything else.

Nationally, home sale prices have fallen 12% from the 2022 peak of $838k, but more is needed. Canadian home affordability remains the worst in over 40 years, with ownership costs demanding an impossible 63.5% of the median household income in 2024 nationally, 106% in Vancouver and nearly 85% in the Greater Toronto Area. Only Edmonton has prices low enough that ownership costs are less than 40% of household income.

The long-standing affordability rule is that no more than 32% of a household’s gross annual income should go to mortgage principal, interest, property taxes, heating costs, and condo fees (total debt service (TDS) ratio).

The long-standing affordability rule is that no more than 32% of a household’s gross annual income should go to mortgage principal, interest, property taxes, heating costs, and condo fees (total debt service (TDS) ratio).

Interest rates are historically average today. Suppressing them to uneconomical lows is the disease, not the cure. Only lower for longer home prices can meaningfully restore shelter affordability and help free up resources for other essential spending and investment.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Danielle Park April 4th, 2024

Posted In: Juggling Dynamite