April 26, 2024 | How Far Can The Yen Fall Before Japan Goes Bankrupt? We may be about to find out

Japan’s ongoing march to national bankruptcy has been a recurring theme here. See:

Japan Is In That Box

Japan Takes Another Step Towards the Cliff

How a Country Goes Bankrupt, In 10 Steps

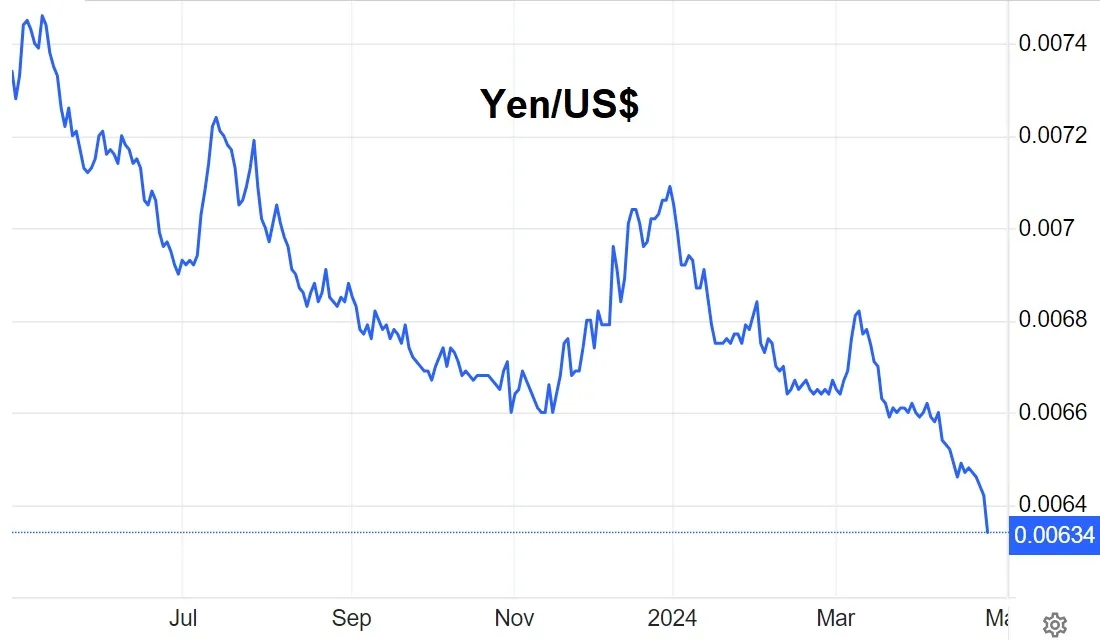

Now the death spiral has entered a new phase, with the yen/dollar exchange rate heading straight down:

To restate the “Japan collapse” thesis, soaring government debt will eventually cause the yen to crater and/or interest rates to spike. The Bank of Japan will then face an impossible choice: Support the yen with even higher interest rates and watch government interest expense rise to national bankruptcy levels. Or push interest rates down to keep a lid on debt costs and cause the yen to collapse.

As the above chart illustrates, the “cause the yen to collapse” part of the story seems to be happening. Interest rates, meanwhile, are now spiking in a mirror image of the yen’s collapse.

Decision Time

So it’s decision time for Japan’s leaders. What will they choose? And — more importantly — what happens when the global financial system realizes that it no longer matters?

Japan is a big country, so its impending crisis creates risks for the global economy. But it’s more important as a signal to the US, Europe, and China that we’re heading in exactly the same direction.

In other words, the Fed is in the same box as the Bank of Japan, and that box is shrinking with every new trillion dollars of debt.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

John Rubino April 26th, 2024

Posted In: John Rubino Substack