The endgame inched closer to singularity last week with rigged rallies in stocks that had rightfully been given up for dead. There was the more than doubling in the price of Beyond Meat, for example. Until last week, shares of the veggie-burger upstart seemed content to scuddle sideways on a tortuous path to death. At $7 a share, the stock had lost 97% of its value since peaking at $240 after its 2019 debut When it was apexing, Wall Street incited the usual wack-jobs into believing that meatless burgers were the food of the future. Cattle ranchers parried this nonsense with a campaign that emphasized why real meat was better for you. They needn’t have worried, however, since most people had already discovered that real meat also tastes a lot better.

Carvana is another stock to have received premature last rites from Rick’s Picks. Consumer complaints about the used car dealer had been piling up mountainously, like grievances against the airlines, causing the stock to pancake from $376 to under $4. Its clever handlers managed to waft it back up to $40, which eventually became a launching pad for an undeserved pop last week to $80. Watch for freaked-out shorts to continue covering their bad bets in the weeks ahead, giving the stock an artificial boost before it finds well-deserved obscurity in the low teens during the next recession.

Two Kinds of Sardines

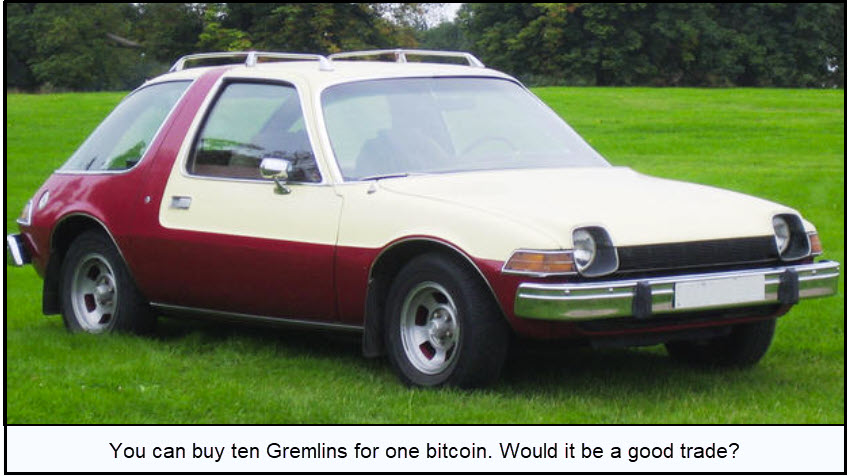

Even so, if Carvana had just one Pontiac Aztek or an AMC Gremlin sitting on a lot, the company’s intrinsic value would exceed that of the world’s entire supply of bitcoin. This inconvenient fact seems not to have deterred speculators from bidding up BTC to $64,000 last week, where it sat poised to take on the all-time high at $70,000 recorded in November 2021. We expect the price to hit $80,547 before the fact of cryptocurrency’s near-worthlessness begins to dawn on speculators. Indeed, a friend who is a demon-genius with numbers calculated that bitcoin if correctly priced would sell for around $1.38 per copy. This valuation is based mainly on the blockchain’s usefulness for recording financial transaction securely. So far, though, the only other argument we’ve heard for why bitcoin should be worth anything is that it is scarce. But money it ain’t. It is universally hoarded rather than spent, recalling the old joke with the punchline: “These aren’t eatin’ sardines, these are tradin’ sardines!” In any event, we’re inclined to agree with Warren Buffett, who evidently thinks cryptomania will not end well for those who own it at these heights.