February 11, 2024 | Desperately Seeking Neutral

One of the more fascinating and mysterious parts of watching the Federal Reserve is the ongoing dialogue between Fed leaders and Wall Street. We imagine private meetings held in great secrecy. Those may in fact occur, but I’m not sure they are even necessary. The parties exchange their requests publicly. All those speeches, interviews, and papers are available to everyone, but have a specific audience in mind.

Wall Street (i.e., bankers, money managers, large investors, etc.) makes its preferences known mainly through market price action. This group almost always wants lower interest rates and more liquidity. “We” (as Wall Street likes to speak for Main Street) always need lower rates to “save” some piece of the economy.

The last few months were a kind of open negotiation with Wall Street wanting rate cuts pronto and the Fed saying, “Not so fast.” This is still in progress but seems to be wrapping up. Jerome Powell has been saying the market dream of six rate cuts this year is fantasy. We should expect three cuts at most, and they won’t start until mid-year. Investors seem to be reluctantly accepting it.

None of this is locked in, though. Today I want to think about what the Fed is doing, what it is saying, and how the rest of 2024 may unfold.

Relative Terms

When Fed officials want to stimulate employment, they implement “accommodative” policy, which essentially means lower rates, hoping it will kindle what Keynes called “animal spirits.” They control inflation with the opposite: “restrictive” policy or higher rates. But these are relative terms. Higher or lower than… what?

The answer is something called the “neutral” or “natural” rate of interest. It is a theoretical concept, meaning the interest rate at which an economy is at maximum output with stable inflation. Economists call it “r*” or r-star. No one knows what this rate really is. Monetary policy thus boils down to how far the policymakers think they must deviate from r-star in order to restore their beloved equilibrium without causing even more mayhem.

You will notice this is not just a moving target, but two moving targets. To make their policy decisions, they must define r-star and then decide how far they can safely move away from it. That’s a tall order, to say the least. It’s no wonder central banks so often fail.

The current US situation is a good example. It was pretty clear in late 2021 “price stability” was disappearing as inflation rose. It wasn’t clear what the Fed could or should do about it. This was a different kind of inflation, driven more by supply shocks (first COVID, then the Russia-Ukraine War) than overheated demand.

Restrictive policy (higher rates) can help reduce demand by making loans more expensive. If you can’t afford the payments, you are less likely to buy that house, car, etc. Businesses are less likely to expand. In time, this brings inflation back down.

Higher rates don’t do anything to increase energy or food supplies. Hence, they were less effective in the kind of inflation that accelerated in 2021‒22. This was obvious almost immediately as both employment and many consumer spending indicators more or less ignored the Fed’s tightening. The impact showed up mainly in rate-sensitive goods: homes, vehicles, major appliances, and so on. But even there, the impact was mild relative to the increased rates, at least historically.

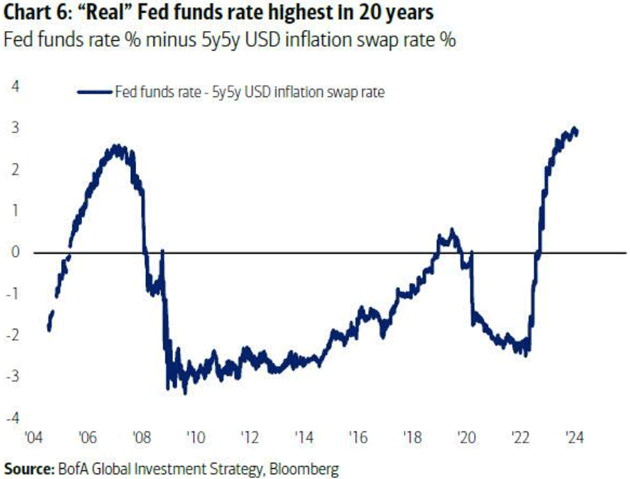

Fed officials were left wondering if they needed to be even more restrictive. Their answer was “yes” until last July’s pause but the tightening actually continued in other ways. The Fed kept reducing its balance sheet assets as the QE-era bond purchases rolled off without being replaced. Meanwhile, flat nominal rates combined with falling inflation rates meant inflation-adjusted “real” interest rates kept rising. By one measure, the real fed funds rate is now at a 20+-year high.

Source: Over My Shoulder

For most of this period nominal rates were zero or slightly above while inflation was in the 1% to 2% range. That kept real rates negative from 2008 until 2022 except for a few months in 2019.

Negative real rates are terrible for savers, such as retirees. I have often written that this is financial repression for retirees. While good for large borrowers like the government, it had other ill effects and needed to end. Now it has; real rates are roughly as positive today as they were negative in 2010.

Unfortunately, neither policy regime had the desired results. ZIRP/NIRP didn’t stimulate much growth, nor has the currently “restrictive” policy suppressed growth. Inflation is subsiding, yes, but I suspect much of it would have faded anyway as the 2022 energy disruptions eased.

Sophisticated Guesswork

The real problem is the Fed is always shooting in the dark. The FOMC tries to calibrate policy to the r-star “natural rate” which, while it certainly exists, is unknowable because we have no real-world comparisons that are free of central bank manipulation.

This leaves the policymakers no choice but to follow a sophisticated decision-making method called “guesswork.” They have plenty of data to consider, all of which has its own quirks and limitations. They call it “data dependent” but the data itself is dependent on things no one understands. The FOMC members don’t know what they don’t know. Yet we expect them to make these Olympic judgements on the most important price in the world.

“The concept of a neutral stance of monetary policy is critical to assessing where policy is now and what pressure it is having on the economy. While we cannot directly observe neutral, economists have models to estimate it, which are imperfect even under normal economic circumstances. Our various workhorse models for the economy have struggled to explain and forecast the pandemic and post-pandemic periods given the extraordinary changes and disruptions the economy has experienced. So I also look to measures of economic activity for signals to try to evaluate the stance of policy.

(JM: AKA guessing. Not that guessing is necessarily a bad thing. I do it every day in my business.)

“To assess if monetary policy is tight, I start by looking at what are traditionally the more interest-rate-sensitive sectors of the economy for signs of weakness. Start with housing: While home sales are down relative to the pre-pandemic period, overall residential investment was flat in real terms in 2023. Construction employment has not fallen during our tightening cycle and instead continues to climb to all-time highs. While home price growth has slowed, prices have not fallen and are quite high by historical measures, contributing to record household wealth. Even the stock prices of homebuilders are near all-time highs.

“Private nonresidential investment was up 4.1 percent in 2023, and consumption of durable goods was up 6.1 percent. And with the backdrop of low unemployment noted above, consumers continue to surprise with robust spending.

“These data lead me to question how much downward pressure monetary policy is currently placing on demand.

“But the data are not unambiguously positive, and there are some signs of economic weakness that I take seriously, such as auto loan and credit card delinquencies increasing from very low levels and continued weakness in the office sector of commercial real estate.

“This constellation of data suggests to me that the current stance of monetary policy, which, again, includes the current level and expected paths of the federal funds rate and balance sheet, may not be as tight as we would have assumed given the low neutral rate environment that existed before the pandemic. It is possible, at least during the post-pandemic recovery period, that the policy stance that represents neutral has increased. The implication of this is that, I believe, it gives the FOMC time to assess upcoming economic data before starting to lower the federal funds rate, with less risk that too-tight policy is going to derail the economic recovery.”

I like what I read from Neel Kashkari. He is one of the few top Fed officials who is not an academically certified economist. He has engineering degrees and later worked at Goldman Sachs and PIMCO, and in between all that ran the TARP program as a Treasury official. He doesn’t strike me as someone who gets married to his theories. He has publicly changed his mind a few times over the years.

But all that said, it’s hard to read what he says without seeing their policy process is highly subjective. This isn’t science. They don’t have experimental data like we do with, say, gravity. Lots of data shows everyone who jumps off a cliff falls down. We are confident in how that process works. The Fed doesn’t have similar data showing how its policies help the economy.

I know that many economists would argue that the Fed policies have been effective, because look at what they’ve done to bring us out of recessions, control inflation, etc. Of course, their monetary policy errors have also put us into recession and/or created inflation. To repeat a worn-out cliché, it is like the arsonist taking credit for putting out the fire after the building has already burned down.

I have long argued that a free economy composed of business owners and consumers all managing their own situations would generate its own recovery as long as the government gets out of the way.

Cause and Effect

If the cause and effect of monetary policy could be attributed to known factors, the Fed wouldn’t need a committee. A spreadsheet would suffice. They have a committee precisely because all this is so subjective. The remarkable thing, when you think about it, is how they retain any kind of consistent strategy at all.

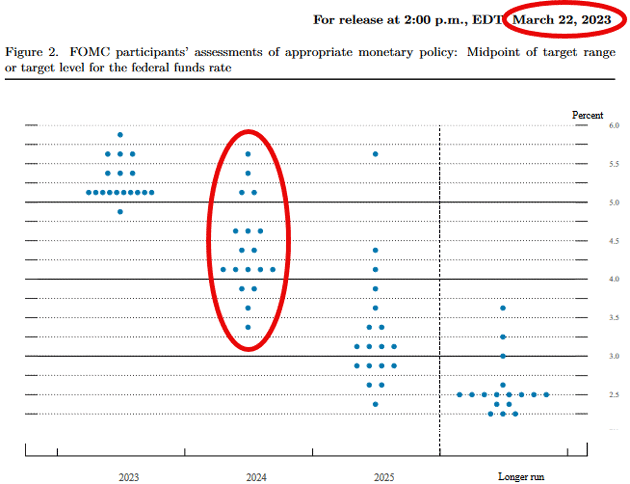

Each quarter all the FOMC members submit their personal assessments for future GDP growth, employment, inflation, and the federal funds rate. These are the “dot plots” you hear about. Below is the fed funds dot plot as of last March. Each dot represents one (unidentified) committee member’s projection for 2023, 2024, 2025, and beyond. I circled the 2024 dots.

Source: Federal Reserve

As of 11 months ago, the FOMC members assessed their key policy rate would be about 4.3% this year. That’s the median of those dots.

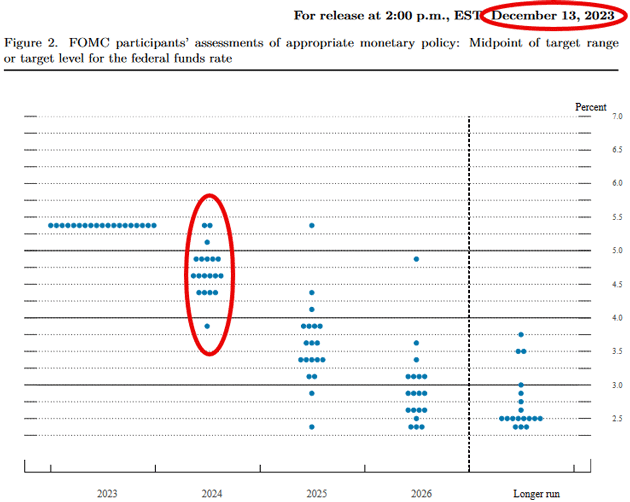

Now, let’s look at the same committee members’ opinions as of December.

Source: Federal Reserve

Nine months later, the range tightened, and the 2024 median actually rose from 4.3% to 4.6%. Does this look like a committee that wanted to cut rates six or more times this year? Not to me. Yet that’s what Wall Street was expecting until just recently.

I have been very critical of the Fed and their policies over the last 20 years. Multiple leaders have made numerous policy mistakes. When Bernanke initiated Quantitative Easing and zero interest rates, he financialized the economy, making it cheaper to buy out your competitors than to actually compete. Real estate prices lost any connection to reality. And now many investors would like to go back because (no surprise) it is easier for real estate investors to operate in a very low interest rate environment.

The simple fact is that anything the Fed does will impact the market in unpredictable ways, in essence creating winners and losers. To be fair, if you let the market set rates you are also going to have winners and losers. But given the FOMC’s abysmal record of distorting the economy I would argue that it is about time we let the markets have a chance to determine the price of overnight money.

Wall Street would hate that because it loses the opportunity to have a “Greenspan put” or a Bernanke put or whatever. Many bemoan (correctly, I think) the growing wealth and income disparity in this country. But one of the main contributors to wealth disparity has been the extraordinarily easy monetary policy of the last 25 years.

Quite simply: If you don’t have money or assets, low interest rates mean very little to you. But if you have assets, low interest rates have pushed the relative value of your assets up, whether it’s stock or real estate or your business. And when the labor market was not tight, which it hasn’t been for the last 40 years until recently, labor loses relative to capital. Thus income and wealth disparity.

All that being said, this is just my theoretical opinion. We have to face the world as it is, and I don’t think we’re going to move away from a top-down monetary policy. It benefits both governments and banks. So where is reality today?

The Fed’s official inflation target is still 2% in the core PCE. And not just one print of that level; they want to see it stay consistently near that level. As of January, core PCE’s 12-month change was at 2.9%. That’s much lower than it was. Great news. But the FOMC wants to see it reach 2% and stay there awhile. They’ve had many opportunities to change that goal if they wish. I believe they would send very clear signals if any such change were being considered.

As I’ve said many times, I think Jerome Powell is serious about inflation. He doesn’t just want to suppress it. He wants to stomp it down to that 2% target and below. The rest of the FOMC members seem to agree.

I believe (and the dot plots also show) they will gradually relax rates as inflation subsides. But if inflation doesn’t cooperate, they will wait. They have plenty of wiggle room as long as employment and GDP growth hold up.

This isn’t as complicated as many seem to think. The Fed has told us what it is going to do. We should believe it. Higher and tighter for longer until something breaks.

I have written several letters (most recently here) around the concept that real interest rates should be in the 2% range. “John Bull can stand many things, but he cannot stand 2% interest rates,” said Walter Bagehot. Too-low rates always distort the economy in unpredictable ways that produce unintended consequences.

Yes, I understand inflation is itself subjective. But since we don’t have an objective market setting the rates, I hope the subjective FOMC decides that negative real interest rates, except in recessions, should be in the trash can of history.

We Want to Hear from You

You may have noticed a change to our comments section. We’ve moved to a new platform, but it is so much more. We are building a community of readers engaging in a never-ending conversation. You can join us at the link below.

I get a lot of replies, comments, and questions to my letters. I read every one but replying has been cumbersome. The new app has made it much easier for me to answer. I can sit anywhere and simply dictate an answer on my iPad. What would have taken 5 or 6 minutes is now in the 1-minute range, unless I decide to wax eloquent. I really like being able to reply so easily.

You can log in through our website or download the app to your mobile device. It really is a great way to connect with me and fellow readers. Ed and our other editors are there as well.

Click here to join our Thoughts from the Frontline community.

Florida and Going Back to College

My friend (and Palantir co-founder and celebrated VC) Joe Lonsdale embarked in the spring of 2021 to change higher education, along with an all-star list of educators. Part of that was founding a new university in Austin called the University of Austin (UATX). It will open this fall to 100 students. This inaugural class will receive four-year scholarships and 10 students will get $100,000 stipends. The faculty is a dream team. Joe and his friends will round up some of the leading thinkers and entrepreneurs in the world to interact with students. Joe is VERY connected.

If one of my kids were looking to go to college today (and qualified) I would do everything I could to get them into UATX. Businesses will be beating down the door to hire these kids when they graduate or fund their new enterprises. The connections they are going to get attending the school will be simply mind-boggling. I almost wish I were young enough to go back myself. More information here.

I plan to be somewhere on the west coast of Florida in the coming months for a meeting on a new (and very promising) longevity drug. I will keep you updated.

My schedule is slammed between planning for the SIC, finishing a new book, writing a white paper or two, starting a new business venture, and keeping up with research. Not to mention this letter. And did I mention gym and real life? Plus, I try to keep up with the latest in the sci-fi world, although real life sometimes seems like that these days.

And with that, it is time to hit the send button. Have a great week and write me on the new app!

John Mauldin

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

John Mauldin February 11th, 2024

Posted In: Thoughts from the Front Line