January 8, 2024 | The Fate of the Housing Market

Happy Monday Morning!

We’re back after a two week hiatus, hope everyone had an enjoyable holidays. I’m back in the saddle and gearing up for what will surely be an entertaining year ahead. I have seen a plethora of predictions for 2024, from soft landings to no landings, rate hikes to rate cuts, and everything in between. Predictions are a crap business so i’ll refrain from indulging here, however I think there are some big themes to monitor that will ultimately dictate the fate of the housing market. Let’s discuss.

Interest Rates & The Mortgage Renewal Wall

The market is currently pricing in four rate cuts from the BoC by the end of 2024. Is that the right number? I personally don’t have a lot of conviction here, and I don’t think Tiff Macklem does either. Predicting rates has proven challenging at best over the past couple of years. However, the housing market is driven by animal spirits and I fully expect just the idea of rate cuts will get buyers off the sidelines. We saw this in the spring of 2023 when Tiff moved to the sidelines and mortgage rates fell into the high 4’s, buyers eagerly jumped back in. Whether they stay in the pool really depends on our buddy Tiff.

Meanwhile, fixed mortgage rates have tumbled nearly 100bps over the past few months and currently hover in the low 5’s. A bit more help from the bond market and buyers should expect mortgage rates with a 4 handle for the spring. This would be a huge boost to housing activity. There’s just one problem, bond yields have bounced higher to start the year, with the 5 year bond yield up 20bps so far. Will the bond vigilantes spoil the party?

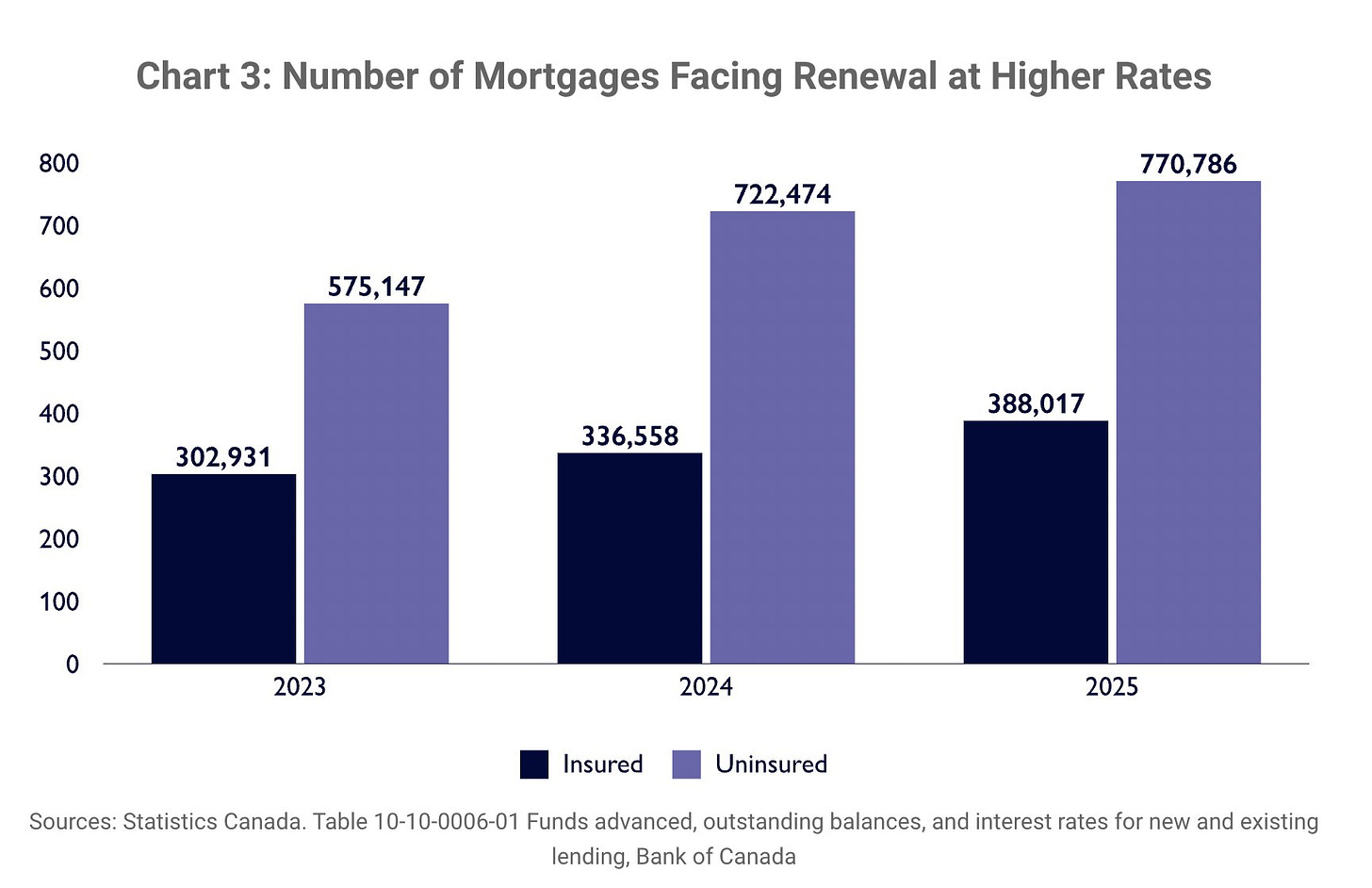

If you’re one of the million Canadians renewing a mortgage this year you’re going to need economic data to deteriorate further to keep bond yields and mortgage payments from ballooning further. In fact, so far only 45% of mortgages in Canada have seen any payment increase.

More pain is coming, even with a modest drop in rates. The mortgage renewal wall is a real problem, but likely not as big as housing bears think it is. As my friend Ron Butler points out, 90 day mortgage default rates are still super low (16 bps), they will go up but not disastrously. We have the proof with Scotia Variable Mortgages which saw rates jump from 1.45% to 6.20% and there’s been effectively no change in default rates. We haven’t seen a wave of distressed sellers flooding the market either. Instead, I suspect we will continue to see investors lighten up their portfolio and move to the sidelines. The math for investors simply doesn’t work today, even if mortgage rates fall back into the high 4’s. Interest rates will continue to be the big story in 2024.

Multiplex Housing in BC

As we’ve discussed in previous notes, the BC Government has enacted what I believe is the largest housing policy decision in recent history. Single family zoning is now eliminated throughout the province in areas with a population greater than 5000 people. It doesn’t mean you can’t building single family houses anymore, it just means you can’t restrict multiple units on a single family lot. Here are the highlights:

- Municipalities have until June 30, 2024 to update their zoning bylaws to comply with the legislation.

- All single family zoning must allow one secondary suite and/or an ADU (accessory dwelling unit, also known as a coach house or laneway)

- All single family zoning must now allow a minimum of 3 units on a lot size 3000sqft or less

- Allow a minimum of 4 units on lots larger than 3000sqft

- Allow a minimum of 6 units if within 400 meters of a bus stop and the lot must be larger than 3025sqft.

- Minimum of 3 storey building height

- Sets out recommended legislation for minimum site coverage depending on lot size

- Sets out recommended legislation for maximum parking requirements

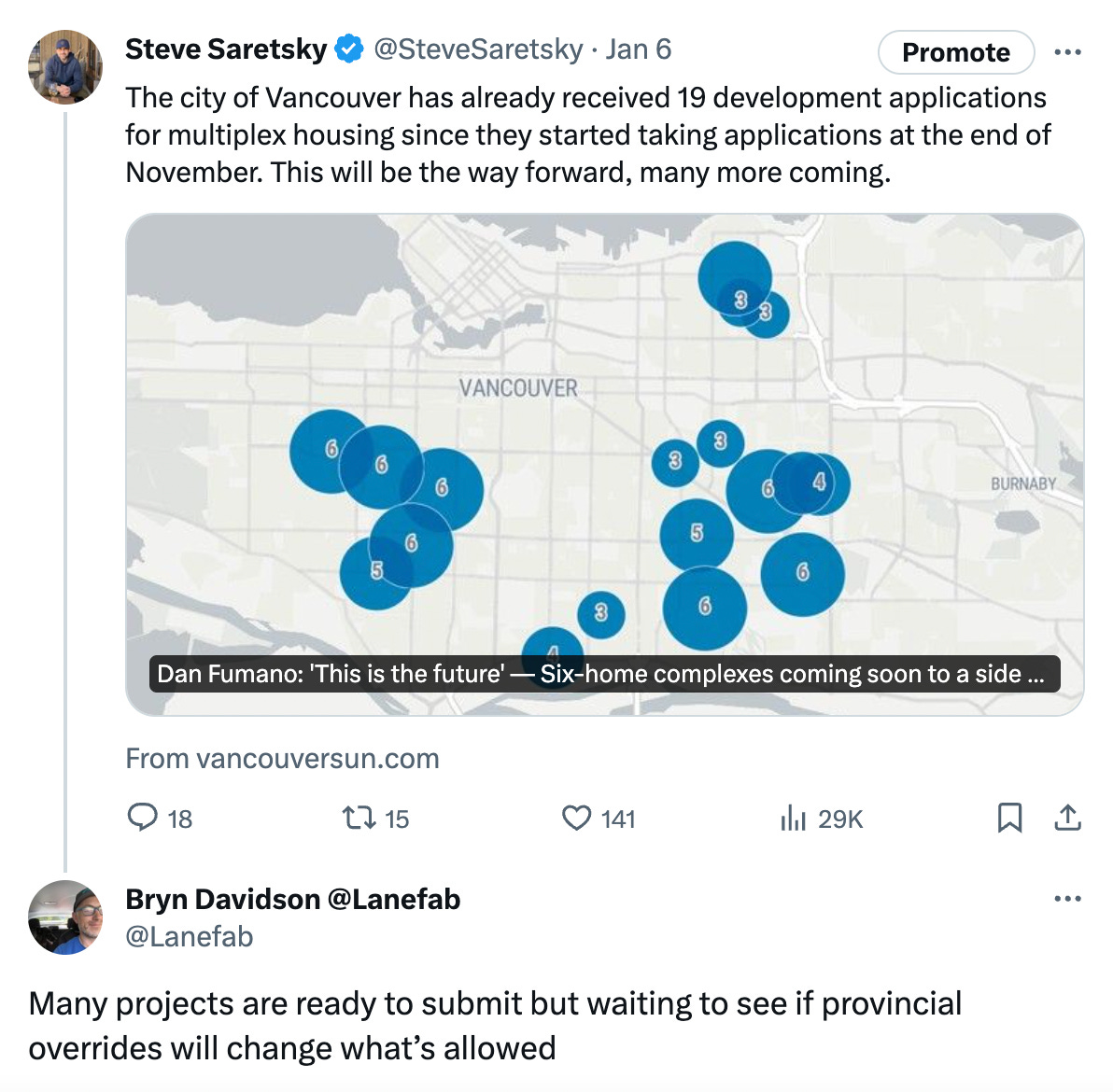

As of right now the big question is how much municipal governments will fight back, trying to find ways around this. In my discussions with the local building industry, things are largely on hold until we get more direction from each city.

For example, less than four months ago the city of Vancouver approved their own mulitplex zoning, allowing for 1.0 FSR on standard lot sizes. However the BC Government’s legislation is pushing for 1.5 FSR. This is a huge difference! As a developer contemplating multiplex development I don’t see how you can proceed until this is clarified.

Remember, the BC Government has granted cities until June 30, 2024 to update their zoning bylaws. The devil will be in the details.

Property Taxes

Not only are homeowners and landlords facing rising mortgage payments, ballooning insurance costs, rising strata fees, but now property taxes. This is a big secular trend that is destined to continue, in fact local governments have already told us so!

The city of Vancouver just announced a 7.5% property tax hike for 2024. The City of Calgary just bumped theirs by 7.8%. Meanwhile the city of Toronto is set to unveil their bad news in February, already warning “it will be substantial, because we really have reached a point where if we’re having to solve our own problems, it means a substantial increase.”

Hey it could be worse, the average single family home in Osoyoos will see an increase of 39.3%, along with user fees for water, sewer, and garbage totaling more than a 110% increase. This has come as a bit of a shock for Osoyoos resident Ron Sargeant who says he’ll be paying an extra $2500 per year in property taxes.

These cities desperately need more tax dollars from the development of new housing, they’ll just have to hope- along with millions of Canadians renewing their mortgages that interest rates play ball.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Steve Saretsky January 8th, 2024

Posted In: Steve Saretsky Blog