December 1, 2023 | Someday This Will Happen To Silver And Everything Will Change

In March 2022, there was a disruption in the nickel market that spiked the metal’s price. The lucky investors and market-makers who owned long futures contracts made fortunes.

Just kidding. The exchange on which the futures traded canceled them and stiffed the contract owners. Some of the victims understandably brought suit and were awarded a massive victory when the court agreed that contracts are sacred and the exchange had to pay up.

Just kidding again! The judges found that it’s okay for an exchange to arbitrarily tear up contracts and snatch fortunes away from successful speculators.

LME triumphs in lawsuit over canceled nickel trades

(Reuters) – The London Metal Exchange (LME) won a legal battle with U.S. financial firms on Wednesday which brought a case demanding $472 million in compensation after the exchange canceled billions of dollars in nickel trades last year following a surge in prices.

Hedge fund Elliott Associates and market maker Jane Street Global Trading brought the case after the world’s largest metals marketplace canceled $12 billion in trades when prices shot to records above $100,000 a metric ton in a few hours of chaotic trade in March 2022.

In its written ruling, London’s High Court said the LME could cancel trades in exceptional circumstances and was not obligated to consult market players prior to its decision.

“This judgment recognizes the LME’s obligation to maintain orderly markets and its powers to intervene to this end, including by canceling trades,” the LME said.

Other exchanges were closely watching the case because it could have wider ramifications on their ability to react to crisis situations.

Judge Jonathan Swift and Judge Robert Bright accepted LME Chief Executive Matthew Chamberlain’s position that consultations would not have revealed anything the exchange did not already know.

“It seems obvious to us that everyone involved was aware both that the suspension and cancellation decisions were momentous, and of the likely effects on all market participants – including those in the position of the claimants,” the judges said.

Britain’s Financial Conduct Authority in March this year launched its first ever investigation of a UK exchange for possible misconduct after the LME’s decision to cancel trades.

A source at the FCA said: “We are aware of the judgment and we are considering it, in light of our supervisory remit over the exchange.”

The LME said it had both the power and a duty to unwind the trades because a record $20 billion in margin calls could have led to at least seven clearing members defaulting, systemic risk and a potential “death spiral”.

Elliott and Jane Street had been critical of Chamberlain for taking account of possible adverse consequences for some members.

“It is difficult to think of anything more likely to make the nickel market disorderly. Further, it would not only have affected the nickel market; the failure of an LME member, let alone a clearing member, would have had a serious impact on the global commodities market more broadly,” the judges said.

“The judgment raises fundamental questions for UK market participants who trade not only on the LME but more broadly on other exchanges, about an absence of trade certainty prior to settlement,” Elliott Associates said in a statement.

Why should silver stackers care?

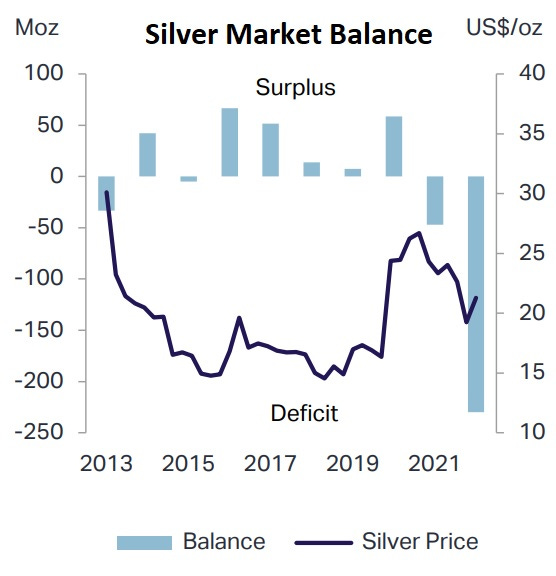

Silver is a tiny market in which demand outstrips supply:

Meanwhile, the exchanges where silver futures trade function like fractional reserve banks in which the potential claims on physical silver vastly exceed the available metal.

That’s the kind of environment where “squeezes” happen when, for instance, an unusually large number of contract holders ask for physical delivery. Obviously, that’s going to happen one of these days, and the exchanges will be faced with some tough choices.

Just kidding one last time. The above court decision means that when paper silver demand soaks up all the physical and then some, causing the price to spike, the exchanges will just stiff the contract holders who are demanding delivery.

This quasi-default will show the world that physical silver is much less plentiful than previously thought, and panic buying will ensue.

If you’re sitting on a pile of Silver Eagles when that happens, consider taking some of your massive profits and buying that homestead. You’ll want to be as insulated as possible from what comes next.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

John Rubino December 1st, 2023

Posted In: John Rubino Substack