December 4, 2023 | Rate Cuts and Density

Happy Monday Morning!

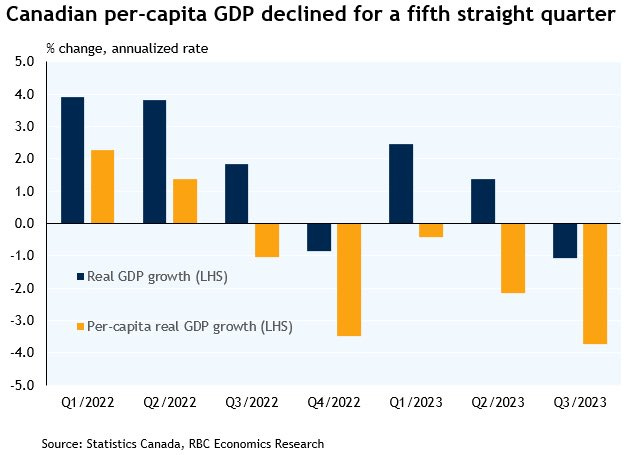

On the heels of inflation slowing to 3.1% last week, we got more evidence rate hikes are indeed working through the system. Demand continues to weaken, households have stopped borrowing money, and as a result, the economy is circling the drain. GDP fell at an annualized pace of 1.1% in Q3, well below the Bank of Canada’s expectation for 0.8% growth. While economists debate whether we’re officially in a recession or not, real GDP per capita has now declined for a fifth straight quarter.

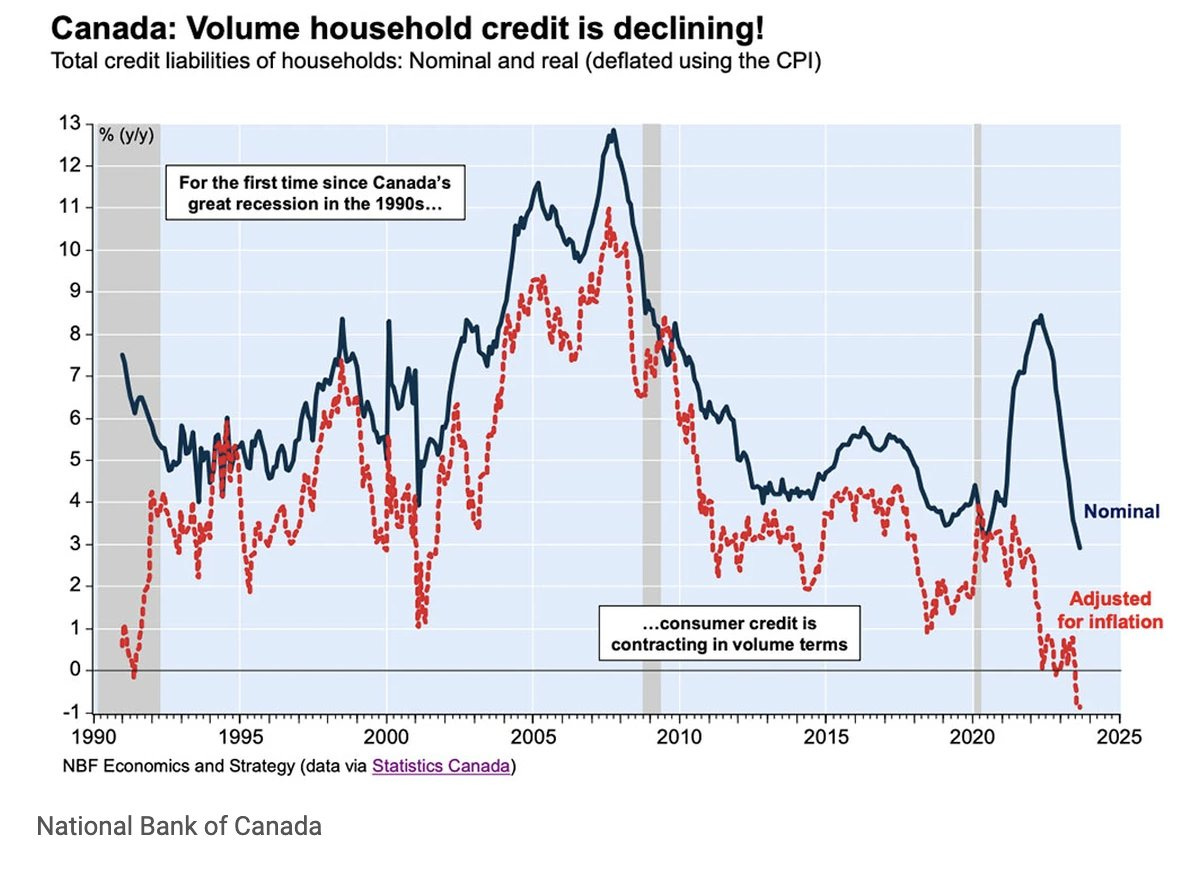

Most Canadians are worse off today than they were a year ago. Spending has slowed as Canadians shovel more savings into paying off ballooning debts. You can see this in bank earnings from last week which is showing a decline in negative amortizing mortgages. What’s happening is borrowers are capitulating and converting their variable rate mortgages into fixed rate mortgages and deploying more cash to pay down their balance. Consumer credit in Canada has now slowed to its weakest pace in 30 years, and when adjusting for inflation household credit is outright declining for the first time since the great recession of the 1990s. The deleveraging has begun.

Suffice to say we have ourselves a household balance sheet recession, and it has the potential to get ugly in a hurry unless interest rates come down, and quickly! According to 26 economists polled by Reuters, the Bank of Canada will start cutting interest rates in the second quarter of next year, with the median expectation for 100 basis points of rate cuts by the end of 2024.

Tiff Macklem is on deck this week, let’s see if he flinches.

BC Government Passes Sweeping Housing Legislation

In case you missed it, the BC government followed through with their plans and have officially passed legislation mandating multiplex zoning on all single family lots and high-density development next to transit. Bill 44 requires municipalities to allow 4-6 units on single family lots greater than 3000sqft across the province in communities with more than 5000 people.

Suffice to say this is going to drastically alter neighbourhoods in the coming years once this housing downturn bottoms and the construction cycle ramps up once again.

In perhaps even bigger news is the transit oriented development legislation. The province has mandated a minimum building height of 8 stories or more depending on proximity to a transit station. For example, if you’re within 200 meters of a skytrain station it will be minimum 20 storey buildings.

Over the coming year, the province will designate around 100 TODs (transit oriented development sites). Skytrain accounts for over 70 TODs. The map below highlights all skytrain stations with the yellow circles highlighting the density radius of the new legislation.

The remaining TODs will be set near bus exchanges, which are deemed as any stop with 2 or more connections.

Whether you agree or disagree with the incoming changes is irrelevant at this point. All we know is density cometh. Don’t be surprised if provinces like Ontario follow suit.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Steve Saretsky December 4th, 2023

Posted In: Steve Saretsky Blog

Next: Easing Cycles are No Quick Fix »