December 18, 2023 | Circling the Drain

Happy Monday morning!

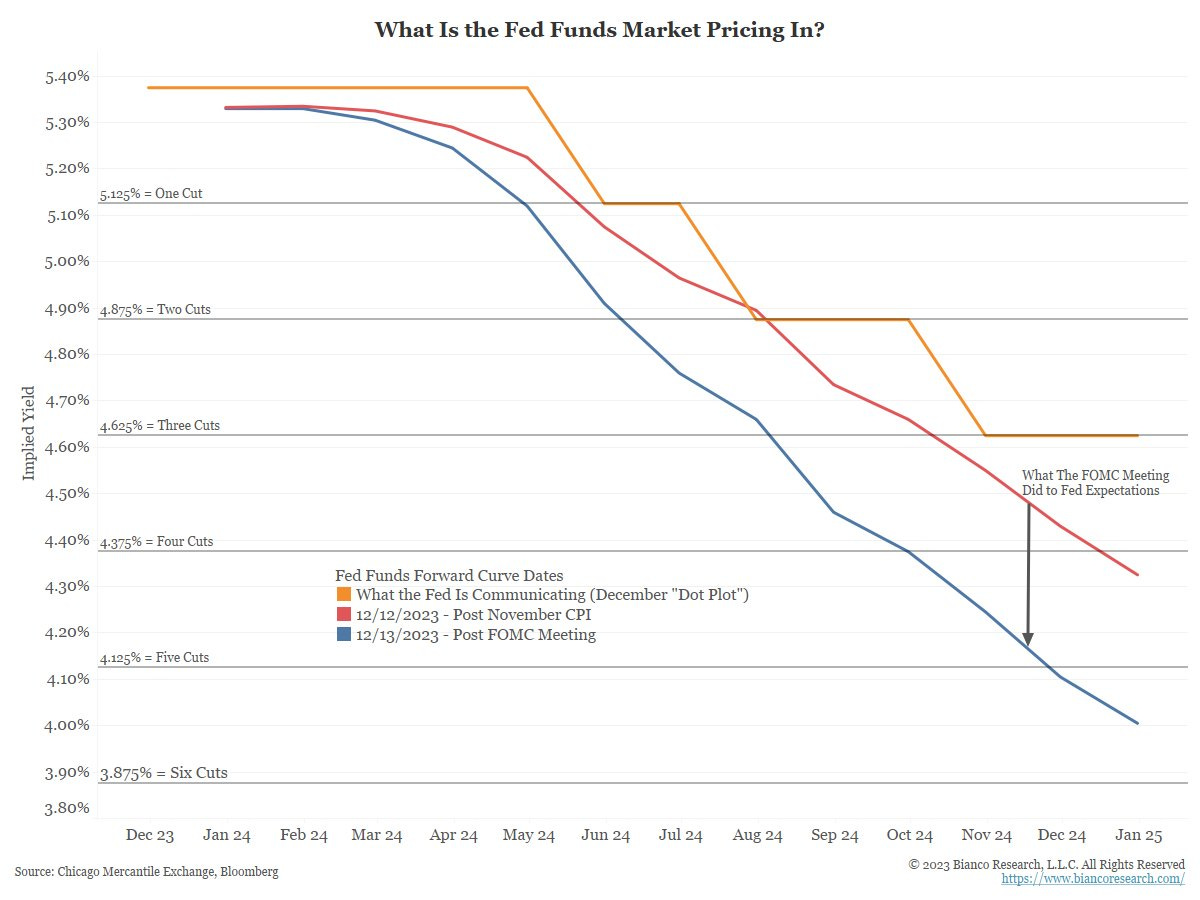

The worlds largest and most important central bank shook financial markets this past week, signalling rate cuts are now on the table next year. The feds dot plots, which are basically forecasts from fed members point to three rate cuts in 2024. Markets are currently expecting six!!

Suffice to say market expectations for interest rates have been woefully optimistic for awhile, and were completely wrong this year. There’s a decent chance they’ll be wrong again. Nonethless, the implications of what appears to be a major shift in central bank policy from the US is welcome relief for Macklem and Co at the BoC.

The Canadian economy is suffocating under higher interest rates. The Canadian economy has contracted on a real per capita basis for five consecutive quarters, the household debt service ratio just touched record highs and this is before 60% of Canadian mortgages have even seen a payment increase!

As it stands right now, 16% of all mortgages at the big 6 banks have an amortization longer than 35 years and nearly 8% of all mortgages are negatively amortizing. With a wave of mortgage renewals coming due over the next 24 months, Tiff desperately needs interest rates lower, but he’s not willing to publicly throw in the towel just yet. “I know it is tempting to rush ahead to that discussion. But it’s still too early to consider cutting our policy rate,” noted Macklem this past week.

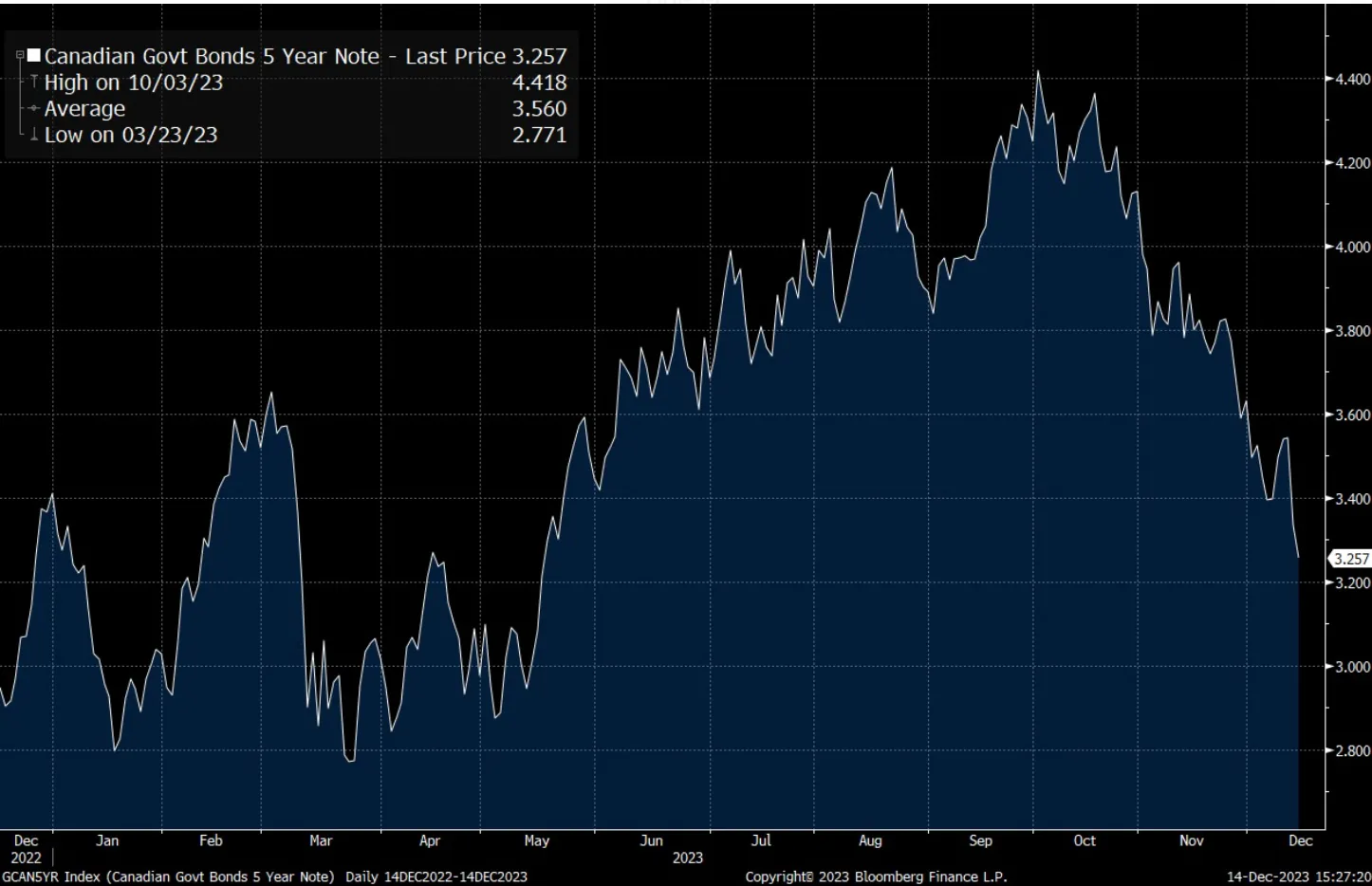

However, bond markets are doing the work for him. The all important Canada 5 year bond has plunged 120bps over the past two months. It currently hovers about 25bps higher than it did in the spring when uninsured mortgage rates could be had in the high 4’s. In other words, there’s a lot of room for mortgage rates to fall further in the months ahead. Banks typically get more competitive on rates leading into the spring market.

So we have to ask ourselves what will the housing market look like this spring with mortgage rates back under 5% with the idea that the BoC is likely cutting in the near future? Market expectations are approaching five rate cuts in 2024 with the first in April.

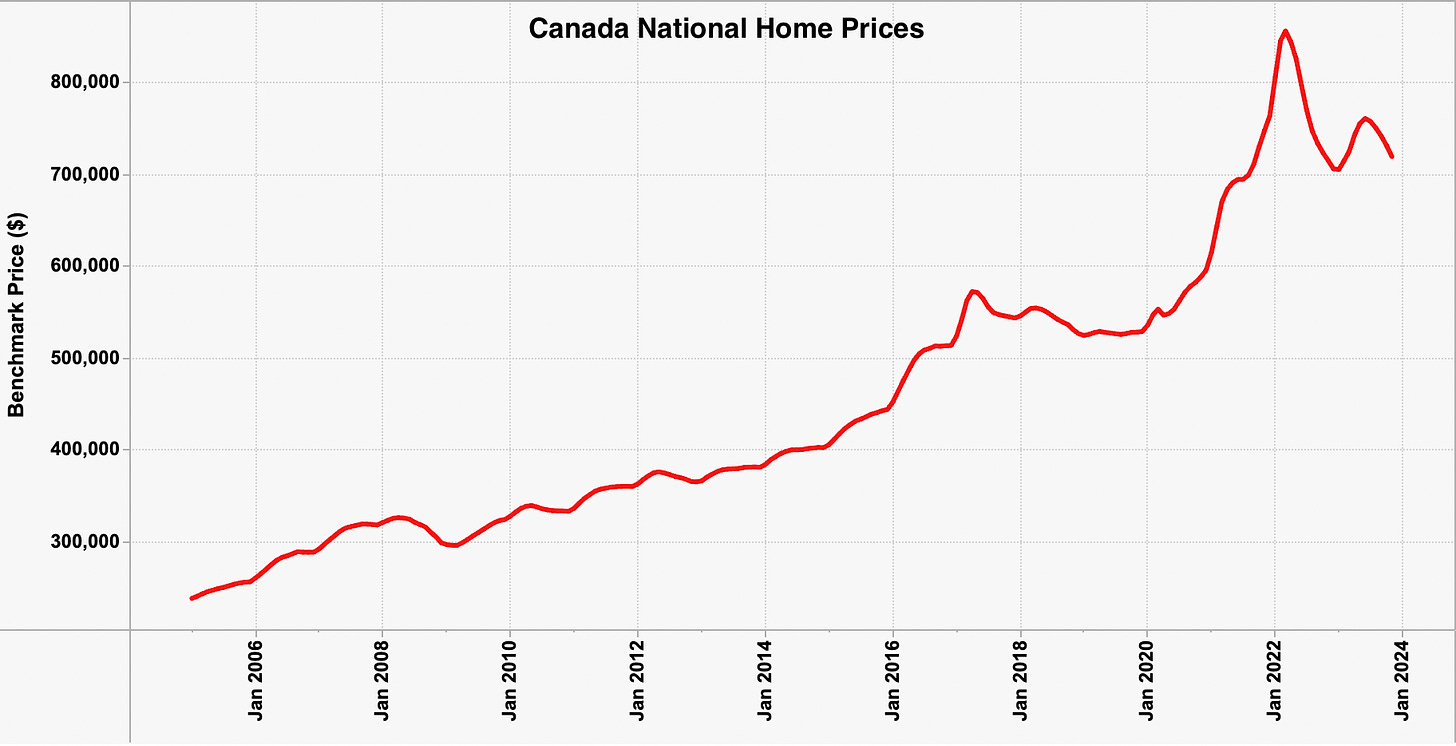

This will get quite a few buyers off the sidelines. After all, housing is largely driven by sentiment and Realtor TikTok videos. It doesn’t mean prices have to move higher or that a new bull market is upon us, it could simply mean housing goes from frozen solid to lukewarm. We saw this exact scenario play out this spring when the housing market bounced following a dreadful twenty year low in home sales in the winter of 2022.

As it stands right now prices are still falling, officially down 1.1% month-over-month in November. Sentiment is in the gutter, condos under construction are mysteriously catching fire, and yet prices are still higher today than they were this time a year ago when mortgage rates were lower.

As my friend Ron Butler says, prediction is a crap business. Outside of some far flung suburbs in Toronto and Vancouver, house prices have hardly budged since interest rates surged nearly two whole years ago. You woud think this would have humbled a lot of doomsday forecasters.

I personally believe more pain is coming, even if the Bank of Canada cuts rates and prices remain sticky.

Let’s be honest, a 100bps decline in the prime rate won’t stave off some over leveraged developers or households behind on their mortgage payments. Insolvencies are circling the drain, it just takes time for the crap to flush through the plumbing.

Mortgages being renewed at 4.5% instead of 5.5% is still going to be a problem for some borrowers, and if rates are being slashed by more than 100bps next year you have to wonder how bad the labour market looks in order to prompt that type of reaction from the BoC. Food for thought.

CPI out Tuesday, GDP on Friday. Hold on to your hats.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Steve Saretsky December 18th, 2023

Posted In: Steve Saretsky Blog

Next: Will Trudeau Resign? »