Bonds are betting that falling inflation and rising unemployment will prompt policymakers to cut interest rates next year aggressively.

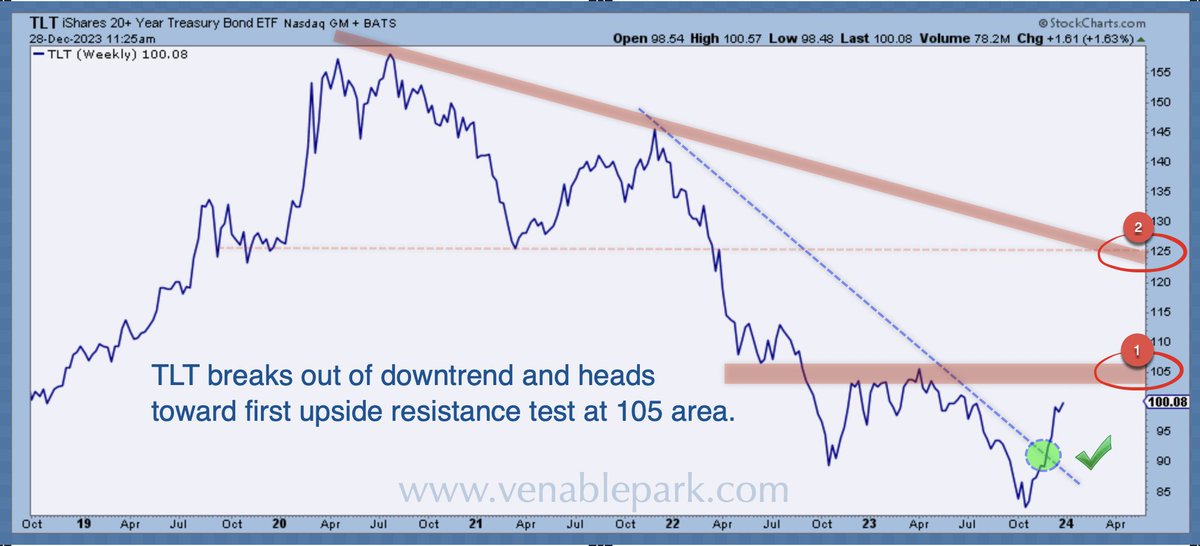

After selling off in 2021 and 2022, the world’s bond market has rebounded sharply into year-end. The Bloomberg Global Aggregate Total Return Index (shown below) has risen nearly 10% over November and December, its best two-month run in data going back to 1990. Canada’s 10-year Treasury bond has rallied 15% since October 2, 2023, and the US 20-year Treasury ETF (TLT) over 20%, recently breaking above its downtrend that had held since late 2021 (chart below from my partner Cory Venable).

As rate cuts begin, government bonds typically rise further on safe-yield-seeking inflows.

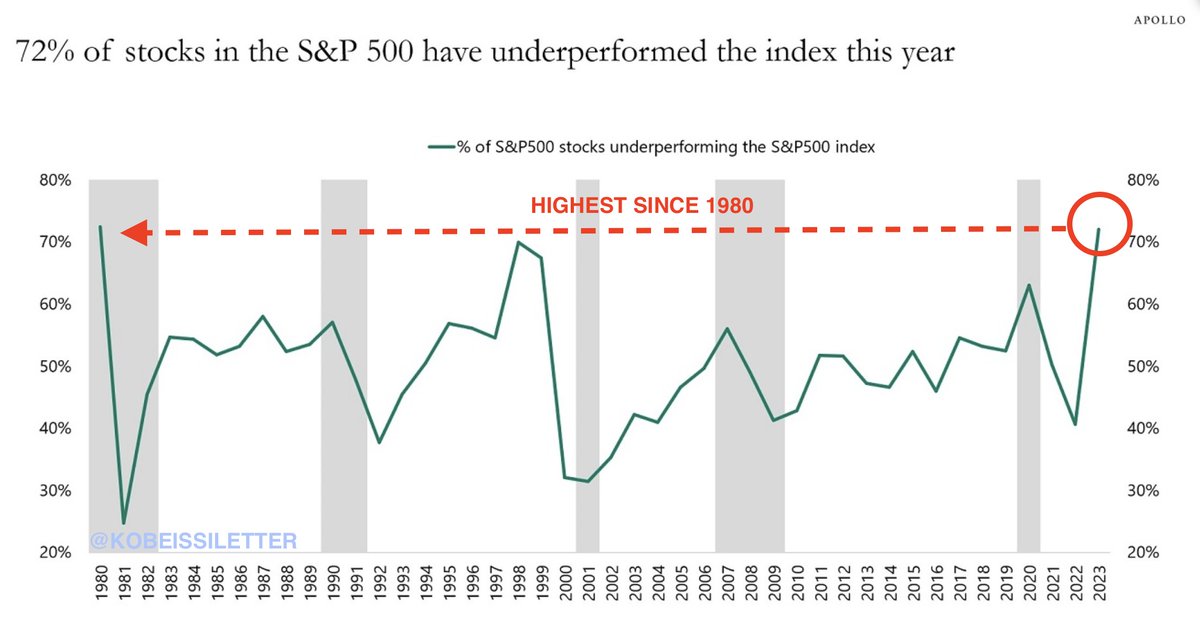

Stocks have rebounded, too, on terrible breadth. Over the last three months, the widely-tracked S&P 500 index has recovered near its all-time high of January 3, 2022 (when base interest rates were .25 versus 5.5% today), with a 31% concentration in the ten most expensive tech stocks. Under the surface, 72% of S&P 500 stocks have underperformed the index this year–the highest percentage underperforming since 1980 (see red line below, courtesy of The Kobeissi Letter).

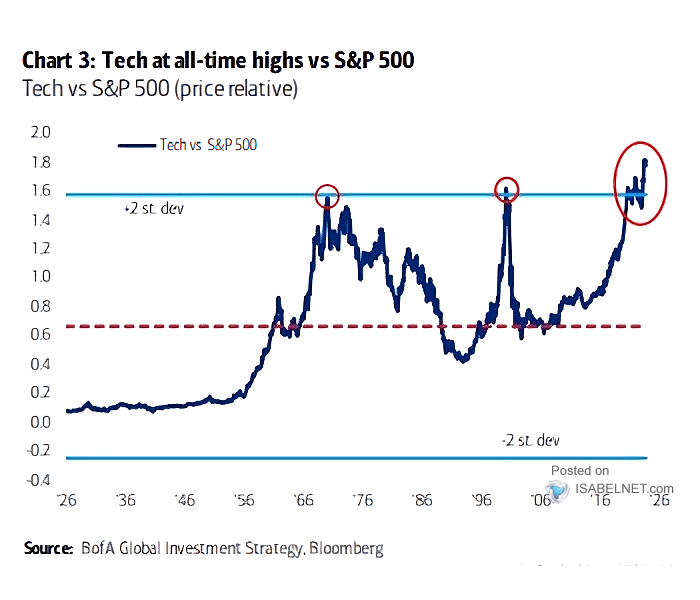

The relative price of the S&P tech sector versus other sectors is more than two standard deviations above the historic mean–something that’s only happened twice since 1926 (blue line below, courtesy of ISABELNET.com). The two other times, 1966 and 1999, preceded secular bear markets where tech shares led broad stock markets into multi-year drubbings.

While portfolio allocations have retreated with stock prices since 2022, the buy-and-hope masses still have an optimistic 60% of their savings in equities and far above the 40% average near past bear market lows (see 2009 below, courtesy of ISABELNET.com). The retail net worth allocation to government bonds is less than 5%.

Current allocation weights are likely to prove painful. Government bonds are among the few assets that typically deliver positive returns during recession-inspired rate-cutting cycles, while equities endure 80% of their cycle losses as recessions and rate cuts unfold (blue bars in the table below since 1933).

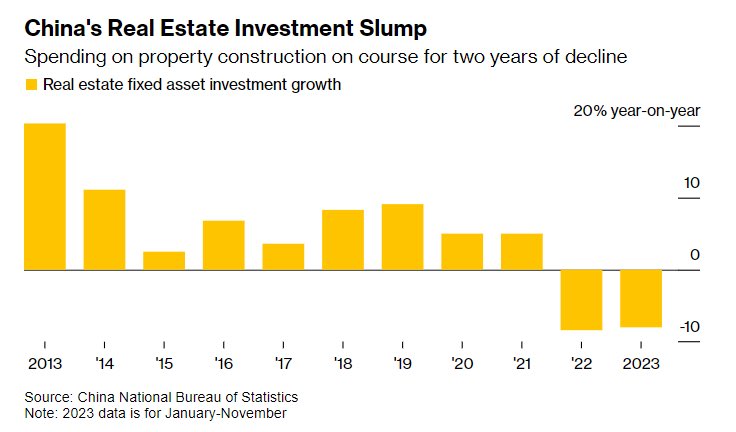

Government bonds see the storm clouds hanging over the world economy in 2024; stocks are, so far, still ignoring them. When reality dawns, great opportunity unfolds for those who have prepared.