November 17, 2023 | Wind Power Growth Hits a Major Bump in the Road

Wind power was predicted to boom in the U.S., partly due to incentives under the Inflation Reduction Act. Plans to build offshore and onshore wind turbine farms were expected to create a surge in capital investment and provide substantial new sources of renewable energy.

The offshore wind power capacity was forecast to reach 30 gigawatts by 2030, according to Bloomberg New Energy Finance (BNEF).

But recent developments in New Jersey and elsewhere cast a large shadow of doubt over those estimates.

Is this setback just temporary or is it a sign of a change in direction?

Forecast installed capacity of 30 gigawatts in offshore wind in the U.S. by 2030 compares to 141 GW expected in Europe.

But there are some who question the viability of reaching those targets for U.S. offshore wind.

Source: Orstead S/A

The expectation was that offshore and onshore wind power in the U.S. would double in size by 2030, to 273 gigawatts, with about 10 percent in offshore capacity. This electric power production would be equivalent to the power of about 140 nuclear reactors, when adjusted by a capacity factor of 50-60 percent for wind compared to 100 percent for nuclear.

Until now wind power installations, especially offshore in the U.S., were far behind similar investments in Europe and China. But the U.S. was expected to start building substantial new capacity in offshore wind after the passage of the Inflation Reduction Act.

The world leader in offshore wind, Orsted S/A, from Denmark, was expected to play a big role in that expansion.

The company, along with others, had been trying to renegotiate terms of deals signed when the cost of materials and interest rates were much lower. They were seeking contract amendments to allow price increases of 50 percent from the sale of electricity. The regulator for two of those projects, the New York Public Service Commission, denied an application to amend prices in October.

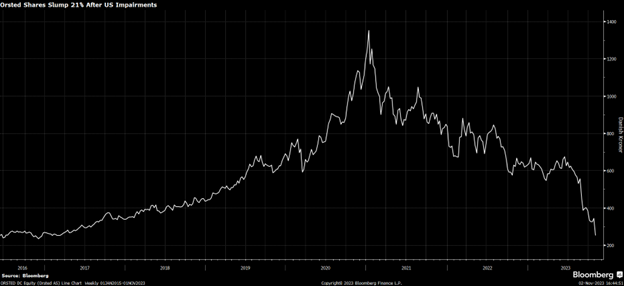

On November 1 Orsted A/S walked away from Ocean Wind 1 and 2 in New Jersey, and announced they will take a loss of $4 billion in impairment charges as the cost of cancellation. The listed shares of Orsted plunged after the announcement, extending share price declines that started in early 2021.

Source: Bloomberg

Mads Nipper, CEO of Orsted, said that supply chain challenges and higher interest rates made the projects no longer viable. Nipper said Orsted will proceed with projects offshore Connecticut and Rhode Island.

Others, such as Avangrid, a subsidiary of Spain’s Iberdrola, have also canceled projects.

The largest offshore wind farm, near Virginia Beach, is under construction. Dominion Energy said it would have 176 turbines in the Atlantic producing 2.6 gigawatts by 2026 at a cost of $10 billion.

The increased price of electricity from offshore wind — US$114.20 per megawatt hour — is higher than solar but is competitive with some other sources of electricity.

These recent cancellations are likely only a temporary setback, as the renewable energy industry adjusts to higher interest rates and costs.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Hilliard MacBeth November 17th, 2023

Posted In: Hilliard's Weekend Notebook

Next: An Answer Long-Overdue »