November 1, 2023 | What Interest Rates Say About Home Prices

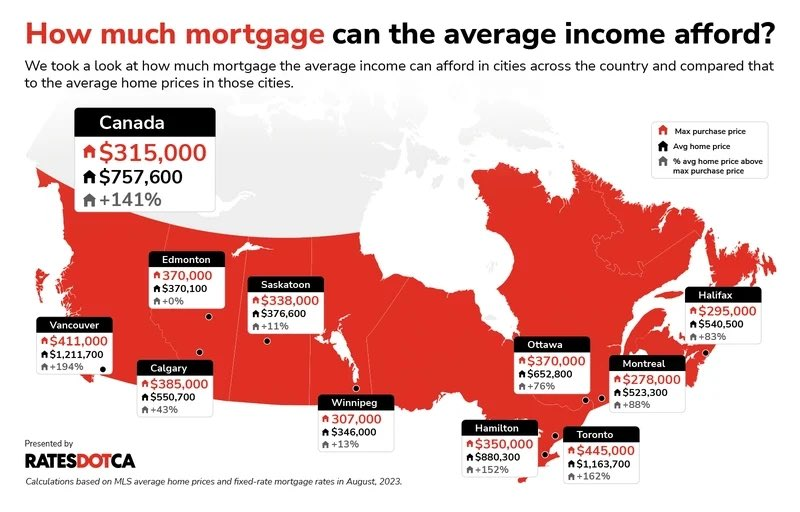

The average home price in Canada ($757k) is about 141% higher than what is considered affordable for the average household income. In the highest-population areas, like the Greater Vancouver and Toronto Areas, where incomes and home prices are higher than the national average, the affordability numbers are much worse. Price-to-income ratios in the mid-west and east are less outrageous, but only Edmonton has an average home price that measures in line with income ability (see chart below from RatesDot.ca).

Not only does this math knock out most would-be-buyers, but it’s also a big hurdle for the millions who took out mortgages when interest rates were abnormally low/prices ridiculously high in 2020-22.

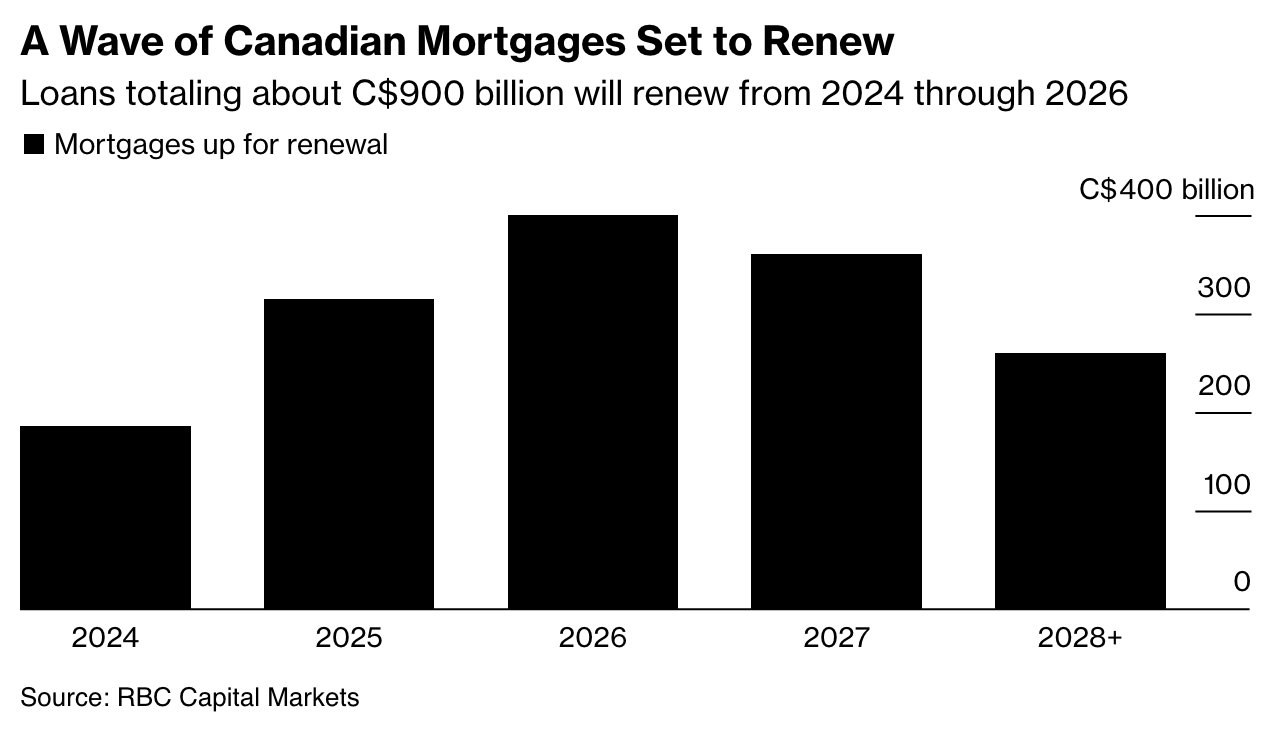

60% of Canadian mortgages are set for renewal within the next three years (chart below) courtesy of Royal Bank. See Payment Shock Coming for Most Canadians with Mortgages, RBC says. At current rates, this would equate to a payment increase of 32% for the half trillion in mortgage debt that is up for renewal over 2024-2025.

At current rates, this would equate to a payment increase of 32% for the half trillion in mortgage debt that is up for renewal over 2024-2025.

By 2026, when another $400 billion worth of mortgages are set to renew — including a large proportion of so-called negatively amortizing loans — the increase in monthly payments could be as high as 48% on a weighted average basis, while variable-rate mortgagors could face a payment shock of 84% by 2026 if interest rates do not decline significantly. (RBC data).

Yes, the Bank of Canada is likely to ease overnight interest rates starting in 2024. But it is unlikely to move back towards the zero-bound madness of 2009-2022 and even that would not solve the problems here. RBC calculates that to reduce payment shock to 20% for the variable-rate cohort, the Bank of Canada rate would need to fall to 0.25% by July 2026, and this is “perhaps an unreasonable expectation at the moment.”

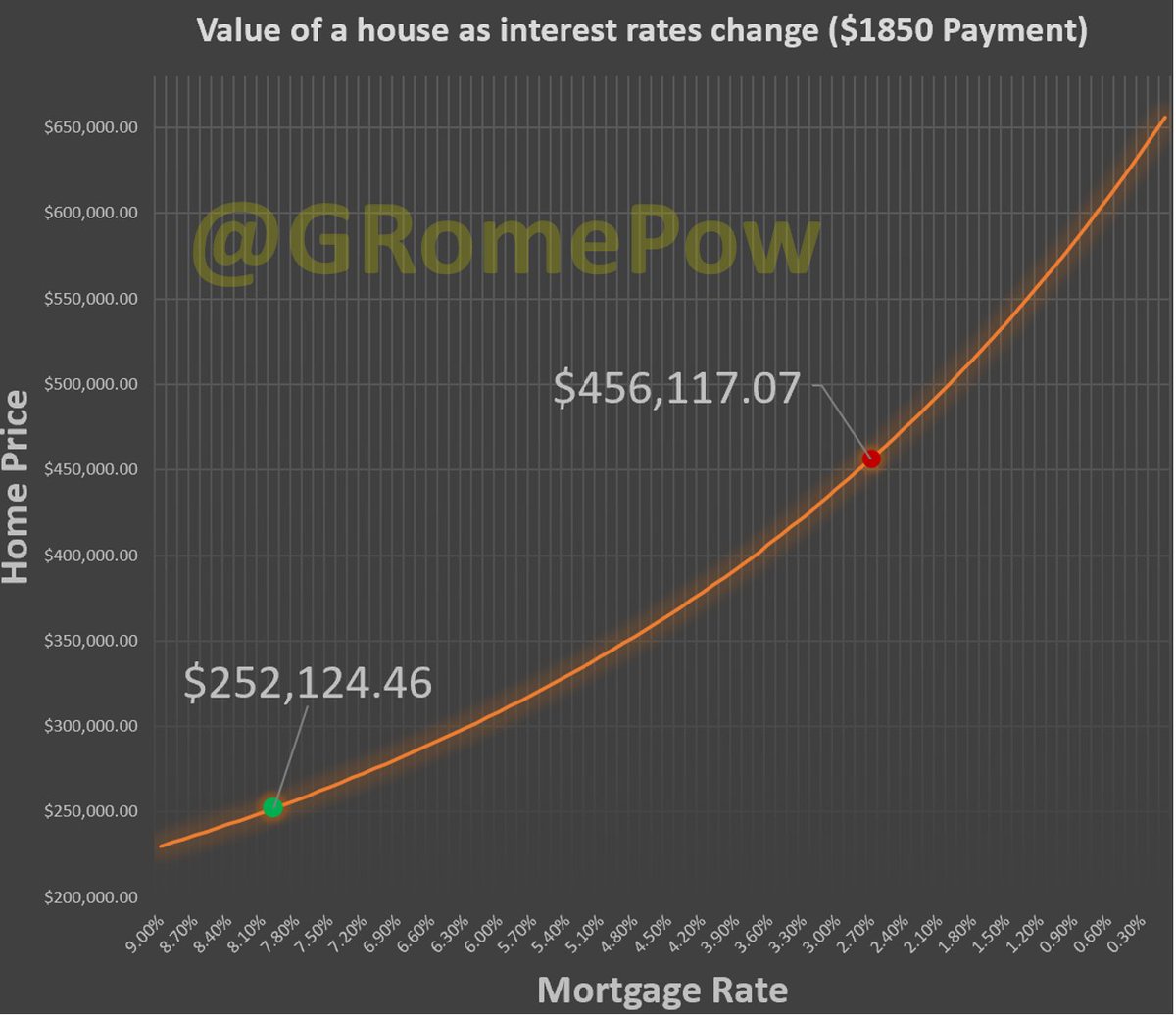

A significant number of current owners will look to sell and new listings are already multiplying like measles. Unfortunately, the bid that would-be buyers can offer is much lower than would-be-sellers have in mind. Market prices are a lot lower now than they were. As shown below (courtesy of @GRomePow), the same $1850 in monthly mortgage payment can afford a home price of $252k at 8% compared with $456K when rates were less than 3%.

This mathematical reality is now confronting owners and lenders alike. As the RBC report observes, payment shock “represents a tail risk to Canadian banks

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Danielle Park November 1st, 2023

Posted In: Juggling Dynamite