November 6, 2023 | Weak Hands

Happy Monday Morning!

Let’s address the elephant in the room. I sent out this tweet last week and it went viral.

I can’t comment on who it is, for obvious reasons, so please stop asking. Although it really shouldn’t come as a surprise that a developer with a large construction pipeline is suddenly feeling the squeeze when the prime rate nearly triples in the span of eighteen months.

It’s not so much that interest rates increased. It’s the fact that they were near zero for the better part of a decade, lulling investors into a false sense of security that rates would never rise. It unleashed a wave of speculation, inflating land values at an unprecedented pace. After all, a rolling loan gathers no loss. When land values inflate at 10% per year it can cover up a lot of bad decisions.

Pre-sale buyers shared equal optimism. Often paying 20% above spot prices for a chance of future price appreciation? In some glitzy high-rise projects there was seemingly no price too high! After all, we were promised “rates would be low for a very very long time”.

And then, suddenly, the music stopped.

We’re at the part where the ugly lights turn on and you get booted out of the bar. The party is over and most people know it. There’s a wicked hangover coming, at least for some partygoers.

When some of these high-profile names hit the tapes it will be shocking. It doesn’t necessarily mean these projects won’t finish construction, most will. However, nothing screams confidence like creditor protection. The housing market is already in a sad state of affairs. People are bummed out, as one would expect when a multi-decade housing bull market ends and you’ve hit your trigger rate.

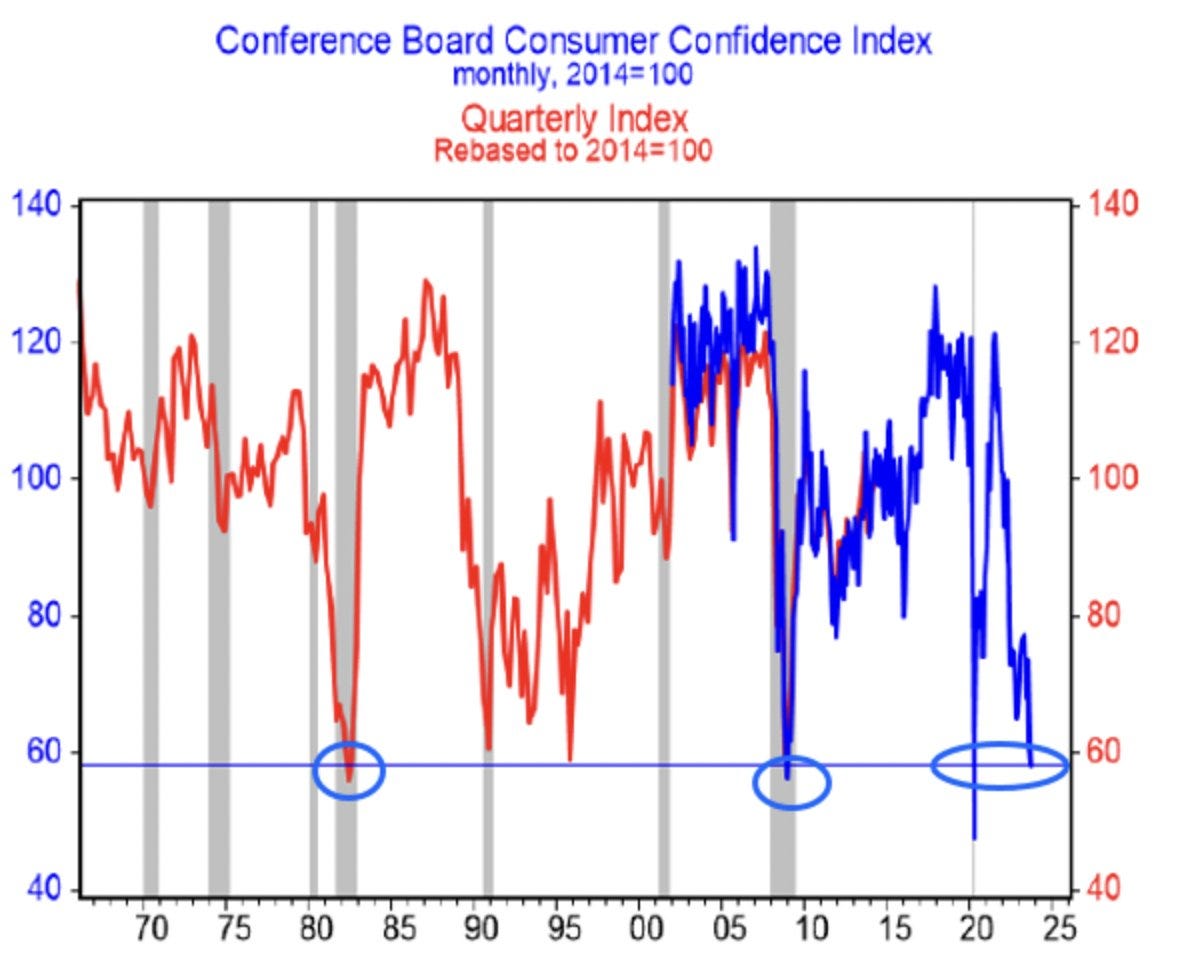

Consumer confidence in Canada just fell to levels only seen during the depths of the pandemic, the GFC, and the deep recession in 1982.

We’re already in a recession but no economist seems willing to officially declare it. The economy hasn’t grown in two consecutive quarters, and the unemployment rate has seen a cumulative increase of 0.7% over the last 6 months. Since the 1980’s this has happened six times, four of which were in recessions.

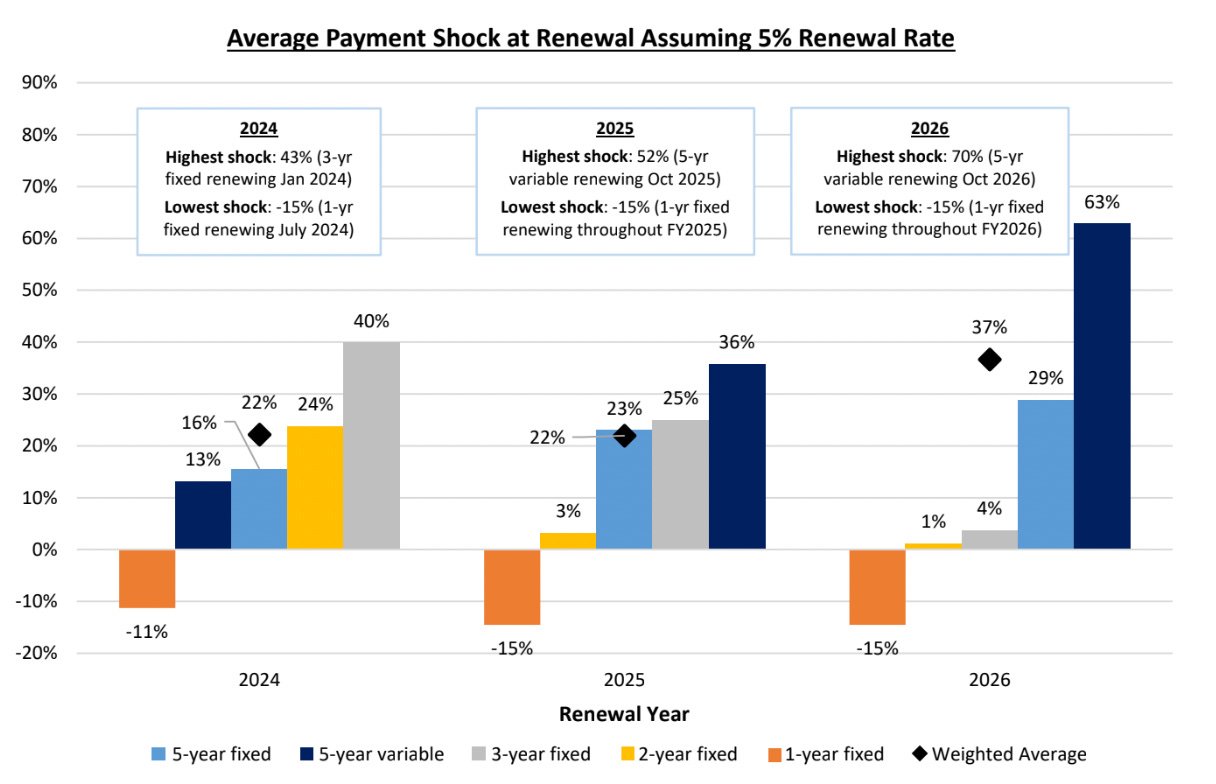

Don’t forget this is all happening when less than 50% of mortgage borrowers have even seen a mortgage payment increase. According to RBC, there is just over $186B of mortgages renewing in 2024 at chartered banks in Canada. Assuming rates hold at 6%, borrowers will see a weighted average payment increase of 32%. On a more optimistic note, if rates fall back to 5% the weighted average payment increase will drop to 22%. However, the longer this drags on the larger the payment shock.

If the Bank of Canada were a forward looking entity i’d be inclined to think they should be cutting rates, however there’s a strong argument to be made that we could use a good cleansing to purge the weak, speculative hands playing in the housing market.

Seemingly, that’s what governments are telling us they want to get rid of. In case you forgot, here’s a short list of recent policy measures. Foreign buyers tax, empty homes tax, a mortgage stress test, an increased foreign buyers tax, a speculation tax, a luxury homes tax, an increased empty homes tax, an outright foreign buyers ban, an AirBnb ban. And there’s more coming says housing minister Sean Fraser.

If you’re looking for cues, look no further.

In a recent press conference Trudeau noted,

“There are many factors that have gone into the housing crisis that people are facing right now. Whether it’s just the growth of our economy or the growth of our population. Whether it’s the success of our communities, or whether it’s under-investment by previous governments in housing over a very long time that requires us to step up in very strong ways right now,” he told reporters.

“But we do know that one of the factors that is challenging for so many people is the commodification of housing (and) the fact that people are using homes and houses as an investment vehicle — particularly corporations using homes as an investment vehicle — rather than families using them as a place to live, grow their lives and to build equity for their future.”

There was no mention of a decade of zero interest rate policy, excess immigration, excess credit creation, or the fact it often takes several years to rezone a property in major metros. Lest we forget government fees and taxes account for 30% of the cost of a new home. Ironically its investors who are responsible for financing new housing supply the government so desperately claims it needs.

Anyways, none of this matters now. New housing supply is going to get obliterated over the coming year or two and there’s nothing policy makers can do about it. If you’re a pre-sale buyer in one of these condo towers who payed 20% above spot, we thank you for your service.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Steve Saretsky November 6th, 2023

Posted In: Steve Saretsky Blog