November 4, 2023 | Trading Desk Notes For November 4, 2023

Stocks and bonds soared this week, and the US Dollar fell as markets believe Central banks are “done” raising interest rates

Bonds

30-year Treasury futures fell ~20% from the post-SVB highs in April to last week’s 16-year lows. (Yields rose from 3.55% to 5.10%.) The market turned higher last week and soared this week on a combination of softer economic data, a “dovish” Fed, a conciliatory Treasury (thank you, Janet, for getting the ball rolling) and aggressive short-covering.

This week’s bond market rally followed five consecutive down months and a brutal 3-year decline from the 2020 All-Time Highs.

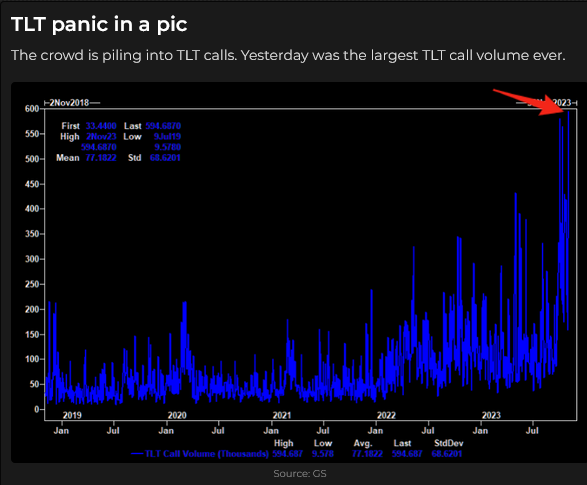

The massive October volume in the TLT ETF may signify a “sea change” in the bond market, but that idea will tested next week when the Treasury plans to sell $112 billion in a quarterly refunding. ($48 billion in three-year notes, $40 billion in 10-year notes and $24 billion in 30-year bonds to raise new cash of ~$9.8 Billion.)

The long bond rally off the October 16-year lows to this week’s highs recovered ~38% of the July to October decline.

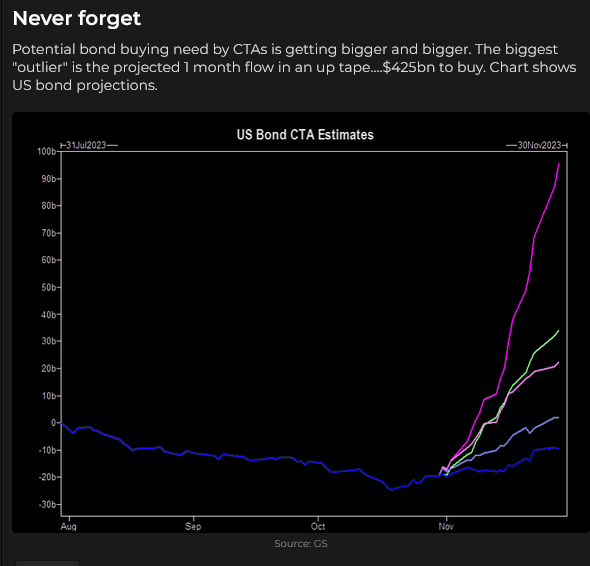

A three-year downtrend in the bond market will produce significant short positions, which must be unwound if bonds keep rallying.

Stocks

S&P futures fell ~11% from July highs to last week’s 6-month lows, with the decline very much in sync with falling bond prices. The 6.5% rally off last week’s lows to this week’s highs represents a ~50% recovery of the July to October decline.

The TSE Composite Index had its most robust weekly rally in ~40 months.

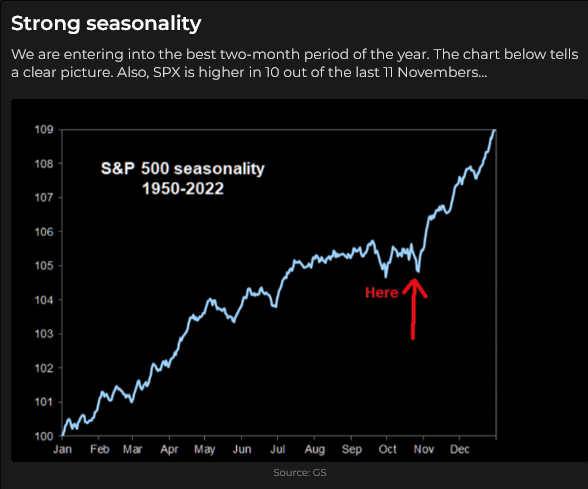

From last week’s TD Notes: The Bank of America contrarian Buy Signal got stronger this week as share prices fell. This is NOT a short-term signal.

From last week’s TD Notes: The BoA contrarian buy signal might be a bell-ringer if historical seasonality patterns kick in. (This is NOT investment advice!) Remember, bear market rallies can be nasty, and most stocks are in a bear market.

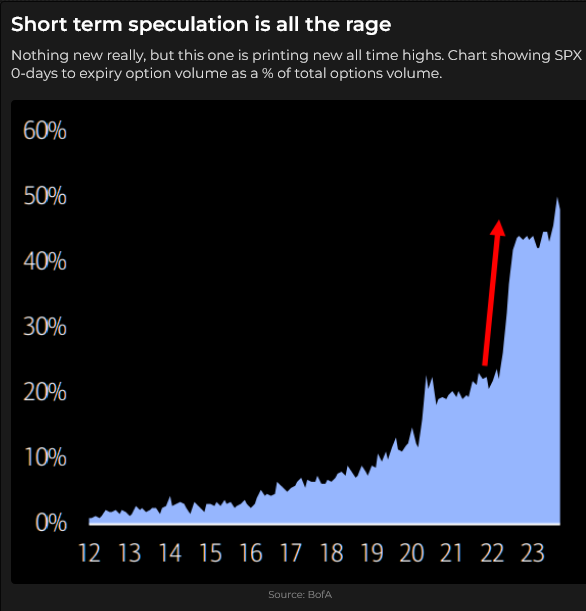

In previous Notes, I’ve often said that the stock market would see the end of Fed tightening as a “Green Light Special” to buy stocks. It has also been a “Flashing Red Light” for shorts to cover. For instance:

Currencies

The US Dollar Index had its steepest fall this week since early July.

The Euro closed this week at a 9-week high after very choppy price action throughout October.

The Canadian Dollar hit a 12-month low on Wednesday but bounced back Thursday/Friday (as stocks rallied and interest rates and the USD fell) to create a Weekly Key Reversal on the charts.

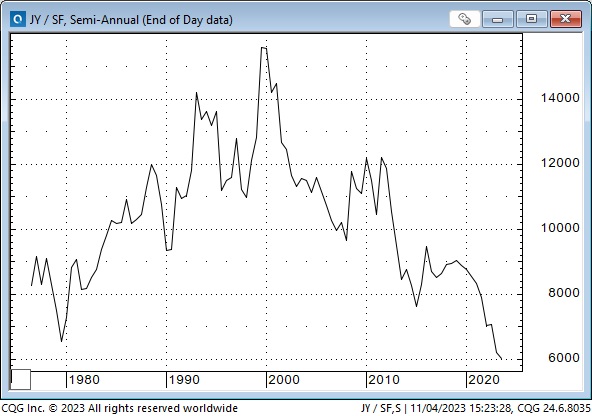

The Japanese Yen tumbled to 12-month lows on Tuesday after the BoJ essentially left their Yield Curve Control program intact. Speculators may have bought the Yen before the BoJ meeting, hoping that the YCC program would be significantly changed (or abandoned) and that such a change would cause Japanese bond yields to rise, which in turn might cause the selling of foreign bonds and the repatriation of capital to Japan (causing the Yen to rise) to buy Japanese bonds. That didn’t happen, and the speculators dumped their long Yen positions, taking the Yen down to very near the 32-year lows it traded at in October 2022.

Speculators have been hung out to dry so often over the years when they tried to “front-run” the BOJ that their trades have been nick-named “widowmaker” trades. In the On My Radar section of last week’s Notes, I was considering the “greatest-ever FX trade,” buying the Yen and selling the Swiss Franc, but I worried that it might also be a “Widowmaker” trade. I think the spread is the widest ever since currencies began to “free float” in the 1970’s.

Late in the week, the Japanese government approved a $100+ Billion stimulus program to get inflation under control. Somebody must have translated the MMP playbook into Japanese.

Gold

Comex December Gold futures rallied ~$200 from their October lows to this week’s high but closed red on the week. The rally from the October lows (following a decline of ~$275 from the May highs) was inspired by the geopolitical crisis in Israel, and with that crisis not “widening,” aggressive bids for gold have faded. The COT and ETF data, together with open interest, indicate a good part of the recent rally was due to short-covering.

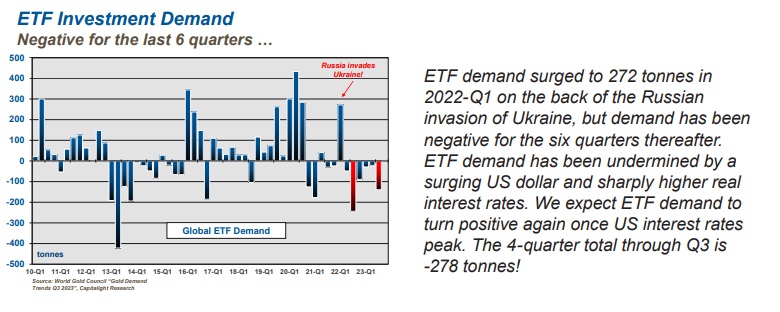

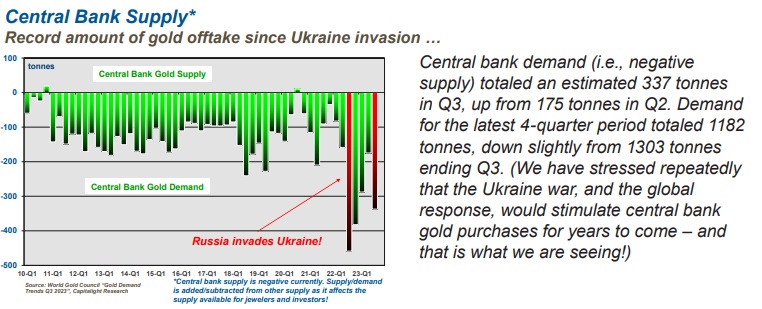

These two charts from Martin Murenbeeld’s Gold Monitor (using data from the World Gold Council) show 1) that there has been net selling of global gold ETFs following the spike of buying on the Russian invasion of Ukraine and 2) that Central Bank buying has increased dramatically as ETF demand has faltered.

My short-term trading

I bought OTM calls on the 10-year T-Notes on October 26, thinking that the Fed or the Treasury, or soft economic data or soft labour reports might inspire a bond market rally this week. I added, “What I’m really looking for is enough of a bond rally to ignite some short-covering.”

I got all of those things and covered my calls for a very decent profit, just below Friday’s highs.

I watched the stock indices soar this week and thought about buying some but realized that long bond calls and long the stock market were the same trade (this week), so I just stayed long the Bond calls.

I watched the USD falling and thought about getting short, but again, it was the same trade (this week) as long bond calls.

I saw the CAD make a 12-month low on Wednesday and then start to rally. I bought it, thinking it had to “catch up” to the short USD/long stocks/long bonds trade. It did, and I covered the trade on Friday morning for ~90 tick profit.

I caught a cold on Wednesday, and by Friday morning, I was sneezing and wheezing with a headache that was giving me severe brain fog. I decided the best thing to do was to get flat and hope my cold was better come Monday. I was grateful for the gains, but I probably would have gone flat (because of the brain fog) regardless of the price.

I was flat going into the weekend.

On my radar

Last week may have been the beginning of a “sea change” across markets, but I think a big part of the (rather extreme) moves was from people unwinding positions that had worked well the past few months. (Short-covering in stocks and bonds.)

The dramatic “V” shaped turn in the stock indices may signal a rejection of the bear trend since July, but if the rally runs out of gas, I’ll be looking to get short.

Falling bond yields “cleared the track” for stocks to rally.

I expect a recession, and if the market sees that coming, that is not good for stocks, other than it increases the possibility of Fed easing. A recession will likely increase government spending (2024 is an election year) and more government debt issuance, so I don’t expect the bond rally to be sustained. Continuing reckless fiscal policies guarantees continuing higher inflation and higher interest rates. Click here to see Stan Druckenmiller tell Paul Tudor Jones what he thinks of current fiscal policies. (30 minute video.)

The Inflation Reduction Act is another wonky idea from the Modern Monetary Policy playbook. It should have been called The Government Climate Change Pet Project Act. It amazes me how aggressively governments are willing to spend other people’s money on their vanity projects.

The highest interest rates in 15-20 years are good for savers after they were punished by 15 years of near-zero interest rates. I can agree with the “sea change” idea if it incorporates the view that interest rates and inflation are NOT going back to 2% or less. I don’t see the nearly $6 Trillion in Money Market Funds as “dry powder” looking to get back into the stock market – people like earning a “risk-free” 5% after years of nothing.

I was reading about the fantastic prices charged for concerts, so I looked up Live Nation’s share prices. This stock could be a tremendous short if a recession develops and people have to start making wise choices about spending their money. (This is not investment advice; it’s an example of how I build trading ideas – and I don’t trade individual stocks, although that might change.)

The UAW “victories” against the Big Three will inspire other unions (and other workers) to demand increased pay.

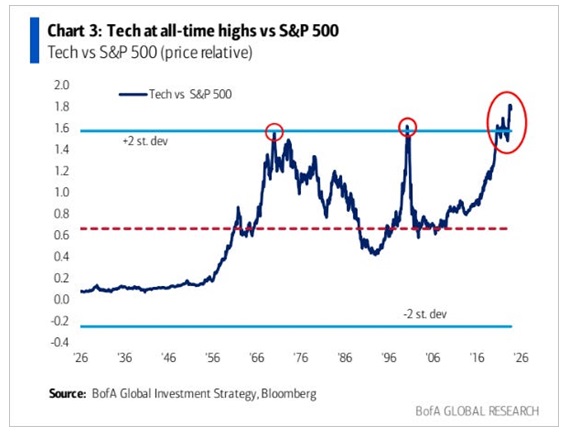

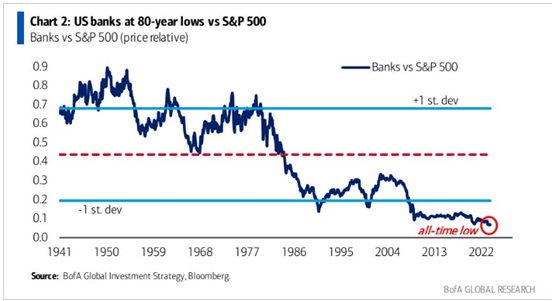

Is it time to sell Tech and buy banks?

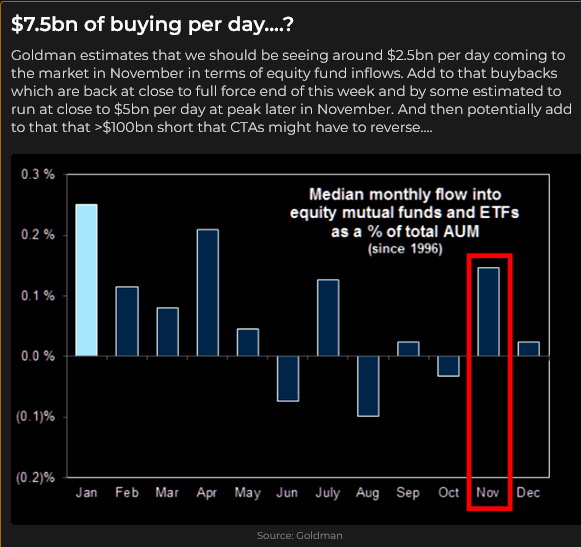

Stock market bulls are dreaming of a Santa rally.

The Barney report

Barney wonders what happened to the Magnificent Seven.

Barney is doing his “profile of a dog” pose on a Douglas Fir log deep in the Northwest Pacific Rain Forest.

Listen to Victor talk about markets

I did an 8-minute interview with Mike Campbell on the Moneytalks show on November 4. We talked about the big moves in stocks and bonds this week, how the Canadian real estate market is more at risk of higher interest rates than the American market and how gold has jumped on the crisis in Israel. My spot with Mike starts around the 1 hour and 8 minute mark. You can listen here.

The Archive

Readers can access weekly Trading Desk Notes going back six years by clicking the Good Old Stuff-Archive button on the right side of this page.

Headsupguys

There’s a reason I put a link to Headsupguys in my Notes every week. I’ve had friends who took their own lives, and Headsupguys helps men struggling with depression.

If you or someone you know is struggling with depression, talk to them and contact headsupguys. They can help.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new – usually 4 to 6 times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Victor Adair November 4th, 2023

Posted In: Victor Adair Blog

Next: Debt Scores »