From a Ben Bernanke speech in 2011:

“Perhaps the most important thing for people to understand about the federal budget is that maintaining the status quo is not an option.

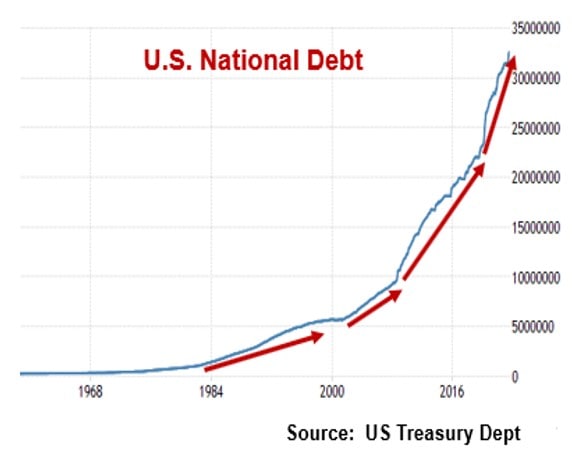

Creditors will not lend to a government whose debt, relative to national income, is rising without limit; so, one way or the other, fiscal adjustments sufficient to stabilize the federal budget must occur at some point.

These adjustments could take place through a careful and deliberative process that weighs priorities and gives individuals and firms adequate time to adjust to changes in government programs and tax policies.

Or the needed fiscal adjustments could come as a rapid and much more painful response to a looming or actual fiscal crisis in an environment of rising interest rates, collapsing confidence and asset values, and a slowing economy.

The choice is ours to make.“

After 50 years of study, I have come to believe there are only three principles of economics that have any real practical value – and one of them is “There is no free lunch. Someone has to pay.”

PS: When Bernanke made that speech in 2011, he said that the U.S. had about 10-12 years to get our financial house in order. Nobody listened then – so my bet is nobody will listen now.

PSS: The rate of inflation in Argentina just went from 40% to 140% per year in less than two years. So yes, things can happen fast.

“Creditors will not lend to a government whose debt, relative to national income, is rising without limit”

But there is one creditor who will lend to a government even in that precarious position – the Federal Reserve. That’s why a government bond is considered by many (I am not one of them) to be the safest investment, because as is so often mentioned in the financial press that the government will never default on a bond because it can simply “print the money” to pay it off.

But Mr. Campbell is right there is no free lunch, the debt will be paid off by the general population through the inflation caused by “simply printing the money” to pay off that bond.