November 27, 2023 | More Firing than Hiring

Happy Monday Morning!

Consumer prices eased in October, clocking in at 3.1% year-over-year, and down from 3.8% last month. This is welcome news for mortgage holders sweating over upcoming mortgage renewals. For Bank of Canada watchers, the BoC’s closely watched 3 month average core inflation measure dropped to 2.95%. We are getting close.

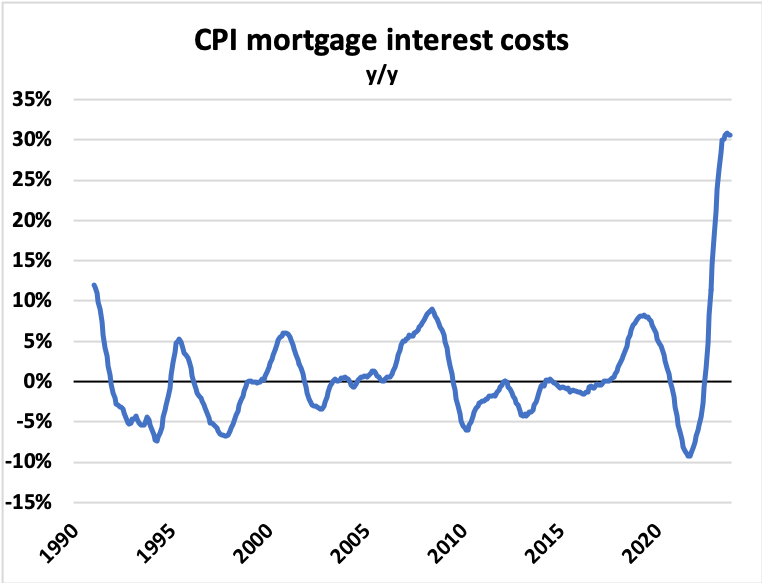

Mortgage interest costs continue to drive the bus, still running 30% higher than last year and feeding into the sticky inflation narrative.

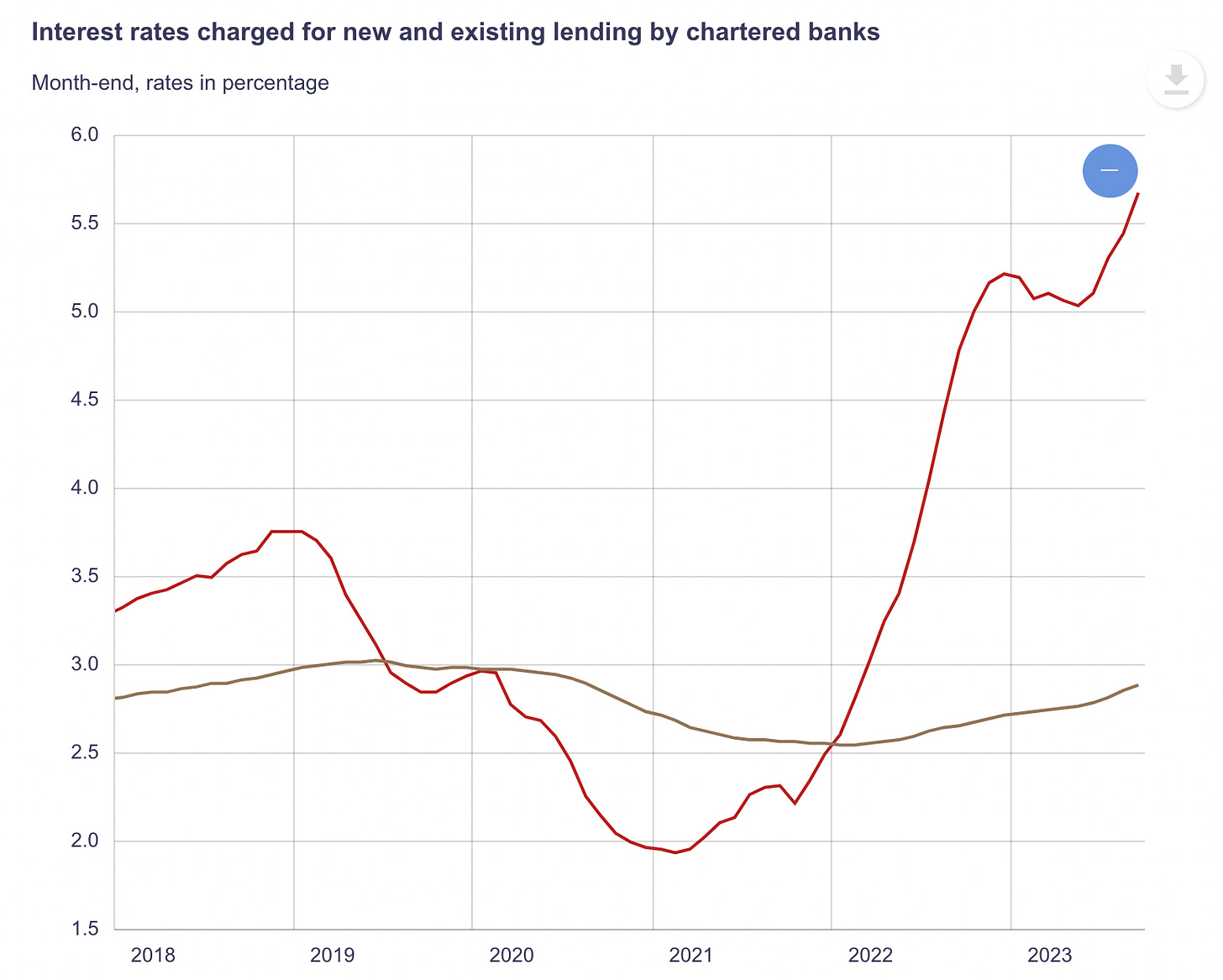

It’s likely that mortgage interest costs will remain elevated. Don’t forget less than half of mortgage holders have actually endured a payment increase. More borrowers will have to face the music as fixed rates expire and come up for renewal. Recent data from the BoC shows outstanding balances for uninsured mortgage holders carry an average 5 year fixed rate mortgage of 2.84%. The new rate today is 5.68%. In other words, there’s a massive spread between what people are paying today and what they’ll likely be paying in the very near future.

It’s no wonder the BoC’s Macklem was out this week suggesting rates may finally be “restrictive enough,” adding “More downward pressure on inflation is in the pipeline.”

In other news, the federal government unveiled a new spendthrift budget aimed at fixing the housing crisis. As we discussed last week, the liberals will officially introduce legislation that will remove the ability of AirBnb operators to deduct rental expenses on their tax returns.

The implications of this are rather profound, but not for the reasons you think.

Freeland estimates that turning short-term rentals into properties available for the longer term in Toronto, Montreal and Vancouver could immediately free up 30,000 units of housing. However, converting these AirBnb properties back to long term rentals will come with a huge tax conondrum.

Short term rental properties, in the eyes of CRA, are typically treated as commercial property instead of residential rental income. In other words, many AirBnb operators will need to self-assess GST/HST when coverting the property back to a long term rental.

For example, lets assume you bought a property for $1M in Ontario and use it for short term rental. Now with the new rules you want to convert it back to a long term rental, you may have to self-assess GST/HST. Assuming the value is still $1 million and HST is 13%, that’s a $130k tax bill to the CRA. Thanks for playing.

So now what? Will a wave of AirBnb properties suddenly hit the resale market instead? I doubt it, just like the foreign buyers tax, speculation tax, and empty homes tax, I still think we’re missing the forest for the trees.

We’re immigrating a million people a year into this country and we’ll be lucky if we complete 225,000 new homes this year. This is a structural imbalance that is going to take a hurculean effort to repair.

The Feds are trying to throw more money at it, begging developers to build more. You can lead a horse to water but you can’t force it to drink. If the economics don’t work there’s not much you can do. The reality is more developers are firing than hiring today. According to Altus Group, the construction industry has shed about 37,000 jobs, year-to-date through August.

These losses are occurring as construction starts slow in the wake of higher interest rates and other hurdles to development, such as government taxes and fees at the municipal level.

“That slowdown is going to create this false look at the balance of supply and demand that is going to impact new recruitment,” notes Marlon Bray, head of Altus Group’s Ontario pre-construction and contract administration services. Altus expects the residential and ICI construction industry to remain slow through the end of this year and probably through 2024, until interest rates come down. Only then, will construction come roaring back.

However, that too will come with challenges. According to BuildForce Canada’s latest forecast, 245,100 people are expected to retire from construction jobs over the next 10 years, roughly 20% of Canada’s current construction industry workforce, and replacing those skilled trades has proven no easy task.

It begs the question, do we really have the ability to meaningfully ramp up supply?

Despite the fanfare, the photo-ops and the head nodding, the outlook for housing affordability remains illusive. But at least we got those AirBnb guys…

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Steve Saretsky November 27th, 2023

Posted In: Steve Saretsky Blog