November 15, 2023 | Inflated Risk Assets Mean Central Banks Tighter For Longer

A flat October US CPI release yesterday inspired both equities and bonds to rally on a growing belief that inflation is decreasing, and the US and Canadian central banks, on hold since July, are done hiking policy rates this cycle.

The most abrupt monetary tightening in many decades has thrown a ton of drag on heavily indebted economies while ongoing quantitative tapering continues to reduce financial liquidity each month.

Central banks will eventually reduce policy rates as the economy slows, inflation falls, and unemployment rises, but the implications for different asset classes are diametrically opposed.

Government bonds attract inflows as the economy slows, and their rising prices help to ease financial conditions via lower yields (market-set interest rates).

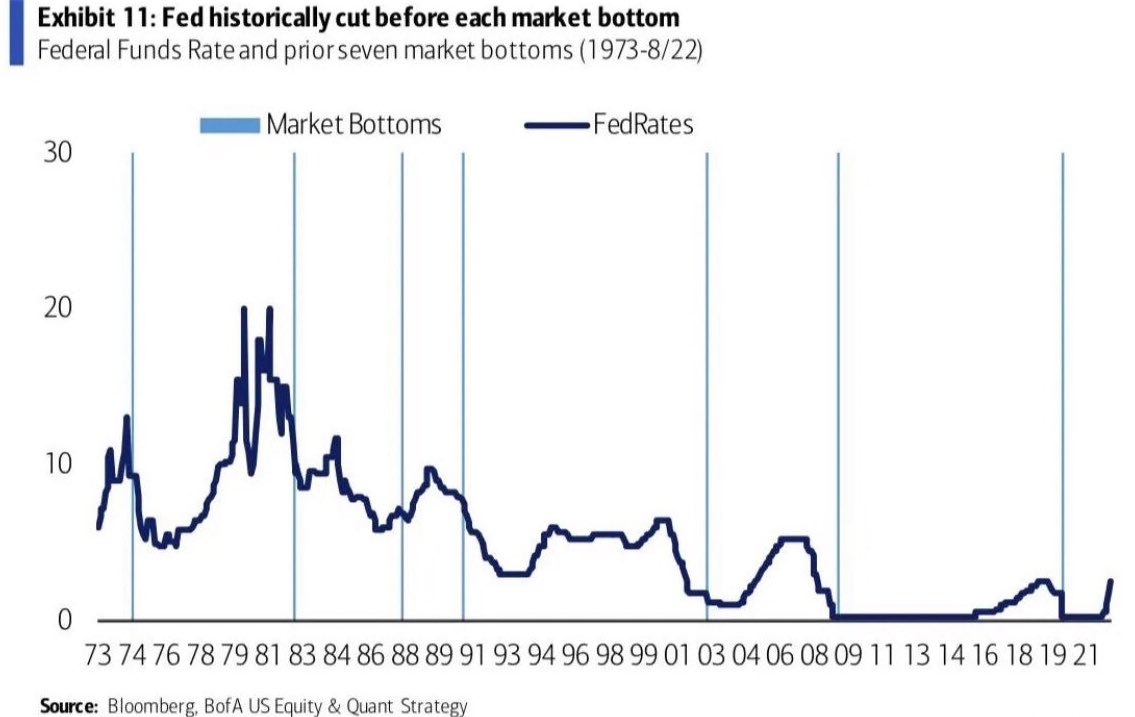

So long as riskier assets like equities, corporate debt, commodities, and real estate remain inflated, however, central banks have reason to stay tighter for longer. Tumbling risk markets (contracting financial conditions) are part of what prompts central banks to start easing once more. As shown below, since 1973, equity markets bottoms (light blue bars below) have come after the Fed slashes overnight rates near cycle lows once more (dark blue line), not before.

Most people don’t know these facts, and sadly, they are getting investment advice from an equity-centric financial industry that grew extra fat and lazy in an anomalous era of ultra-easy conditions from 2009 to 2022. We are now in an old, brave new world where discipline, cycle awareness and risk management skills are essential and painfully rare.

See more in Fund Managers Turn to New Data Sources to woo clients as Flows into equity funds dry up:

Closely studying a company’s balance sheet and debt profile should not be a novel experience for an equity investor. But the extended period of low rates means that even relatively senior analysts and portfolio managers have never invested in a “normal” interest rate environment.

Veiel said investors needed to be wary that a stock may look cheap compared to valuations in the past but “we need to be making sure we frame our analysis not just versus the last five years”, said Veiel. “You can’t build a valuation premise on going back to lower rates.”

“We have folks who’ve been around 30-plus years, and we lean on them in these environments,” he added. BlackRock’s Despirito agreed that “we’re in a market that either favours people with a lot of long-term experience, or at least students of the history of the market.”

Analysing a company’s debt and refinancing risks, he added, “is an easy financial exercise . . . but people don’t always pay attention. Indices definitely don’t”.

Also, see Canada’s Menacing Mortgage Math Means Crisis Looming:

The macroeconomic math relating to Canada’s looming wall of mortgage renewals should be terrifying for the Bank of Canada. A large increase in average monthly mortgage payments will arise from the nearly $1 trillion in renewals due by 2026, triggering, in turn, a large demand shock and putting stress on the housing market in particular and the economy in general. The central bank will need to ease aggressively before the shock strikes to avoid turning a slowdown into a crisis, positioning Government of Canada bonds for outperformance in 2024.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Danielle Park November 15th, 2023

Posted In: Juggling Dynamite