November 22, 2023 | Gold: Resistance Is…Finite

The human mind likes big round numbers. Which is why, when a tradable asset is rising, sell orders tend to cluster in predictable spots. The frequent result is a repeating pattern of strong gains running into waves of selling that knock the price back down. Traders refer to this as “resistance,” and it’s maddening for long-and-strong investors who just want their stock or commodity to go straight up.

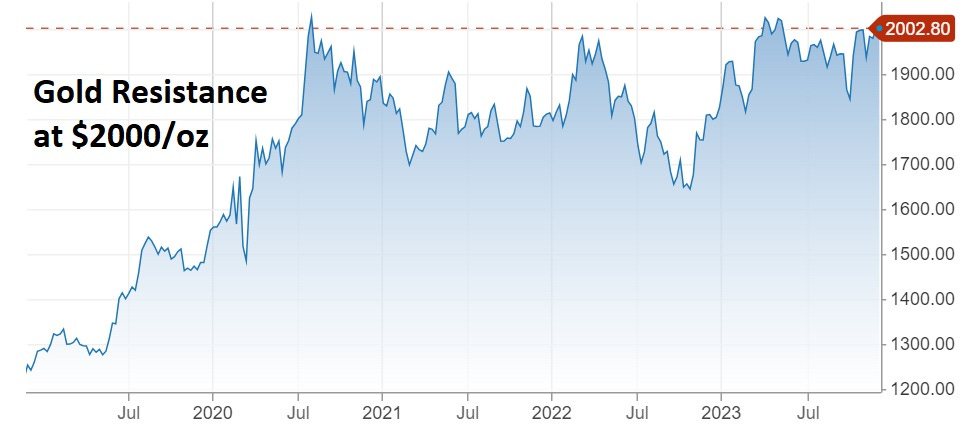

Today’s gold chart is a classic example.

Since July 2020, gold has repeatedly threatened $2000/oz, only to be smacked back down by all the people who bought at $1000 and see $2000 as a psychologically comforting place to take profits.

Resistance is finite

Selling interest at a given price is not unlimited. So one way that this might resolve is for gold to keep threatening $2000 until the number of sellers diminishes to irrelevance. It will then be free to rise with little new resistance until the next big round number — say $2500.

How close is gold to penetrating resistance? Well, $2000 has held for 3+ years, which means a lot (most?) of the potential selling has already happened.

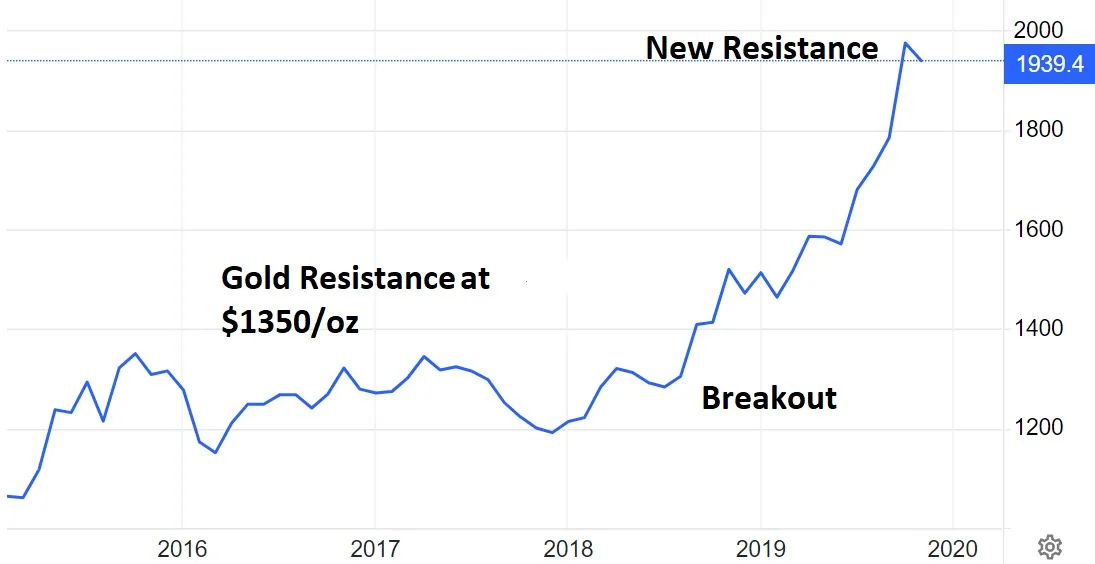

For a sense of how this might look, check out gold’s last resistance battle. Between 2015 and 2019 its price bounced off ~ $1350 four times, until gold bugs began to wonder if $1400 was forever out of reach. But the same repetition that demoralized the longs eventually exhausted the sellers, and when gold finally pierced $1350 it was off to the races until 2020, when it hit the current $2000 resistance.

There’s no guarantee that this pattern will repeat. But both recent history and human psychology say it’s definitely possible.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

John Rubino November 22nd, 2023

Posted In: John Rubino Substack

Next: What is Driving Oil Prices Down? »