Bond analyst Alf Pecatiello warns that over the last 3 months, US bond markets have been in an aggressive and prolonged period of bear steepening of the yield curve. History shows if left unchecked, this steepening is likely to cause serious damage to equity markets and the economy. Here is a direct video link.

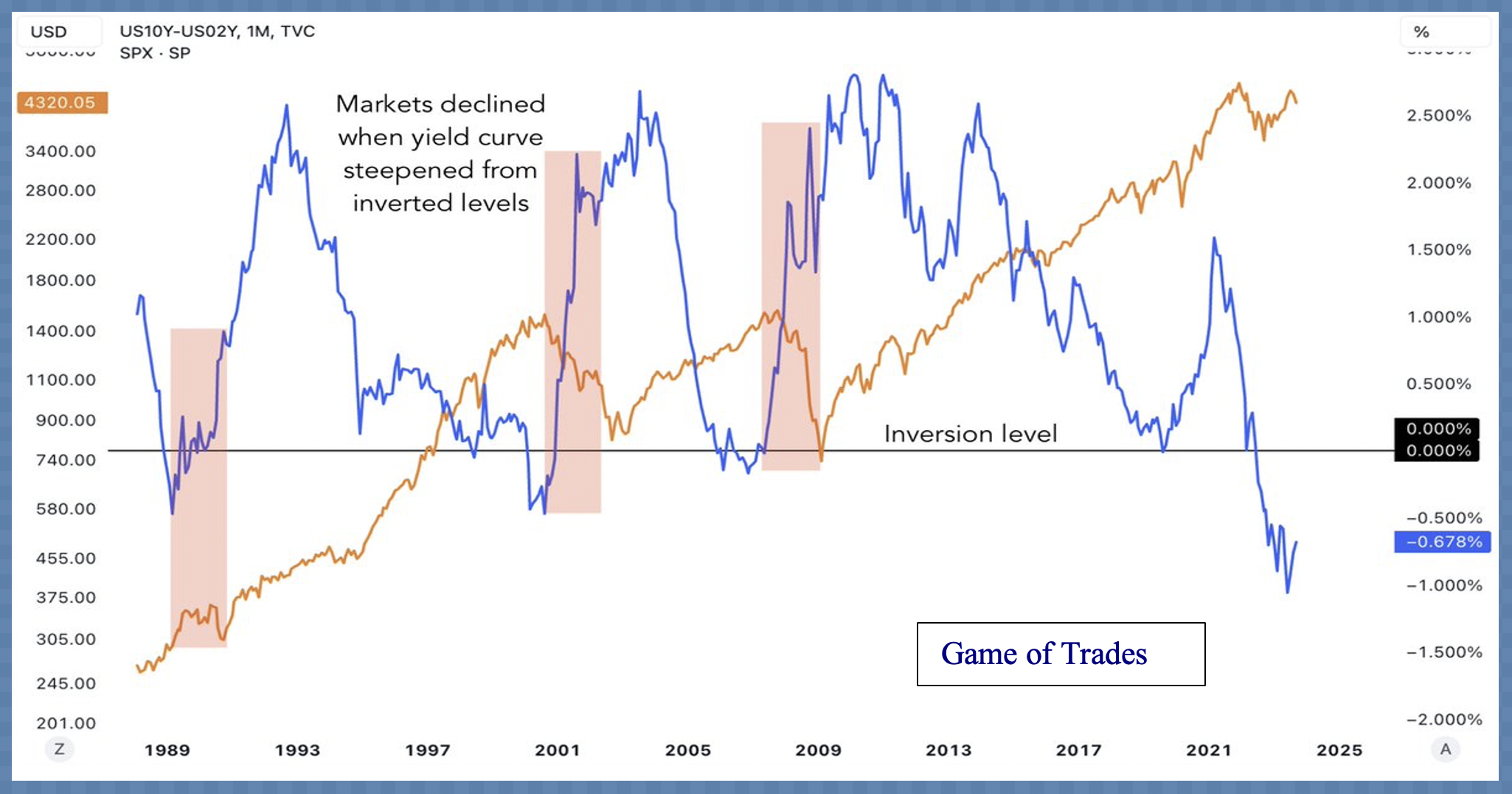

As shown below, since 1985 (courtesy of Game of Trades), a re-steepening yield curve has historically hammered stocks (S&P 500 in orange), especially when starting from above-average valuation periods, like in 2022, 2007 and 2000.