October 23, 2023 | Private Equity “Landlords” Endangered By Falling House Prices

Recessions are necessary to clear out malinvestment before it poisons the whole economy. But they also hurt a lot of people who don’t deserve it, so they’re not a cause for celebration.

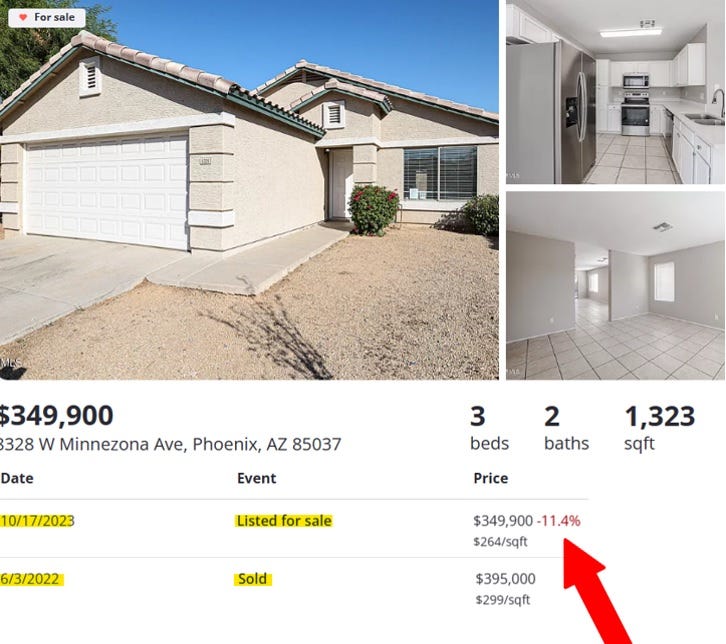

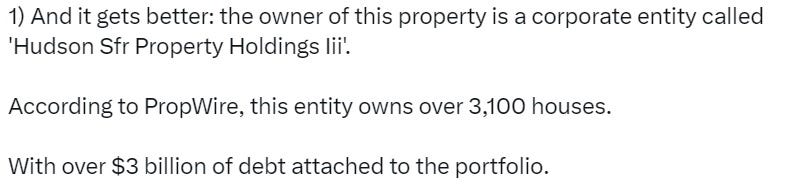

Except when the people being hurt are private equity firms like Blackstone that have been buying up houses (sometimes entire neighborhoods) at inflated prices and then converting them to rentals (also at inflated rates), making fortunes by squeezing would-be homeowners out of the market.

Real estate investor and syndicated podcaster Michael Douville just forwarded a Twitter thread that hints at trouble brewing for Wall Street’s predator/landlords. Some highlights follow, but the thread is much longer and worth reading in its entirety.

[end Twitter thread]

Just the beginning

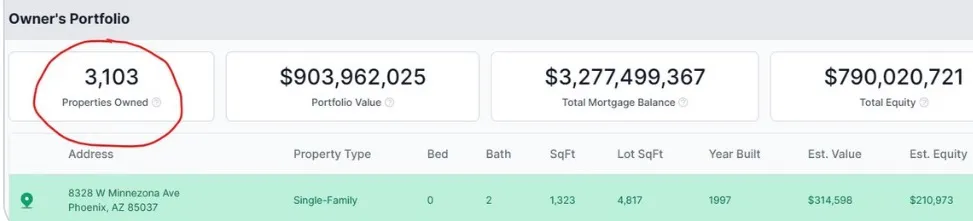

One house does not a stampede make, of course. But Wall Street has snarfed up over 1.2 million houses at prices higher than what will prevail in the coming year. And they did this with leverage, borrowing billions of dollars at (in retrospect) crazy-low interest rates. Now interest rates are up and house prices are falling, threatening a classic liquidity squeeze.

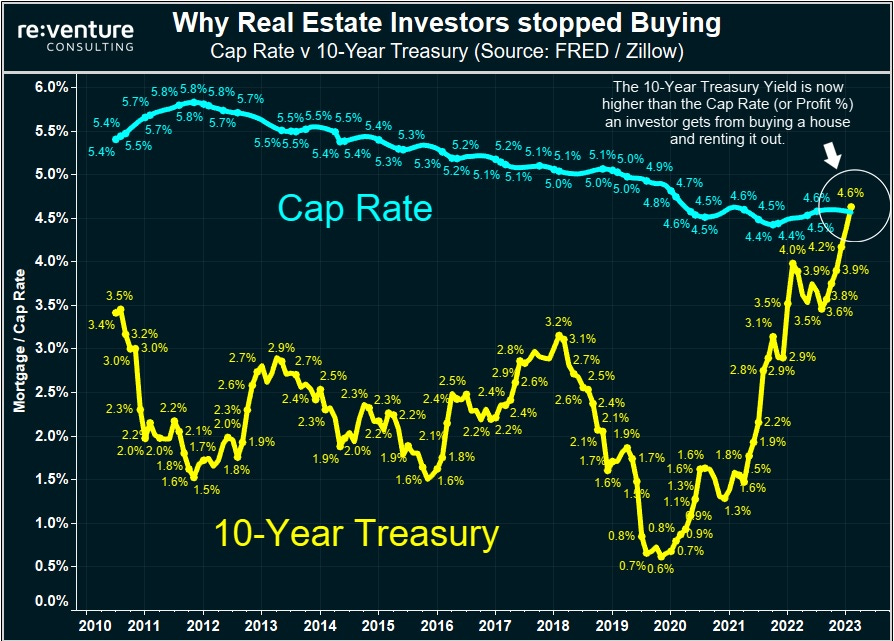

Here’s a chart illustrating the above point. In real estate, the “cap” rate is basically the return expected on an investment. Note how it used to be way higher than the yield on a 10-year Treasury bond, but now the two are pretty much equal. So why buy real estate when the same return is available with a risk-free bond?

Private equity landlords are about to be reminded that leverage works both ways, as refinancing their debt becomes prohibitively expensive while selling their houses will generate debilitating capital losses. Unless they get out before everyone else.

But getting out quick won’t be easy, what with Airbnb entrepreneurs learning the same leverage lesson and preparing to dump their illiquid assets ASAP. The resulting flood of new listings might convert the housing market from shortage to glut in the space of a year, with brutal consequences for overleveraged financial operators.

This is, in short, one of those times when a little schadenfreude is perfectly okay.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

John Rubino October 23rd, 2023

Posted In: John Rubino Substack