October 17, 2023 | Pandemic Buyers Struggling To Unload Properties

Leverage on leverage on leverage, who would have thought?

John Fincham, broker at Re/Max Parry Sound Muskoka Realty, joins BNN Bloomberg to discuss the Ontario cottage market. He says that many cottage owners who bought during the pandemic are now struggling to unload those properties. And as interest rates drive down prices he says cottages located on less popular lakes and listed under $1.5 million dollars could drop by 30% in value in 2024. Here is a direct video link.

Also see: Pandemic Buyers Struggling to Unload Cottages.

As for the fantasy that “rich” Torontoians are not affected by higher interest rates and falling property prices, wait for it: Mortgage defaults and forced home sales now starting to rise in Toronto.

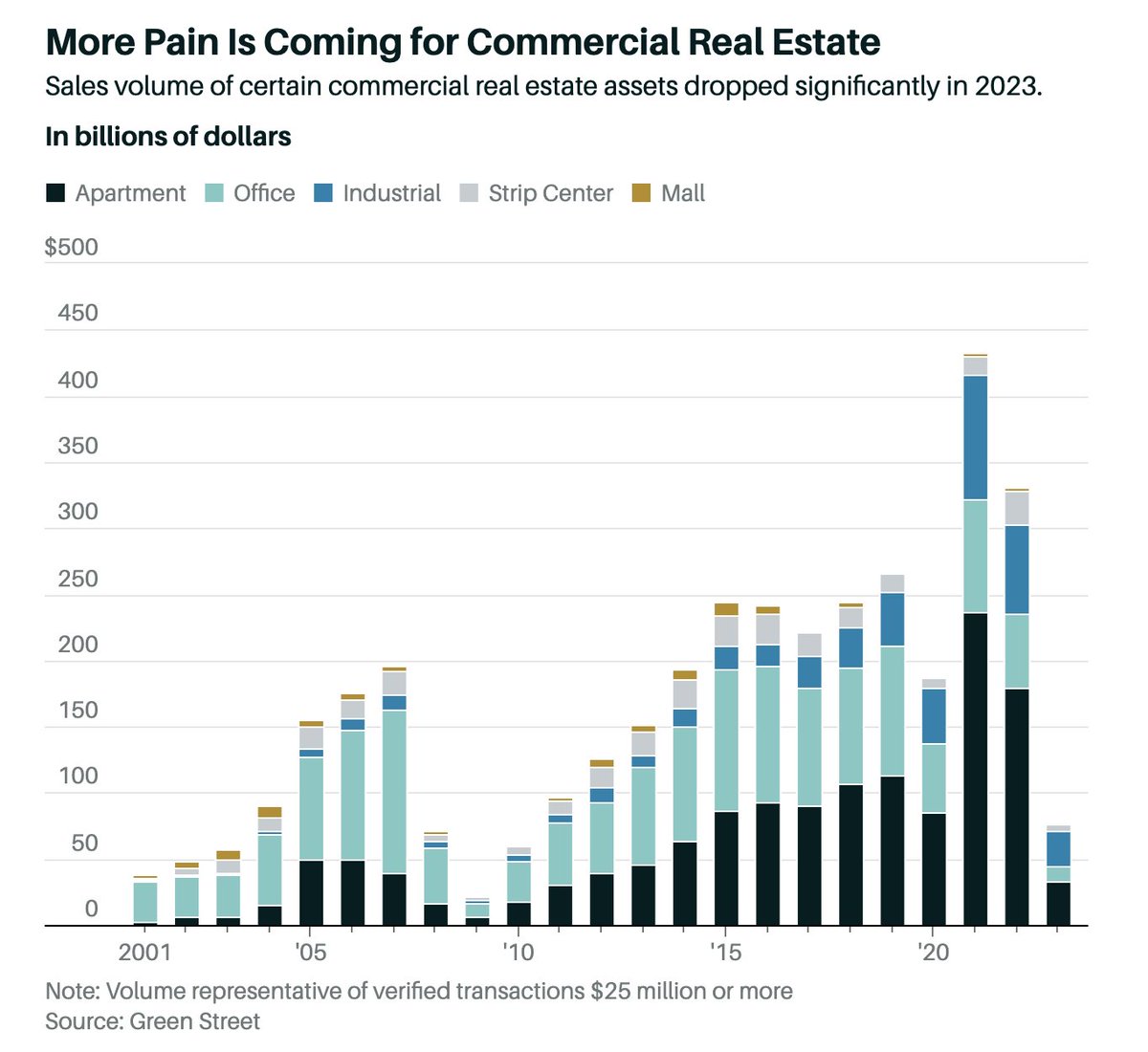

Meanwhile, commercial real estate sales volume (across all property types shown below since 2001) has fallen to the lowest level in 13 years.

And the downdraft is global; see Paris Commercial Property Deals Hit Lowest Levels in 13 years:

Property markets across Europe have ground to a halt as rising rates have increased financing costs and hit valuations. But owners are reluctant to lower their expectations after a decade of rising prices, creating wide divergence between prospective buyers and sellers.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Danielle Park October 17th, 2023

Posted In: Juggling Dynamite

Next: Good Time to Buy Gold? »