October 6, 2023 | A Collapse in Bank Lending is Ominous

A collapse in bank lending is damaging for the economy, as growing credit is the most important fuel of modern economic systems. Without an annual increase in debt outstanding, a recession becomes almost inevitable.

Will the current downturn in bank lending to commercial and industrial clients trigger a recession?

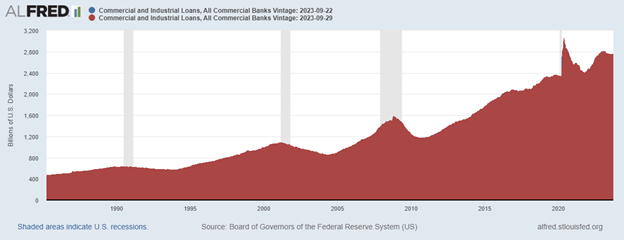

Commercial and industrial lending peaked in late 2022 in the U.S. and has been steadily declining since.

While it’s only a mild downturn (upper right corner of the graph), it is unusual for any decline for a long period outside of a recession.

This is especially true in an environment with some inflation, as the U.S. is experiencing this year. Inflation numbers have declined from a peak last year of 8 percent annually, but even at 4 percent it takes a 4 percent larger loan to buy the same goods or services on credit compared to a year ago.

There have been significant declines in lending during recessions as we see occurred in the 2000-2002 period, which followed the peak of the dotcom bubble. And during and following the Great Financial Crisis of 2008-09 there was a severe downturn in bank lending that lasted until about 2012, matching the period of decline in the housing market.

The other noticeable drop in bank lending is post-2020, when there was a huge spike in lending followed by a drop which brought the total loans outstanding back to the trend line by September 2021. This was just a complete unwind of the unusual activities of banks and governments during the panic over the impact of COVID-19 on business activity.

In a post on the popular blog site Substack the author of “Economics Uncovered” tackles this topic, opining that the decline in bank lending growth is the result of Fed tightening. Fed activity hurts bank lending in two ways —through Quantitative Tightening (QT) and higher interest rates.

The conclusion is that the Fed does not need to tighten any more or raise interest rates at the next meeting which is scheduled for November 1.

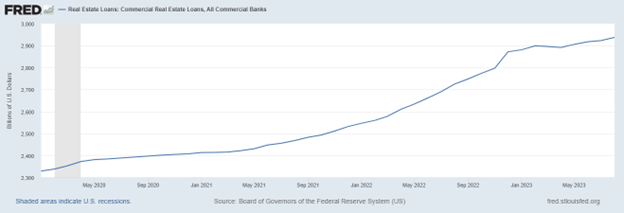

The one bright spot in business lending is commercial real estate, which is puzzling as the sector is already in the grips of a severe downturn.

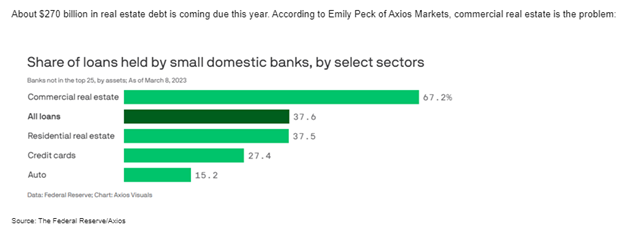

During the banking crisis in March 2023 the exposure of smaller banks to the commercial real estate sector was highlighted, when several regional banks failed, as about 2/3s of lending at those banks was for that sector, a riskier sector than traditional lending to businesses.

As I discussed in my note from March 31, 2023 Commercial real estate is the next domino to fall:

Smaller banks were pushed into the riskier commercial real estate sector just in time for a contraction to start.

Commercial real estate, especially in the sub-segment of office towers and shopping malls, is in serious trouble. The shakeout in that sector could be fatal for some smaller banks and more regional banks.

The fallout from a decline in bank lending will trigger a serious recession.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Hilliard MacBeth October 6th, 2023

Posted In: Hilliard's Weekend Notebook