September 16, 2023 | Trading Desk Notes For September 15, 2023

KING Dollar rises for NINE consecutive weeks

The USDX hit a 15-month low in mid-July but has rallied >5% since then. (I’ve called mid-July a Key Turn Date as several macro markets reversed course then.)

The USD looks attractive as the Eurozone and China/Asia are slowing. American “exceptionalism” draws capital.

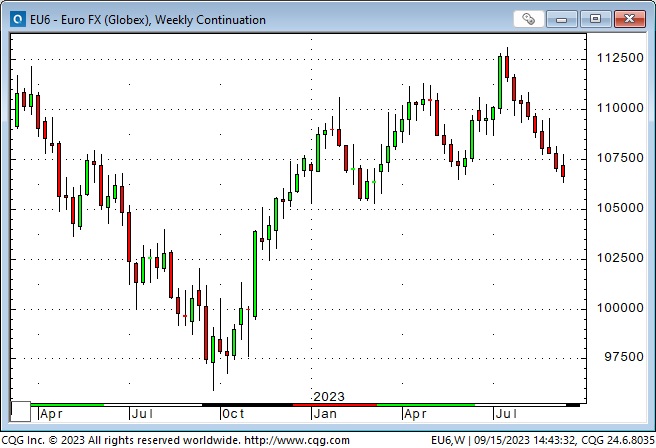

The Euro traded at a 17-month high in mid-July but has fallen ~6% since then, down for nine consecutive weeks. At Thursday’s meeting, the ECB raised short-term rates by 25BPS, but the Euro fell >100 pips following the raise.

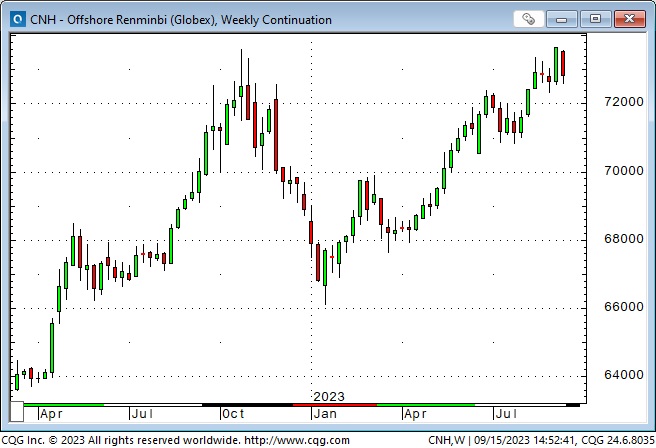

The Chinese RMB fell to 16-year lows against the USD last week but recovered a bit this week as the authorities took action to defend the currency. (On this chart, rising prices mean it takes more RMB to buy a US Dollar.)

The Japanese Yen traded as much as 90 pips higher than last week’s close on Monday following remarks by the new BoJ chief that were construed as a hint that yield curve control may soon be history. Those gains were given back as the week progressed, and the Yen closed at an 11-month low. Gold traded at an All-Time High against the Yen this week.

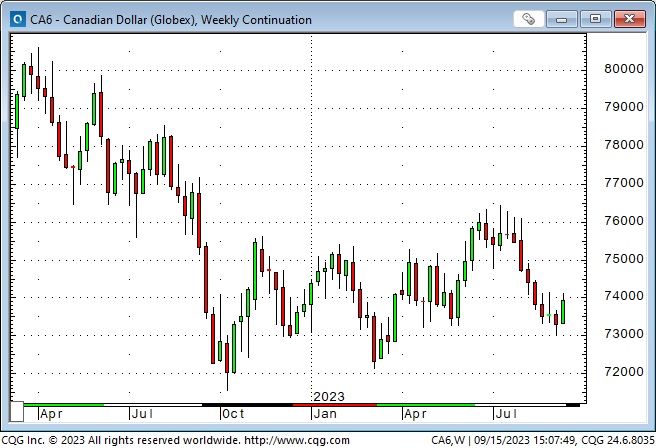

The Canadian Dollar had fallen for 7 of the past eight weeks at last week’s close but reversed course this week to close at the best levels in 5 weeks.

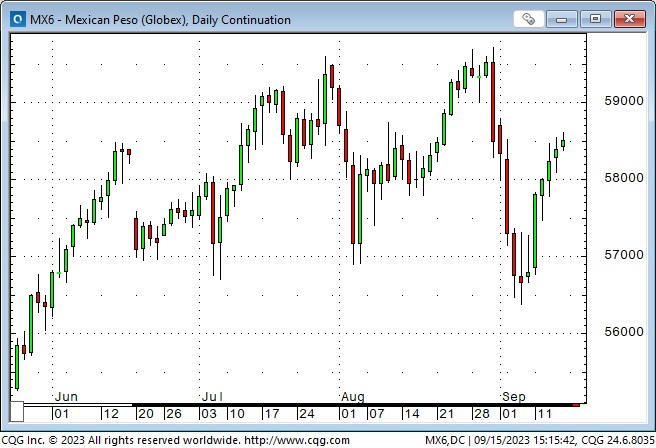

The Mexican Peso has been the strongest currency in the world for most of the past 15 months, but it fell sharply from multi-year highs at the end of August when the Banco de Mexico announced the end of their currency hedging program. The Peso recovered ~65% of those losses by the end of this week.

The Peso was the world’s strongest currency (post-pandemic) because 1) short-term Mexican interest rates have been more than double short-term American rates, 2) the “world” anticipated businesses leaving China and going to Mexico as “friend-shoring” gained popularity, which meant 3) the Mexican stock market boomed. The Peso has also been recovering from losing ~60% of its value between 2008 and 2020.

This chart of the Aussie Dollar (exporting to China) relative to the Mexican Peso (exporting to the USA) is another way of expressing American “exceptionalism.”

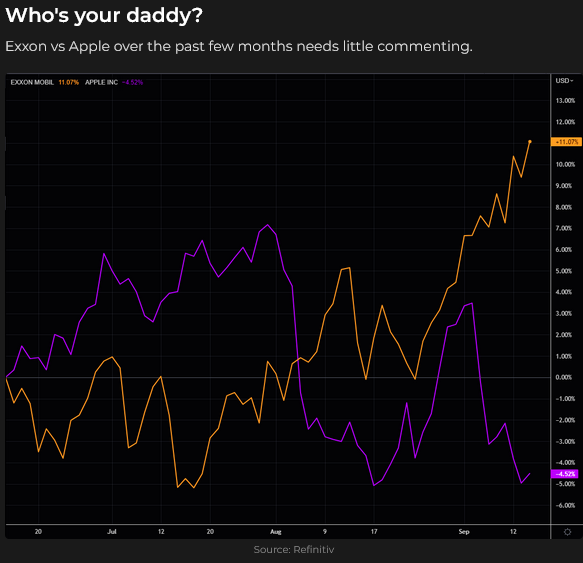

Energy

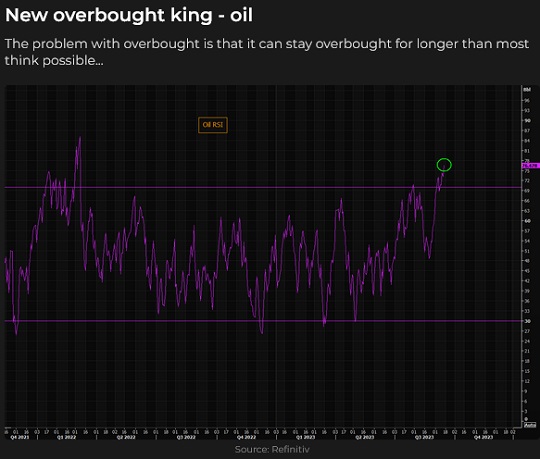

WTI crude oil futures traded above $91 on Friday for the first time in 11 months, up ~35% since the end of June.

US domestic crude oil production is ~12.9 mbd, the highest of any country. Higher gasoline prices were a key component of this week’s higher-than-expected retail sales report. Higher energy prices are also a key component of higher inflation.

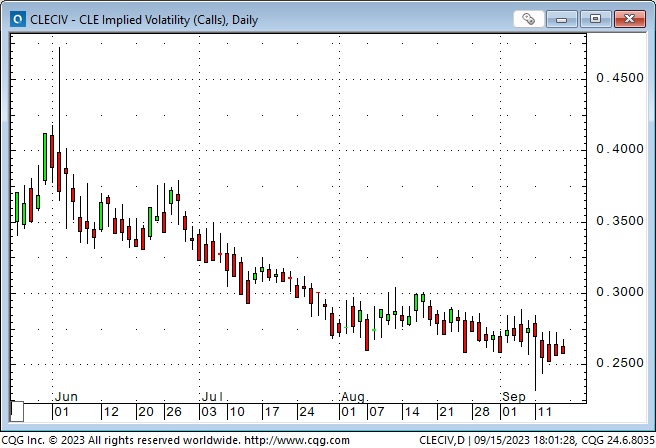

WTI option volatility has been trending lower over the past few months as crude prices have been rallying in an “orderly” fashion.

Uranium prices have been rising all summer, and (spot yellow cake) hit a 12-year high this week. Cameco shares are up ~50% since the end of May.

Equities

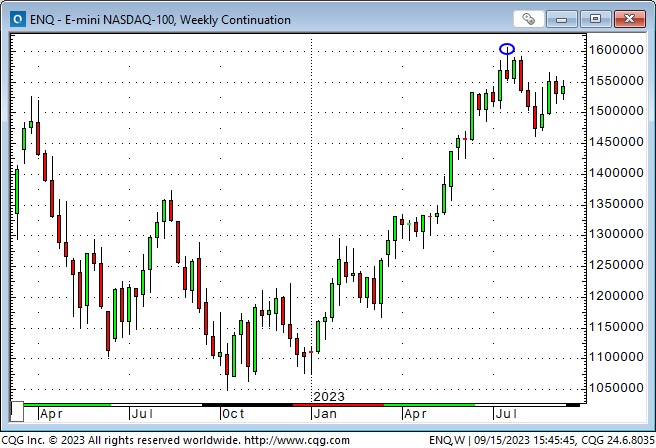

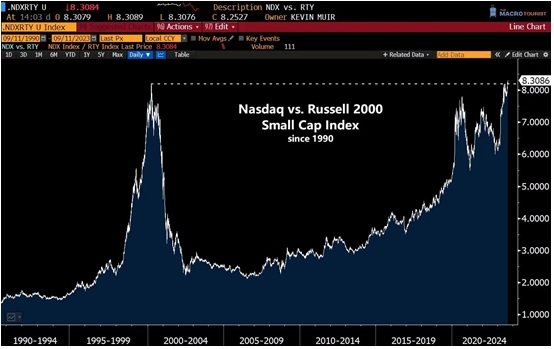

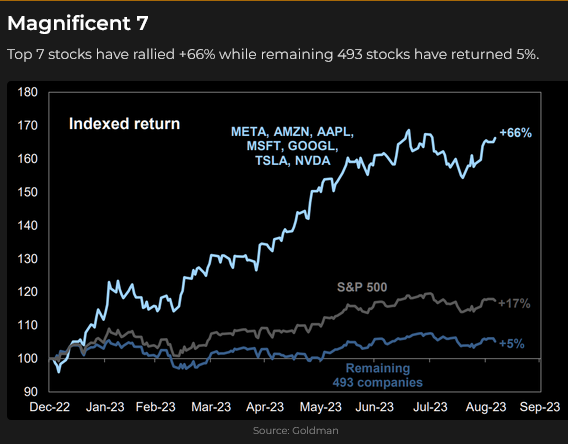

The NAZ rallied >50% from last October’s lows to the Key Turn Date in mid-July. In previous Notes, I’ve called the “blow-off top” in MSFT on July 17 the “defining moment” of the topping action in the Nasdaq.

The other leading stock market indices (without the heavy tech weighting of the Nasdaq) topped out a week or two later, but all traded lower in early August, bounced in late August and have had choppy/sideways price action in September. Corporate share buyback programs will enter their “blackout” period ahead of quarterly reports this coming week.

Investors inclined to believe that a recession is coming (or already unfolding) may see the Dow Jones Transport Average as supporting evidence.

Interest rates

Economic reports were mixed this week, but price action in the interest rate markets supports the view that the economy is stronger than expected and inflation (and interest rates) will stay higher for longer.

Investors inclined to believe that a recession is coming (or already unfolding) may see 10-year T-Note yields around 4.3% as a buy. Investors who expect the economy to remain strong, inflation to remain above target, and the government to maintain deficit spending may avoid buying bonds or may short bonds.

Gold

Gold is another market that reversed on the mid-July Key Turn Date. Rising interest rates (nominal, but especially real) and a rising USD are typically a toxic environment for gold – but gold popped higher on Friday, even as the USD and interest rates rose – an unusual positive correlation. Perhaps it was “follow-through” buying from Thursday’s rally off 1-month lows when gold rallied despite the USD surging against the Euro. (If a market rallies on “bad” news, it’s a strong market!) Perhaps the gold market is sensing that Central Banks are “pretty much done” with raising rates and will, in effect, be willing to live with inflation above their former target levels.

My short-term trading

I bought the Japanese Yen on Sunday afternoon when it gapped higher from Friday’s close, anticipating that there could be a significant rally if the Yen had any follow-through (as news spread about a possible sea-change in BOJ policy. There was no follow-through, as the market saw no significant policy change, and the Yen fell. I covered my position on Monday for a slight loss.

That was the only trade I made this week, and I’m flat going into the weekend.

I was away from my desk Tuesday and Wednesday visiting old friends on Mayne Island, and I will be in Vancouver on Saturday and Sunday to play golf with my son and two old friends at my favourite Vancouver golf course – Kings Links – Click the link to get a look at this beautiful links-style course.

I’m writing these Notes on Friday evening – and they will be shorter than usual because I’m leaving home early tomorrow morning to play golf. Two weeks ago, following Jimmy Buffett’s death, I decided to stop “putting off” visiting old friends – and I’m going to stick with that decision!

On my radar

The FOMC meets this coming Wednesday – no change in interest rates is expected, but the market is currently pricing ~45% chance that the Fed will raise rates by 25 bps in either November or December – and that will be the last of it!

The UAW strikes started today, and the two sides appear far apart in negotiations. I see this as another example of people trying to “catch up” with rising prices, and I think there will be much more of this (by workers and by businesses), and that will keep inflation “higher for longer.”

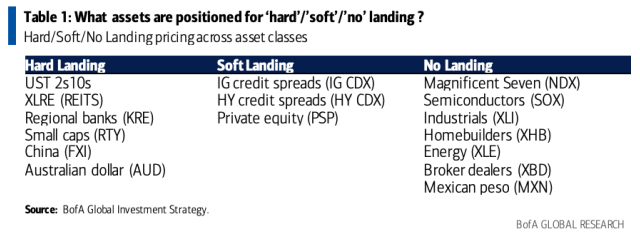

Concerning “what should I buy/sell” regarding the “recession,” here is a thought-provoking Bank of America research chart. I believe that items listed under “Hard Landing” are currently priced for a severe recession, whereas those listed under “No Landing” are priced for no recession. I don’t know if a recession is coming, but seeing how BoA believes the market is positioned is interesting.

The Barney report

Barney loves to hang out with me in my office, but sometimes, he gives up waiting for me to take him for a walk and falls asleep.

Listen to Victor talk markets with Mike Campbell

I will be on Mike Campbell’s Moneytalks podcast on Saturday morning. We will talk about currencies, interest rates and the stock market. Mike’s feature guest this week is Josef Schachter, who will discuss what he sees ahead for oil and gas prices and what impact that will have on energy shares. I will attend Josef’s annual energy conference in Calgary on October 14. You can listen to the podcast here.

The Archive

Readers can access weekly Trading Desk Notes going back six years by clicking the Good Old Stuff-Archive button on the right side of this page.

Headsupguys

I support Headsupguys because I’ve had friends who took their own lives, and Headsupguys helps men deal with depression. If you have a struggling friend, check out Headsupguys and talk with him.

Active listening requires practice, but it can reduce feelings of pressure and judgment to support someone’s mental health.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new – usually 4 to 6 times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Victor Adair September 16th, 2023

Posted In: Victor Adair Blog

As an 88year yoing survivor of the F8u Crusader nam era carrier pilot.. Visit your buddies as it may be the last time you see them..Barey has the right idea, “what me worry” You cannot take it with you so why worry about it??