September 15, 2023 | The Most Splendid Housing Bubbles in Canada: Price Drops Spread amid Slowing Sales, Rising Supply, Bank of Canada Tightening

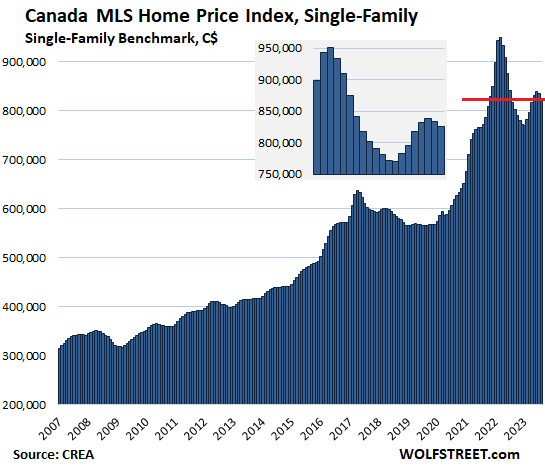

The Canada Home Price Benchmark Index for single family houses fell by 1.1% in August from July, after having already fallen by 0.5% in July, to $825,700 (all prices in Canadian dollars), ending a rambunctious spring selling season that had been further fueled by Bank of Canada rate-cut hopes, which then turned into two additional rate hikes so far.

From the peak in March 2022, the benchmark price has dropped by 13.1%, or by $124,900, according to data from the Canadian Real Estate Association (CREA) today. Year-over-year, given the stunning price plunge last year that forms the base for this year, the benchmark price ticked up 1.0%.

But not all markets are the same. In the Greater Toronto Area, prices dropped more sharply, and were down 14% from the peak in February 2022, while prices in Calgary rose to a new record. More in a moment.

Sales dropped, supply rose. Home sales fell 4.1% in August from July. New listings rose 0.8%. Since March, new listings have surged by 25%. Active listings increased by 1.9% in August, the third month in a row of increases. Supply rose to 3.4 months, double the level of the pandemic low.

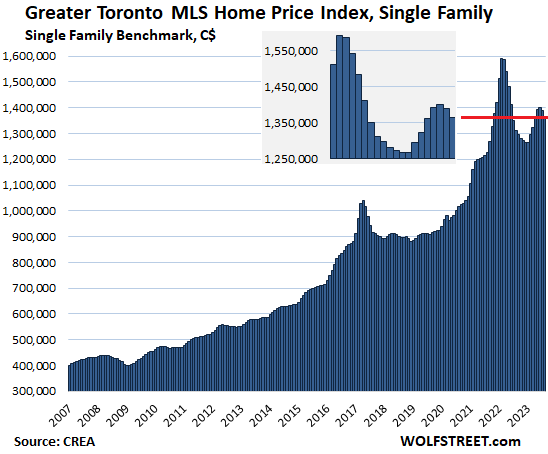

Greater Toronto Area (GTA): The MLS Home Price Benchmark Index for single-family houses fell by 1.7% in August, after having fallen by 0.8% in July from June, to $1.365 million.

From peak in February 2022, the index is down 14.2% or -$225,800. Given the massive plunges last year in the June-August time frame, which form the base for the year-over-year comparison, and the effects of the rambunctious spring selling season, the benchmark price was up 4.1% compared to August last year:

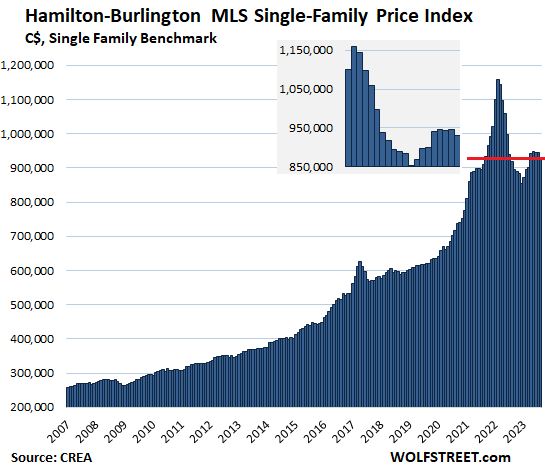

In the Hamilton-Burlington metro, which is part of the “Greater Toronto and Hamilton Area” (GTHA), the single-family benchmark price fell by 1.6% in August from July, to $930,300, after having been essentially flat in the prior four months.

From peak in February 2022, the price has dropped by 19.8%, or by $228,900. Given the stunning plunge last year at this time that had followed the stunning spike, the price in August was up 1.3% year-over-year.

These kinds of free-money-spike-and-plunge charts would be hilarious, like something you’d see in a satirical magazine, if they weren’t so serious.

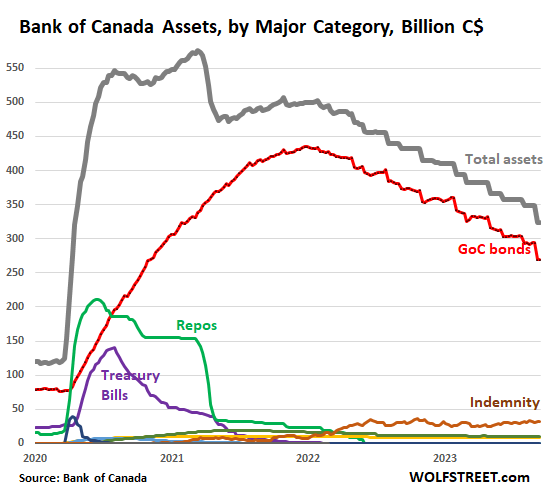

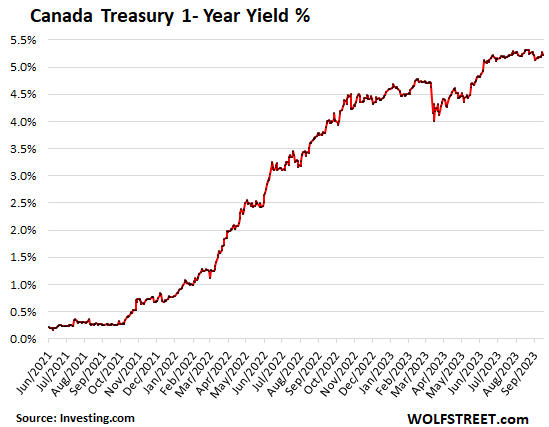

The Bank of Canada has tightened policy with a rate hike in June and another in July, to 5.0%, after announcing in January that it would “pause” its rate hikes at 4.5%, which had ushered in dreams of rate cuts, the result of which was a drop in short-term interest rates, with the 1-year Treasury yield dropping 75 basis points, from 4.75% in January to 4.0% in mid-March, the result of which was the rambunctious spring selling season.

At its September meeting, amid re-accelerating inflation, the BoC paused its rate hikes at 5.0% with a bias to tighten further.

QT would continue, the BoC also said. It has already shed 55% of its $455 billion in QE assets that it had added during the pandemic, including 46% of its Government of Canada (GoC) bonds and all of its repos and short-term Treasury bills. There is still aways to go to get rid of the crazy liquidity thrown at the markets during the pandemic, but the BoC has made quite a bit of progress so far:

Canada’s housing market reacts to shorter-term interest rates, in addition to other factors, such as hype and hoopla. It’s shorter-term rates that move the Canadian market because of the types of mortgages used. Lending typically is via variable-rate mortgages, whose rates are changed based on shorter-term interest rates; or via fixed-rate mortgages with rates that are fixed only for short periods, such as five years (for details, see our Introduction to Canadian Mortgages and Mortgage Insurance).

Today, the 1-year yield is at 5.22%, and it has been in this range since early July, up from 4.0% in mid-March; it’s that sudden drop to 4.0% in March that triggered the spring frenzy.

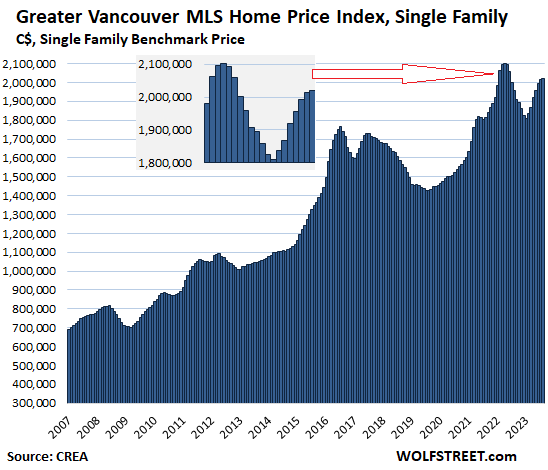

Greater Vancouver: The MLS Home Price Benchmark Price for single-family houses inched up by 0.3% in August, to $2.02 million:

- From peak in April 2022: -3.9% or -$81,600

- Year-over-year: +3.2%

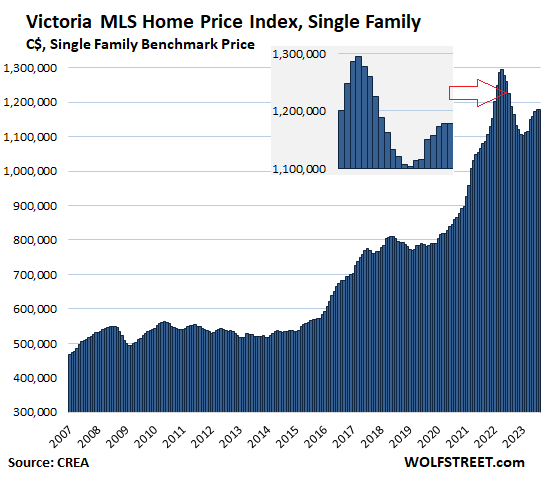

Victoria: The single-family benchmark price was unchanged in August, at $1.178 million:

- From peak in April 2022: -9.0% or -$116,000

- Year-over-year: -0.8%

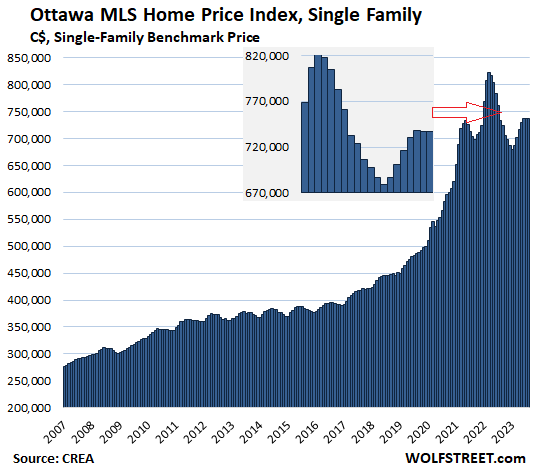

Ottawa: The benchmark price of single-family houses edged down just a hair in August, after dipping 0.1% in July, to $736,900:

- From peak in March 2022: -10.5% or -$86,300

- Year-over-year: +0.6%.

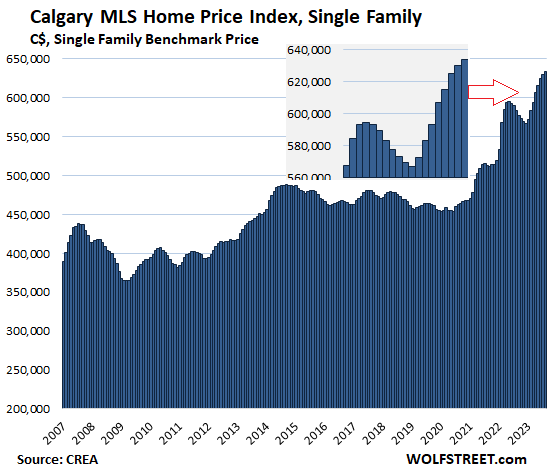

Calgary: The single-family benchmark price rose 0.7% for the month, and by 8.7% year-over-year, to a new record of $634,000:

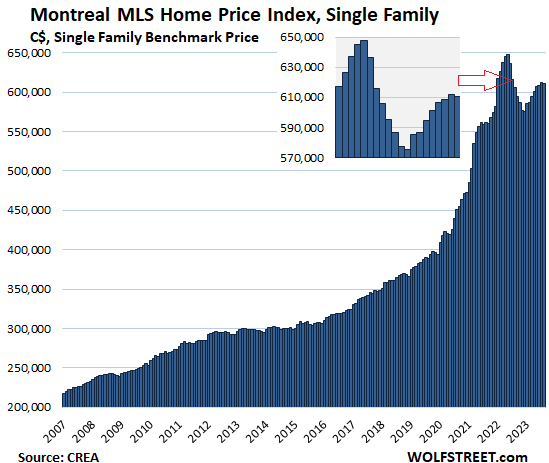

Montreal: The single-family benchmark price dipped by 0.2% for the month to $610,800:

- From peak in May 2022: -5.7% or -$36,800

- Year-over-year: +0.8%

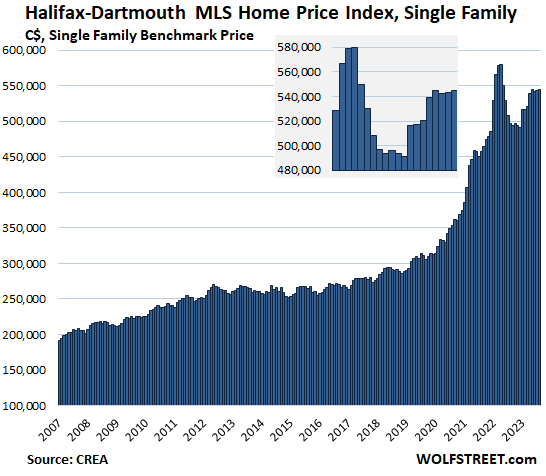

Halifax-Dartmouth: The single-family benchmark price inched up by 0.2%, to $544,600, having been essentially flat for four months:

- From peak in April 2022: -6.0% or -$34,900

- Year-over-year: +9.6%.

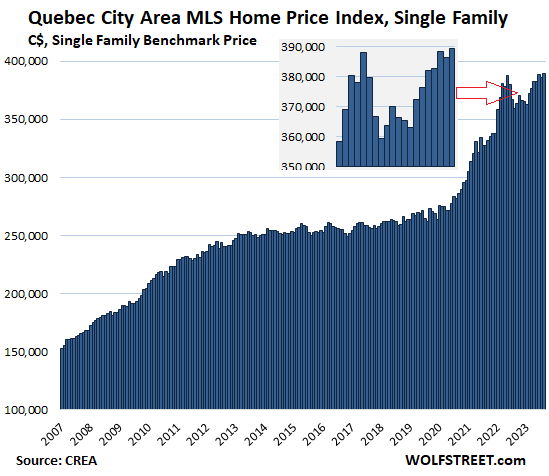

Quebec City Area: The single-family benchmark price rose 0.8% to eke out a record of $389,300, and was up by 8.3% year-over-year:

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Wolf Richter September 15th, 2023

Posted In: Wolf Street