September 24, 2023 | One Last Turn of the Screw, then REAL Pain

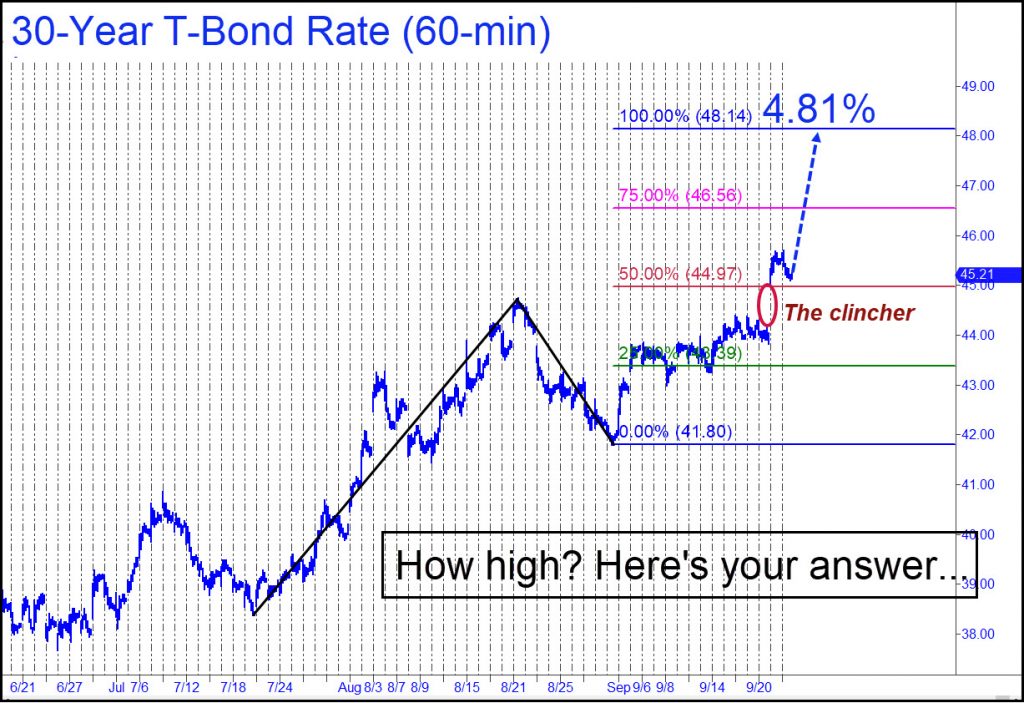

The bullish gap on the chart holds ominous implications for the global economy, since it removes almost all doubt that interest rates on U.S. Treasury Bonds are headed significantly higher. The rally looks nearly certain to reach 4.81%, the target of the pattern shown. The red line through which the gap occurred last Thursday is a ‘Hidden Pivot midpoint resistance,’ and it is where we look to get a firm handle on trend strength. When it is penetrated as easily and decisively as it was last week, this almost invariably results in a continuation of the trend to the target, in this case a 48.14 level that corresponds to a 4.81% rate. A tradeable corollary is that a swoon to the green line would be merely corrective, and that bond bears, far from being scared out of their positions, could double down on their bets with confidence. The equivalent rate for the Ten-Year Note would be 4.68%.

Historical Downturn

You should jot those numbers down, since they will allow you to tune out the din of pundits and economists arguing about how high rates are likely to go. With the economies of China and Europe already sinking into recession, and the U.S. about to do so when the inevitable bear market in stocks gets rolling, another turn of the interest-rate screw threatens a downturn that will be one for the history books. It will feature above all a strengthening dollar that will not only catch economist and policymakers by surprise, but also crush everyone who owes dollars. A ruinous debt deflation is coming, and it will make us nostalgic for the pesky consumer inflation that has ruled our economic lives since the wildly reckless credit-stimulus of the Covid years.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Rick Ackerman September 24th, 2023

Posted In: Rick's Picks