In a September 8th update entitled, Indicators of Financial Vulnerabilities, the Bank of Canada (BOC) notes that in Q1 2023, so-called investors owned 30 percent of mortgaged homes in Canada, up from 20 percent before the pandemic. See, Investors took a bigger chunk of the housing market during the pandemic, data shows.

In the first quarter of 2023, investors owned 40 percent of Canada’s condo market, and most were highly leveraged with a negative cost of carry. During the pandemic, buyers were most likely to leverage existing homes to get downpayments for additional properties—debt on debt on debt.

As explained in the Bank’s 2022 Financial System Review, the presence of leveraged investors tends to amplify price cycles up and then down:

During housing booms, greater demand from investors can add to bidding pressures and intensify price increases. Similarly, when prices are stable or declining, a lower influx of investors can add downward pressure on housing demand and prices.

In January 2023, 30 percent of Canadian mortgages were variable rate, where interest costs have risen in lockstep with central Bank tightening, and fixed rate loans are coming up for game-changing renewals every month.

Many realize they have taken on too much debt and must sell assets.

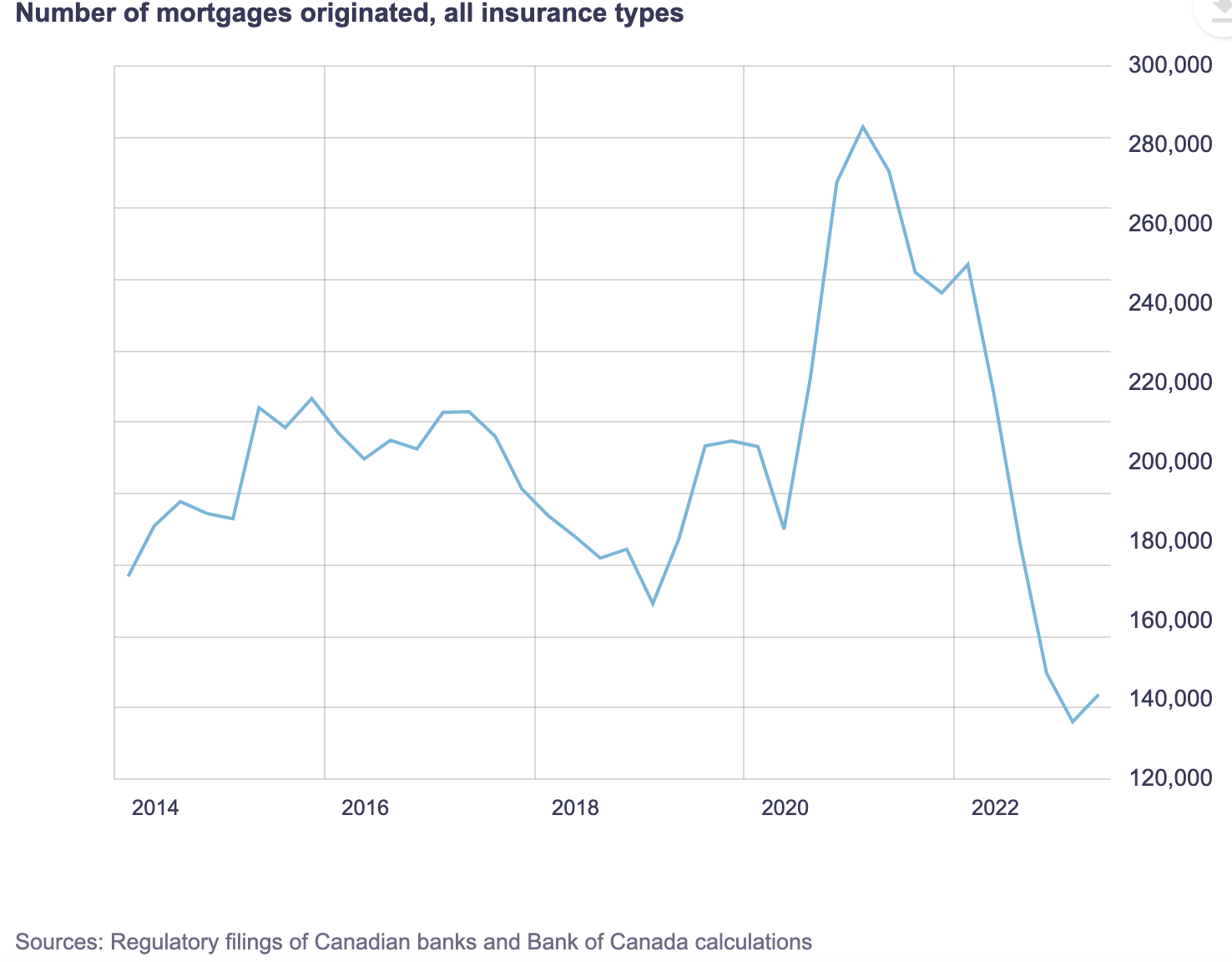

At the same time, a shrinking number of buyers can qualify for financing at current rates and prices. The number of Canadian mortgages originated in 2023 is the lowest in over a decade (BOC chart below since 2013). Makes mathematical sense. Rising unemployment will dent demand further.