August 22, 2023 | Wage Inflation Is a Thing Now, Part 1

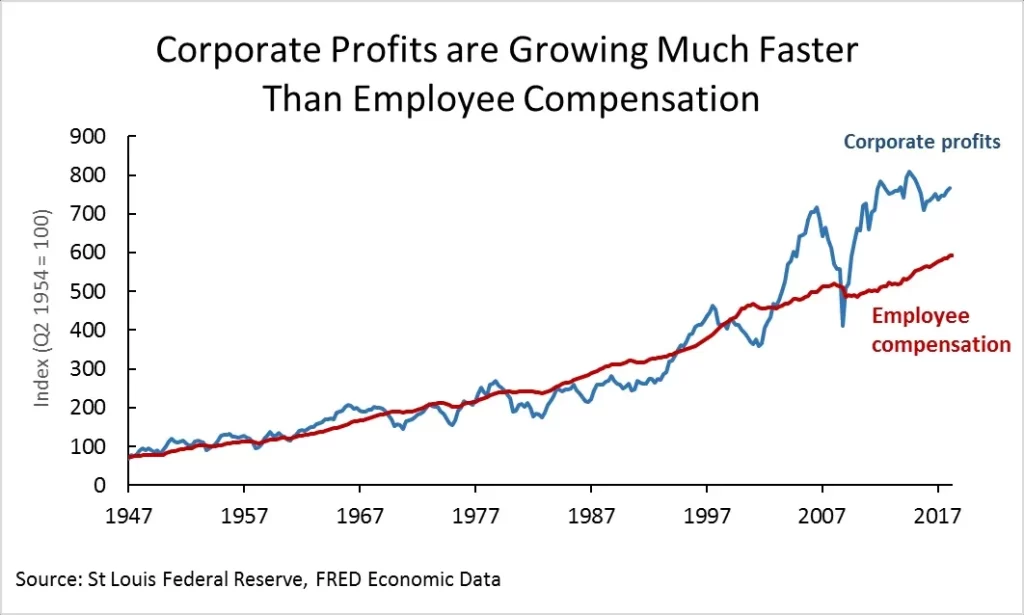

Back when the US was a functional country, wages and corporate profits rose more or less in tandem. That is, each group tried to steal all the money but in the end had to compromise and settle for only half. It was contentious but manageable, and it allowed a broad, stable middle class to emerge, possibly for the first time in human history.

Then in the 1980s, someone had a bright idea called “globalization” in which employers were encouraged to move their factories to China, cut their labor costs by 90%, and pay their CEOs massive bonuses. Unionized American workers who once made middle-class incomes were cut loose and found nothing awaiting them but Walmart and Mcdonald’s. Corporate profits and wages decoupled, with the former soaring while the latter stagnated. Here’s a chart the Fed put together in 2018, just as globalization was peaking:

This kind of widening inequality is a recipe for either a modern French Revolution in which the peasants decapitate the aristocrats or a 1984-style techno-capitalist dictatorship. Either way, very unpleasant.

But just before stepping off that cliff, we seem to have stopped and reconsidered. Factories are being brought back home, workers are regaining some bargaining power, and wages are rising. Two recent examples from the airline industry:

United Airlines, pilots’ union reach deal to raise pay by up to 40%

United Airlines and the union representing its pilots said Saturday they reached agreement on a contract that will raise pilot pay by up to 40% over four years.

The union valued the agreement at about $10 billion. It followed more than four years of tumultuous bargaining that included picketing and talk of a strike vote.

Once the deal is approved, pilots will get immediate wage-rate increases of 13.8% to 18.7%, depending on the type of plane they fly, followed by four smaller annual raises, according to a summary on the union’s website.

Over the course of the contract, pilot pay would rise 34.5% to 40.2%.

American Airlines pilots approve sweetened labor deal with big raises

American Airlines pilots approved a sweetened labor deal, making the carrier the second major U.S. airline to seal a new contract with its highest-paid work group.

The more than 15,000 pilots at American will get immediate raises of 21% with compensation increasing more than 46% over the duration of the four-year contract, including 401(k) contributions, their union said Monday.

Pilots are obviously a privileged group. They can’t be replaced by Chinese or Mexican factory workers and they can devastate their employers by striking. So it makes sense that they’re among the first to win multi-year, double-digit increases. But they’re not the last. From CNBC:

American workers are demanding almost $80,000 a year to take a new job

The amount of money most workers want now to accept a job reached a record high this year, a sign that inflation is alive and well at least in the labor market.

According to the latest New York Federal Reserve employment survey released Monday, the average “reservation wage,” or the minimum acceptable salary offer to switch jobs, rose to $78,645 during the second quarter of 2023.

That’s an increase of about 8% from just a year ago and is the highest level ever in a data series that goes back to the beginning of 2014. Over the past three years, which entails the Covid-19 pandemic era, the level has risen more than 22%.

Employers have been trying to keep pace with the wage demands, pushing the average full-time offer up to $69,475, a 14% surge in the past year. The actual expected annual salary rose to $67,416, a gain of more than $7,000 from a year ago and also a new high.

Now, here’s the problem

It’s great to see workers catching up after three decades of abuse. Here’s hoping globalization is dead and gone, on-shoring is a trend with legs, and private sector unions re-emerge as a counter-balance to corporate hubris.

BUT this change is coming after a three-decade debt orgy that has spread financial fragility across the economy. And while the Fed is blind to inflation in stocks, bonds, and real estate, it recognizes and fears “wage inflation.” So widespread 10% wage bumps will set off all kinds of warning bells, leading the Fed to keep raising interest rates to disastrous levels for banks, insurance companies, pension funds, and everything related to real estate.

So this very good thing — rising wages — might make the next (imminent) bust even worse than it would have been.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

John Rubino August 22nd, 2023

Posted In: John Rubino Substack