Canada’s housing bubble is crystal clear unless you are paid not to see it (wilfully blind) or painfully naive.

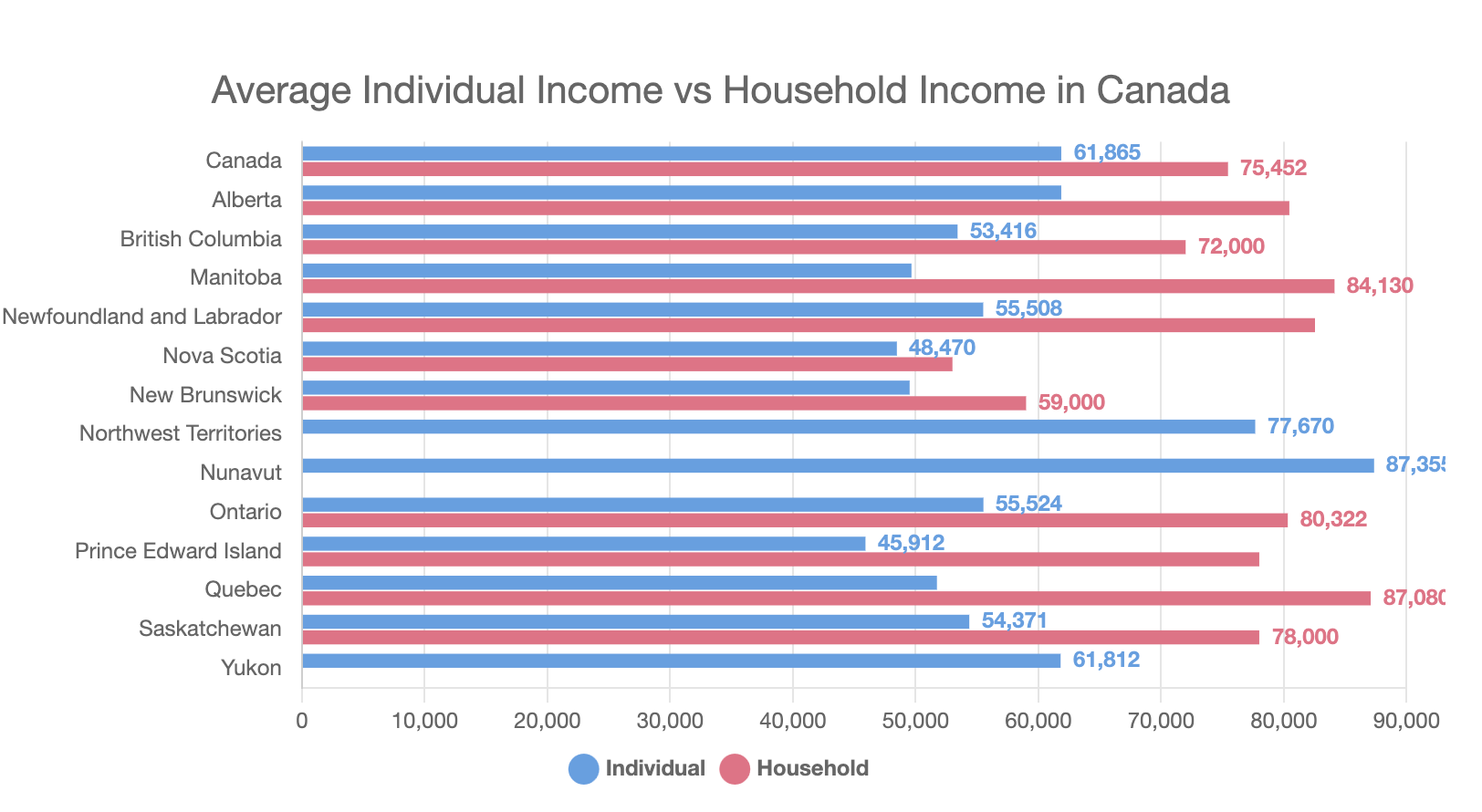

The average national home price of 754K in July is ten times the average household income of $75k. The historically recognized affordability ratio has been home prices that are 3 to 4 times household income; this ratio allows people to pay off their shelter within 25 years and still have some cash flow available for other spending and saving needs. In provinces like Ontario and BC, where the average household income is higher, the average home price is likewise, so affordability is worse. See the table below and more here.

Some seventy-seven percent of Canadian homeowners have a mortgage, and seventy percent were taken out in the last few years with terms coming up for renewal in the next 1 to 5 years. It requires a household income of about $180k (with no other debt) to qualify for a mortgage to purchase or refinance the average Canadian home today. Ninety percent of Canadian households have incomes less than the required 180k.

Historical precedents have ended in multi-year busts where prices tumble greater than 20 percent nationally and more in the most inflated areas.

Lenders, investors and homeowners take losses, bankruptcies spike, and those who are ready buy real estate and related securities at the best valuations in decades from desperate sellers who had leveraged up when prices were high.

It’s important to understand that interest rates do not need to go higher for housing prices to keep falling. The extremity of pricing and leverage in the system has already cast the corrective die. Like driving 200 miles per hour, any wobble or unexpected development is enough to trigger wipeouts.

From a 52-year low last summer of 4.9%, Canada’s official unemployment rate has risen to 5.5% compared with the long-term average unemployment rate of 8%. Job loss will increase over the next year and possibly beyond. The good news is that unaffordable prices are the cure for unaffordable prices. It’s not a question of if, just how long it takes.

Analyst Phillip Colmar delivers wildly unpopular facts well in the segment below. Hate mail is sure to follow.

MRB Partners’ Phillip Colmar explains why he thinks Canada’s real estate market is in a huge housing bubble and what key factors could cause it to pop. Here is a direct video link.

Low interest rates do not make housing affordable. When interest rates are low, the principle goes high, negating the effect of the low interest rates. The limiting factor for house prices is the monthly payment. With interest rates low and the principle high, the monthly payment remains the same. Other expenses can actually increase because of the low interest rates. Insurance and taxes go up markedly because of the high principle.