August 28, 2023 | Tug of War

Happy Monday morning!

This newsletter has been covering three big themes in the Canadian housing sector this year. In no particular order they are as follows, excessive immigration exacerbating a housing crisis, higher mortgage rates ironically trapping people in their homes, and the destruction of new housing supply brought forth by a trippling of interest rates and an economic downturn. We recieved important updates to all three big themes this week. Let’s discuss.

After a barrage of outspoken economists, and a plethora of media attention, the immigration file is finally getting some attention in Ottawa.

“The international student program has seen such growth in such concentrated areas that it is really starting to put an unprecedented level of demand, in some instances on the job market, but given the economic conditions we’ve been living with for the past couple of years, you see it in a more pronounced way in the housing market,” said immigration minister turned housng minister, Sean Fraser.

When asked about putting a cap on such enrolments, Fraser said it’s one of the options the feds are willing to consider — albeit not at this stage in the game.

“I think we should start by trying to partner with institutions to understand what role they may play to reduce the pressure on the communities that they’re operating within,” he said. “We’ll have more to say after I’ve had the chance to engage with Minister Miller.”

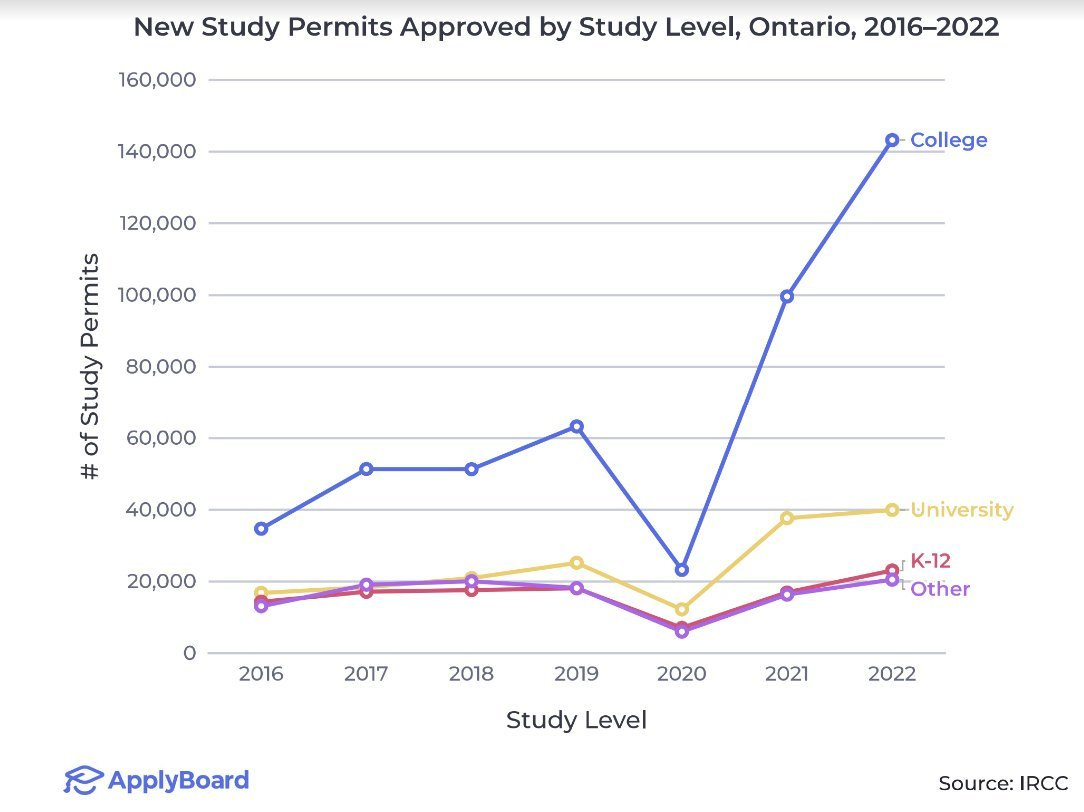

The Ontario international student boom in a single chart.

According to Mike Moffatt, who was invited as an expert witness to the PEI housing retreat, suggests this is largely a result of the Liberal government amending the student visa program into a temporary foreign worker one. If the federal government simply rolled back these reforms, and returned to the rules of, say, 2016 or so, it would drastically cut back the use of international students as defacto temporary foreign workers, and cut down the demand for permits.

Will anything change? Don’t hold your breath.

Switching gears to big theme number two.

Mortgage broker Rob Campbell sums it up nicely. With an 8% mortgage stress test a lot of people today wouldn’t even qualify for their existing home, so they definitely won’t be upsizing anytime soon. In other words, people are stuck in their homes, whether they like it or not. We’ve been stuck with some of the lowest numbers of new listings in two decades, freezing the housing market and robbing it of price discovery.

Let’s not forget all the borrowers who were blindsided by the BoC. Stuck in a variable rate and deferring the pain, amortizations are blowing out. However, if you stay put, shut your mouth, and keep paying your mortgage the banks will mostly leave you alone. Recent Q3 earnings from TD and RBC highlight the magnitude of the problem.

Nearly 23% of TD & RBC’s mortgage book has amortizations longer than 35 years. That number was basically zero last year.

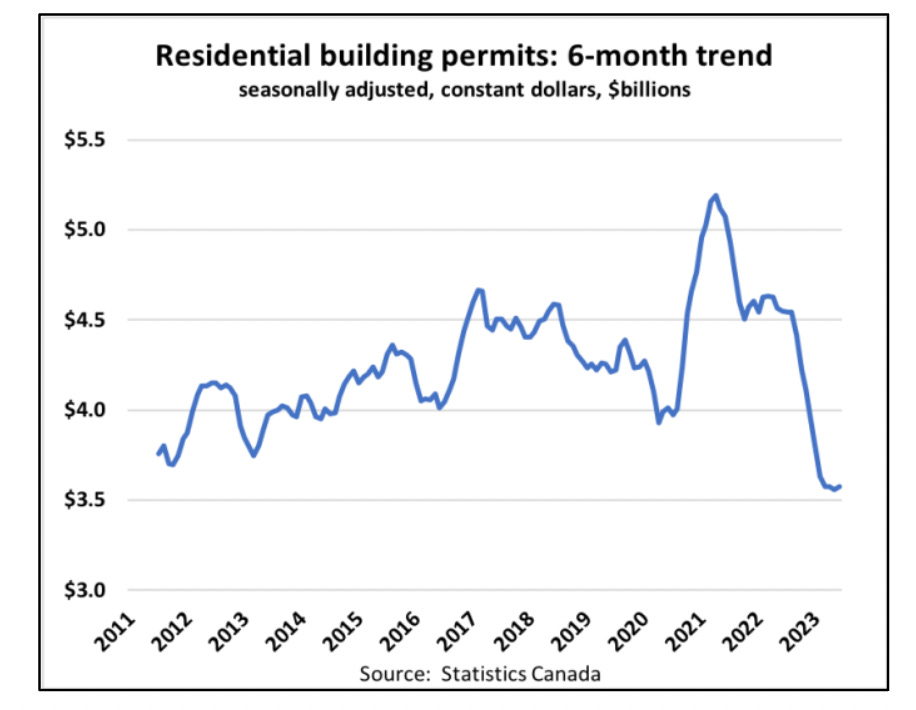

This all crescendos to big theme number three. Amidst a deteriorating economic outlook and a trippling in the cost of captial, the housing construction channel is grinding to a halt.

We’ve talked a lot about building permits, which frontrun not only housing starts, but the actual economy, are now at their lowest levels in over a decade.

There are times when the data lines up perfectly with the anecdotes. This is one of those times.

For those wondering, Jen was the Chief City Planner of Toronto from 2012 to 2017. Suffice to say she knows a few people in the development community.

So just to summarize, we have a federal government grappling with an affordability crisis. A housing bust doesn’t get anyone relected so they desperately need new supply to ease the housing crisis or their political reign is toast. At the same time you have the BoC eagerly trying to slow demand, with a downturn in housing investment seen as a necessary evil.

Canadian households are stuck in the middle of a tug of war between fiscal and monetary policy.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Steve Saretsky August 28th, 2023

Posted In: Steve Saretsky Blog