August 6, 2023 | The Long Wave Versus the Printing Press

This is a reprint [with a few edits] of an article I wrote way back in 2010 — when a supercycle crash was already overdue:

The fascinating thing about “long wave” analysis (broadly defined to include Kondratieff waves, Elliott waves, and William Strauss and Neil Howe’s Fourth Turning) is that while each theory uses its own indicators and terminology to show how societies move through recurring cultural/psychological/financial stages, they’ve all reached the same conclusion: we’re toast.

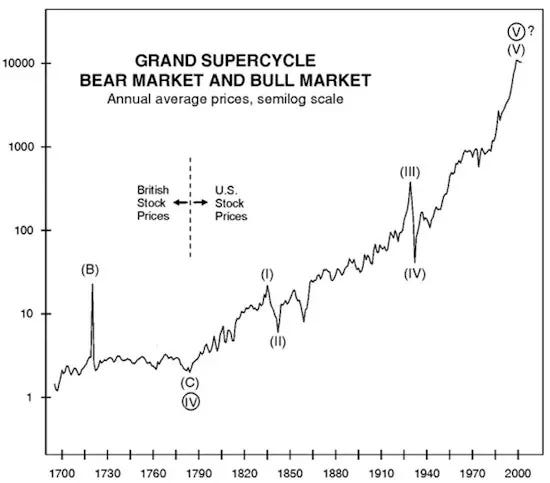

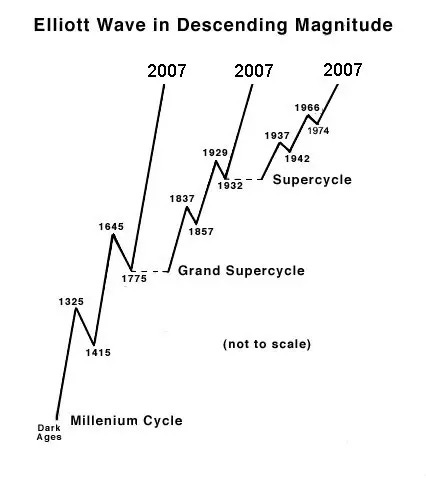

The first decade of this century marked the theoretical end of an Elliott Wave Grand Supercycle — and of an even bigger wave that began in the Dark Ages…

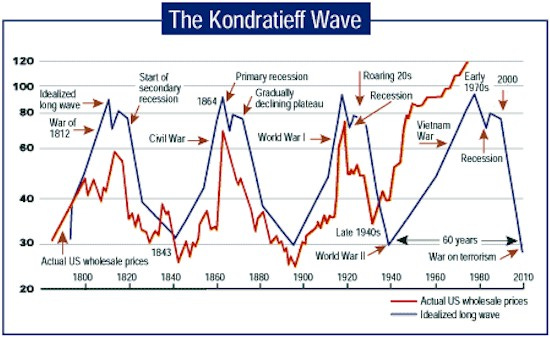

…the start of Kondratiff winter…

…and the beginning of a Fourth “Crisis” Turning. As Strauss and Howe put it in 1997:

Around the year 2005 [give or take a few years], a sudden spark will catalyze a Crisis mood. Remnants of the old social order will disintegrate. Political and economic trust will implode. Real hardship will beset the land, with severe distress that could involve questions of class, race, nation and empire.…Sometime before the year 2025, America will pass through a great gate in history, commensurate with the American Revolution, Civil War, and twin emergencies of the Great Depression and World War II….The risk of catastrophe will be very high. The nation could erupt into insurrection or civil violence, crack up geographically, or succumb to authoritarian rule. If there is a war, it is likely to be one of maximum risk and effort – in other words, total war…

But a funny thing happened on the way to the Greater Depression: We’ve somehow kept it together, inflating the 2000s housing bubble and, when that burst, replacing it with the everything bubble. Policymakers, talking heads, and most investors (judging by the past year’s stock market action) seem to think that a normal recovery is underway and that a crash remains a low-probability event.

So did long-wave analysis fail? Nah, it just bumped up against something new: an unlimited global printing press. Long-wave theories are derived from history, and for most of history money was sound — that is, backed by gold and silver. In a sound money system, when debts reach a debilitating level they have to be liquidated, causing the 10-year Depressions that follow 60-year credit supercycles. Past governments couldn’t derail this process because they couldn’t make more gold.

They still can’t make more gold. But over the past 40 years they’ve conned their citizens into thinking that paper (or electronic impulses), unbacked by anything real, is the same thing. Today’s central banks can create as much new currency as they want, and the global economy continues to accept it as money. This systemic gullibility allowed the US to nationalize its housing market, at a stroke increasing the public debt by half. It allowed the EU to move Greece’s debt onto Germany’s balance sheet without crashing the euro. And it’s currently allowing major governments to borrow trillions more without setting off a panic.

But this monetary orgy hasn’t suspended the economic laws described by long-wave theories. On the contrary, it has amplified those laws. By delaying the end of the cycle by two decades, fiat currency allowed the world to accumulate another $50 or so trillion of debt (more if you count unfunded pension liabilities and derivatives), which will make the coming liquidation that much more painful.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

John Rubino August 6th, 2023

Posted In: John Rubino Substack