August 11, 2023 | Recession Watch: October Surprise?

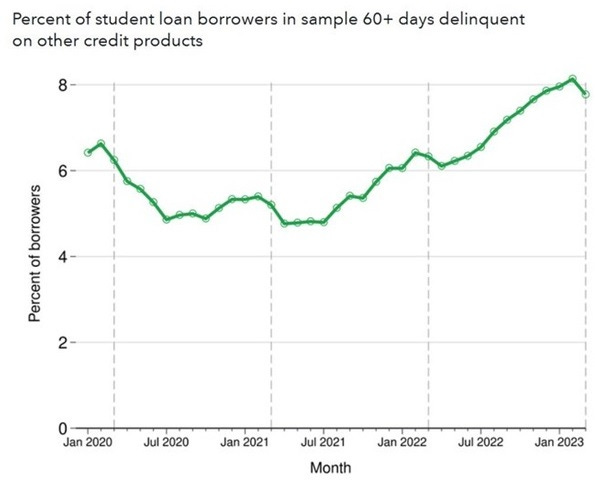

One of the things that kept many Americans financially afloat these past few years is the fact that student loan payments were suspended. That bought some time but apparently didn’t solve the underlying problem of low wages in an increasingly expensive world.

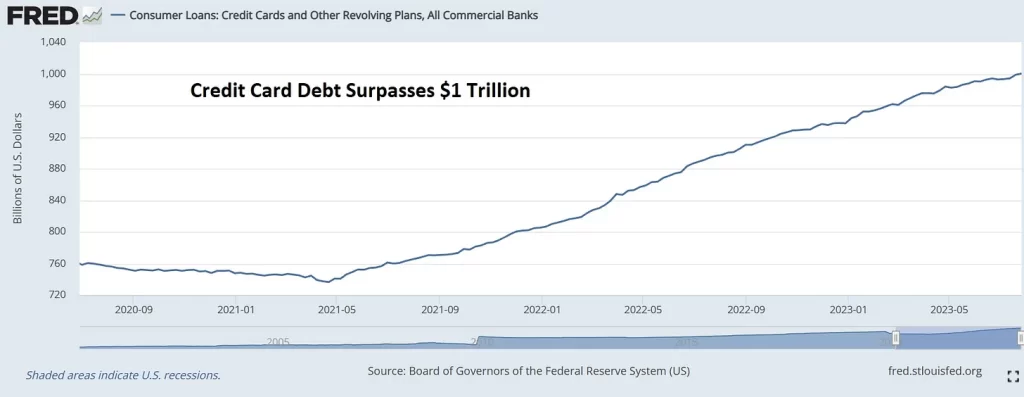

Because it’s now becoming common to use credit cards to cover day-to-day expenses. Total credit card debt just surpassed $1 trillion for the first time ever and the average credit card interest rate has risen to 20%. The result: A growing number of people are paying 20%+ interest on balances they can’t afford to pay off.

So a lot of people with student loans — who, remember, haven’t paid anything on those loans since 2020 — are nevertheless having increasing trouble paying their non-student-loan debts:

And the number of people making “hardship” or emergency withdrawals from their 401(k) plans is soaring despite low unemployment and (supposedly) rising real wages. From a recent Bank of America report:

“The report also found that a growing number of 401(k) participants are initiating withdrawals from their plans. The number of participants taking hardship distributions increased 36% year-over-year.”

The takeaway: Many Americans are already stretched thin and can’t handle another serious expense. But that’s what they’ll get in October when tens of millions of borrowers will be required to start paying their monthly federal student loan bills. The average monthly payment is estimated at $337, which doesn’t sound like that much. But apply it so someone who already can’t cover their credit card debt and it might be the last financial straw.

Something will have to give (actually several somethings). So expect spiking credit card delinquencies and student loan defaults and, as a result, falling consumer spending. A soft landing — in which inflation falls and the economy, driven by consumer spending, keeps growing — now seems highly unlikely.

Government statisticians can see these trends as well as we can, so expect a renewed moratorium on student loan payments, either before October or soon after when the default numbers spike.

Put another way, student loans will, one way or another, be among the many bailouts that will become necessary in the next few years. But probably not until they cause some serious trouble.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

John Rubino August 11th, 2023

Posted In: John Rubino Substack

Next: Deflation Risk in China is Real »