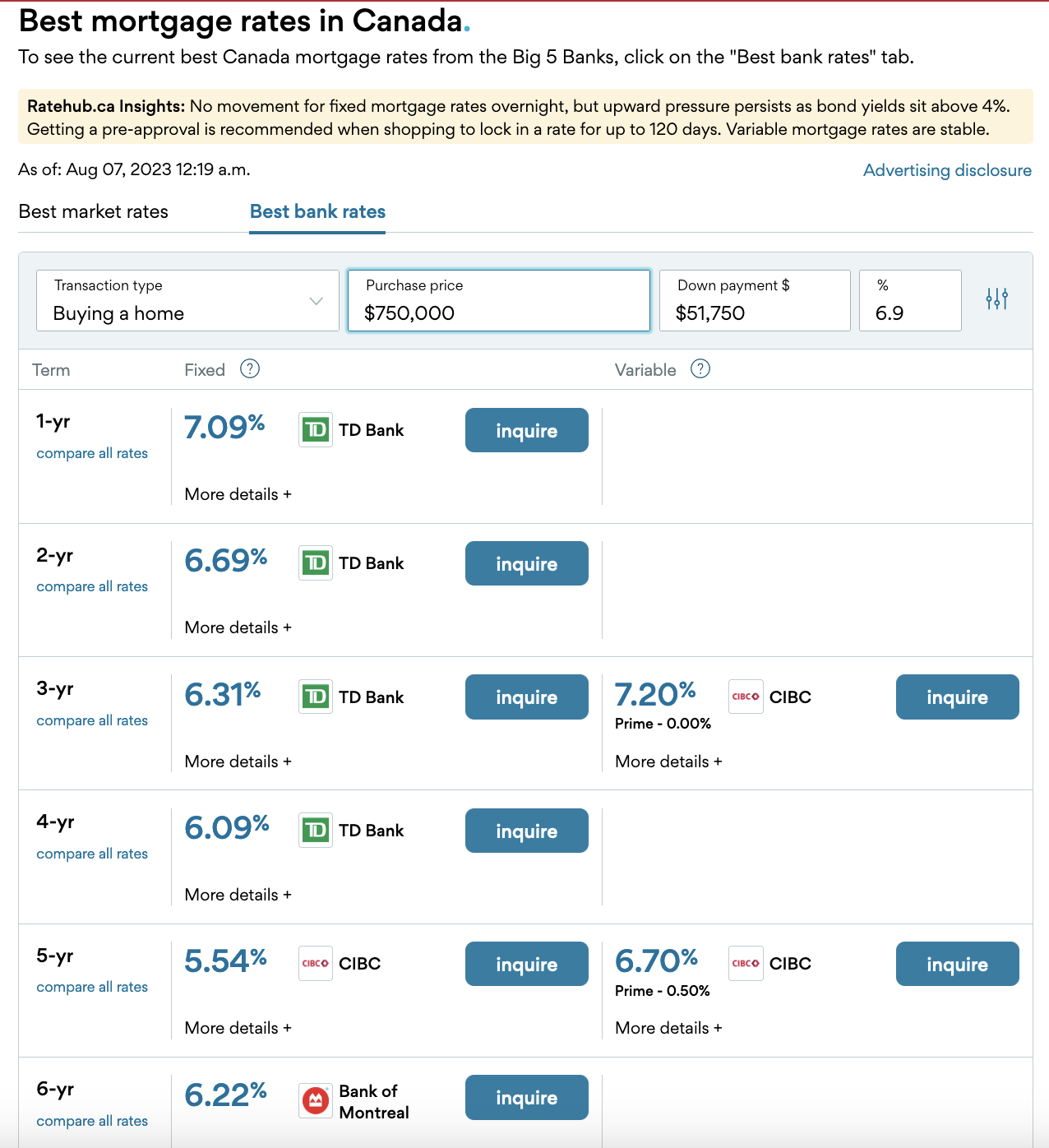

Canadian banks are offering mortgage rates above 6% for 1, 2, 3, 4 and 6-year terms on new purchases (below via Ratehub). Home equity lines of credit are above 7%.

These are historically average mortgage rates. The trouble is that after 13 years of unnaturally low rates (2009-2022), people are carrying debt loads far above the long-term average. The highest debt + the highest interest rates in 22 years is a crushing weight for consumer-dependent economies worldwide. Make no mistake: this pain is contagious; there’s no quick fix, and it’s just getting started. Best to understand and plan accordingly.

John Shmuel, managing editor with RATESDOTCA, joins BNN Bloomberg to discuss how more Canadian homeowners are starting to worry about their mortgage renewals as rates continue to grind higher. Here is a direct video link.

Also, see WSJ, A real-estate haven turns perilous with roughly $1 trillion coming due:

Apartment buildings, long considered a real-estate haven, are emerging as the next major trouble spot in the beleaguered commercial-property world.

Investors bid up the prices of multifamily buildings for years, attracted by steadily rising rents and the prospect of outsize returns. Many took on too much debt, expecting they could raise rents fast enough to pay it down.