August 18, 2023 | Harsh Credit Cycle Has Broad Impacts

Historical context is critical in assessing where we are in this credit, business and employment cycle. Facts demand sobriety, and the discussion below is lucid.

This overall strength in U.S. equities is painting a misleading picture as to where the global economy is heading, especially with the Chinese market indicating signs of a slowdown, David Rosenberg, president, chief economist and strategist at Rosenberg Research, told BNN Bloomberg in a TV interview on Thursday. Here is a direct video link.

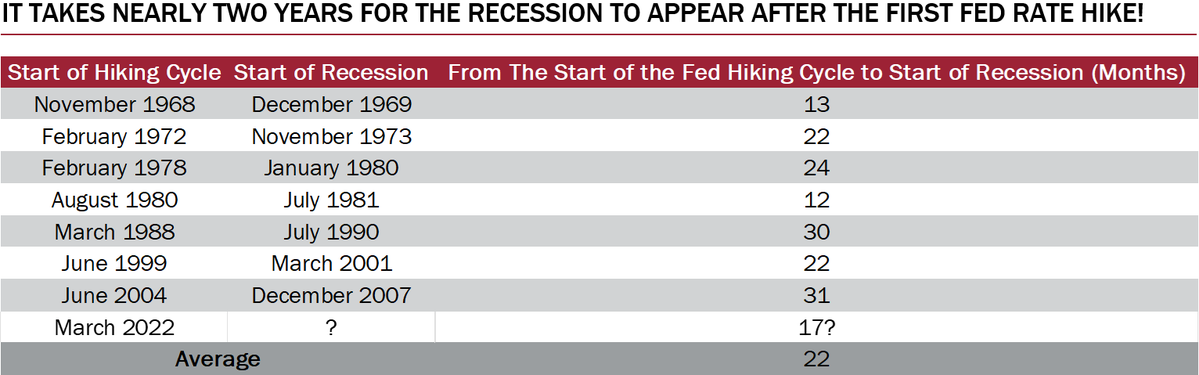

David’s table below shows the lags between the first Fed hike and the onset of recession in tightening cycles over the last 55 years. The range is 13 to 31 months, and the average is 22 months. August marks 17 months since the first hike this cycle in March 2022. The rapidity of the increases this time, coming after unprecedented years of near-zero rates, suggests the shock is likely to be faster and bigger than historically average.

See, We’re not getting out of this without a recession:

See, We’re not getting out of this without a recession:

As for Canada in particular, he warned that the country’s fate will be closely tied to China’s economy.

“Although Canada is hitched to the U.S., commodity markets are really hitched to China, and the Chinese economy is reeling. It’s not getting better, and it’s probably on the precipice of heading into a recession,” he argued.

China accounts for half the demand for basic materials, which is a large component of Canadian corporate profits and a big share of the TSX Composite Index, he explained.

“We’re not getting out of this without a recession,” Rosenberg said.

Also see, China’s housing slump is much worse than official data shows.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Danielle Park August 18th, 2023

Posted In: Juggling Dynamite