August 21, 2023 | Affordability Hell

Happy Monday Morning!

Headline CPI inflation surprised to the upside this past week, pushing back up to 3.3% and well above market expectations of 3%. However, those who have been following along here will know the importance of base effects. When headline inflation fell to 2.8% last month we were quick to highlight some research from our good friend Ben Rabidoux, in which he noted, “If CPI averages 0.2% (or 2.4% annualized.. more or less in-line with the Bank of Canada’s target), CPI will be pushing back towards 4% by year end.”

Except we didn’t get 0.2% we got an absoloute whopper at 0.6%. The bond market immediately launched yields higher, pushing the all important 5 year Canada bond to it’s highest levels since the summer of 2007. Markets are now fully pricing in one more rate hike from the Bank of Canada before year end, with about a 30% chance of that happening on September 06.

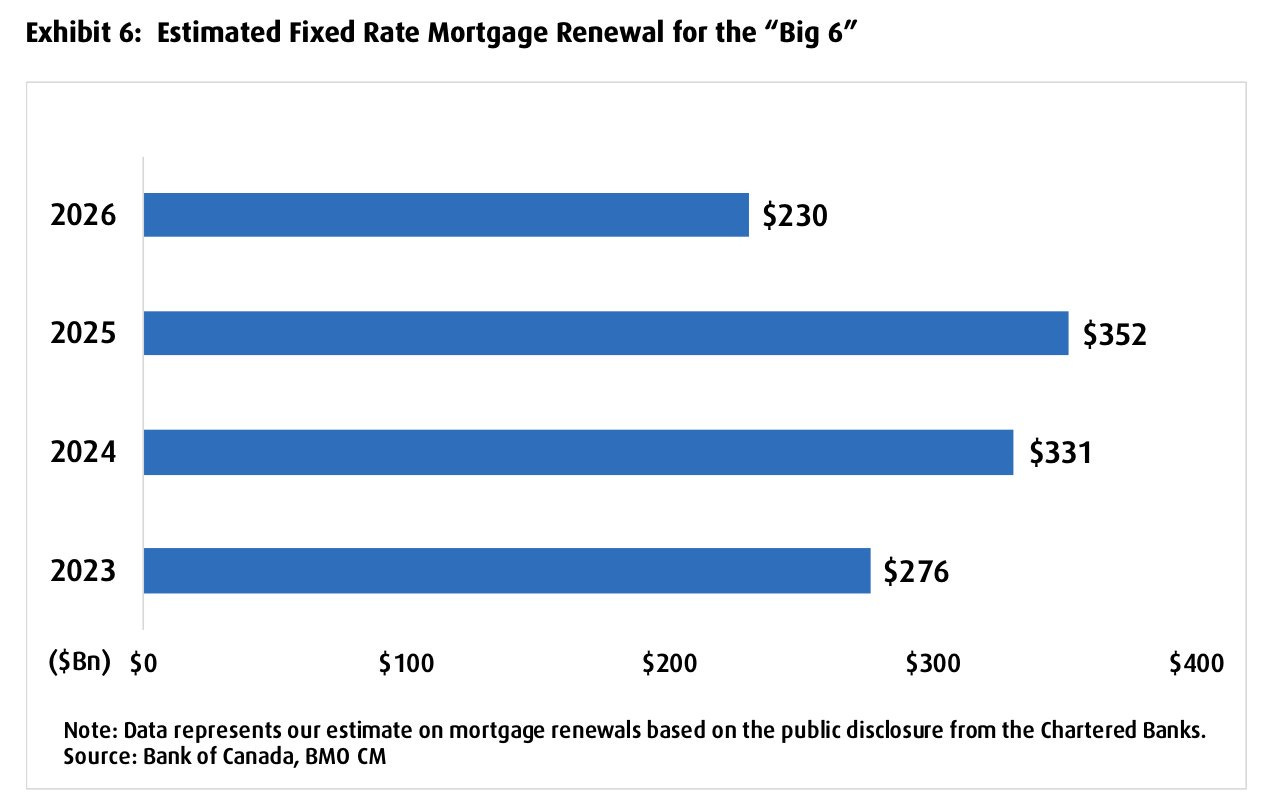

In other words, there’s no relief in sight for Canadian households. The longer interest rates stay elevated, the more pain cometh. Remember the mortage renewal wall hits hard in 2024 and 2025.

The clock is ticking, and political pressures are mounting on both the federal government and the BoC to get this under control. Have you seen the polls lately? The truth is the average Canadian doesn’t calculate base-effects and they aren’t peeling back the onion on how Stats Canada formulates the CPI basket. If they did they’d see that self inflicted mortgage interest costs jumped 30%, and remains the biggest driver of headline inflaiton. No, instead they just want relief from this affordability hell we’ve dug ourselves into, and reading headlines about inflation jumping back up towards 4% later this year will not go over well.

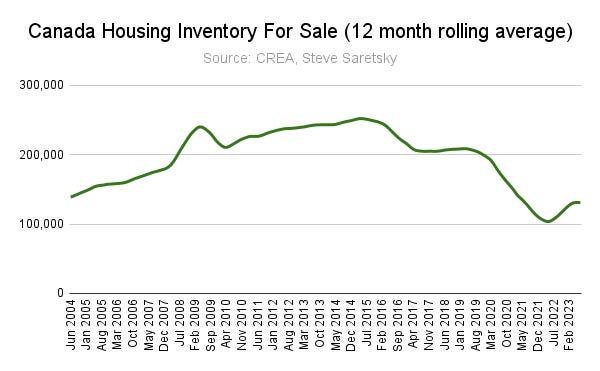

That puts housing in the cross hairs. Mortgage rates across the curve are frozen solid at 6% across the curve, yet prices have barely budged, thanks to essentially 20 year lows in invenotry across the country. That’s right, as of the end of July, total inventory for sale across Canada, outside of 2021, was at its lowest levels since July 2003.

On a 12 month rolling average basis, inventory is running nearly 40% below its long term average.

This has propped up the housing market, with seasonally adjusted benchmark home prices up 4% year to date. Who had that on their bingo card?

Next month you’ll see house prices offically up on a year-over-year basis. Although in real time they have definitely peaked for this year.

It’s true the fastest tightening cycle in modern history has come with unintended consequences, in that it’s actually done the opposite of what most people thought it would. It didn’t free up supply, it choked it off. With an 8% mortgage stress test there’s a sizeable chunk of exisitng homeowners who no longer qualify for their existing home, so even if they wanted to move, they can’t. So you don’t list your house for sale and you don’t buy one either. Batten down the hatches and ride this storm out.

The only ones seemingly heading for the theatre doors are investors. Overleveraged and starved of cash flow in rent controlled provinces. But is it enough inventory to over supply the markets?

The next inventory wave comes in the fall. Don’t be surprised if it starts to overwhelm demand as buyers with expiring mortgage rate holds move to the sidelines.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Steve Saretsky August 21st, 2023

Posted In: Steve Saretsky Blog

Ultra-low interest rates drove house prices to astronomical levels. Now that interest rates are returning to normal (they aren’t high by historical standards) people who bought at the astronomically high prices are not willing to sell and take a loss. So they are hanging on to their homes.