July 7, 2023 | Value Investing Will Come Back

Value investing as a style should be doing better during this period of rising interest rates and growing recession fears. But growth investing continues to perform better than value investing by a wide margin.

Will value investors ever dominate again?

Value stocks are defined as “cheap” when using metrics like share price to book value or earnings or sales.

And growth stocks are the opposite, where investors expect future growth and are willing to pay up for an “expensive” stock on the expectation that share prices will rise substantially due to rising earnings and sales.

A recent example of growth expectations is the elevated price of Nvidia shares, with sales expected to soar for chips made for Artificial Intelligence.

Nvidia hit the magic marker of $1 trillion in total market capitalization recently, which is very rich for a company which had sales of just $27 billion in 2022. The ratio to earnings is also extreme, at 200 times. The ratio of share price to book value is a remarkable 42 times!

More established companies in the tech sector are not much better in valuation. Amazon shares, for example, trade at 8.5 times book value, 2.5 times sales, 138 times earnings and total capitalization of $1.3 billion.

Apple hit a valuation of $3 trillion. Apple’s valuation measures are extreme at 48 times book value and 32 times earnings.

One problem with large companies is that it gets harder to deliver the rapid growth that investors expect when paying such premium prices for a stock. How many more iPhones can AAPL sell?

A value stock is found in sectors or geographies that are not popular among aggressive investors, such as Japan. At this time, about one-half of the stock market in Japan is trading below book value. Most “emerging markets” are trading at cheap valuations also.

This long period of dominance by US growth stocks was a surprise as the Global Financial Crisis was expected to deliver a dose of reality to US stock markets.

One obvious reason for the failure of value stocks to outperform post-GFC was the decision by central bankers to set interest rates at zero and keep them there. Low interest rates shrink the opportunity cost of waiting for future earnings.

Now that interest rates have risen, with government bonds yielding 5 percent, that tailwind has been removed.

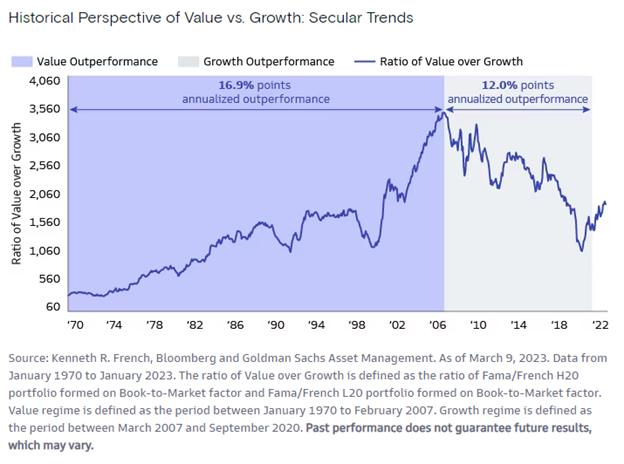

This current period is similar to 1996-1999. Then the ratio of performance of value to stocks stagnated. The period immediately after that, when the dot-com bubble burst, produced excellent relative gains for value investors. On the chart above we can see the relative outperformance of value over growth more than tripling from 2000 to 2006. Part of this was the implosion of values for telecom leaders like Cisco, plummeting from $77 to $10, while value stocks in the non-tech sectors held up well.

Watch for “reversion to the mean” when value stocks will outperform, and value investors will be happy after sixteen years of excruciating pain.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Hilliard MacBeth July 7th, 2023

Posted In: Hilliard's Weekend Notebook